By Elizabeth Low and Grant Smith

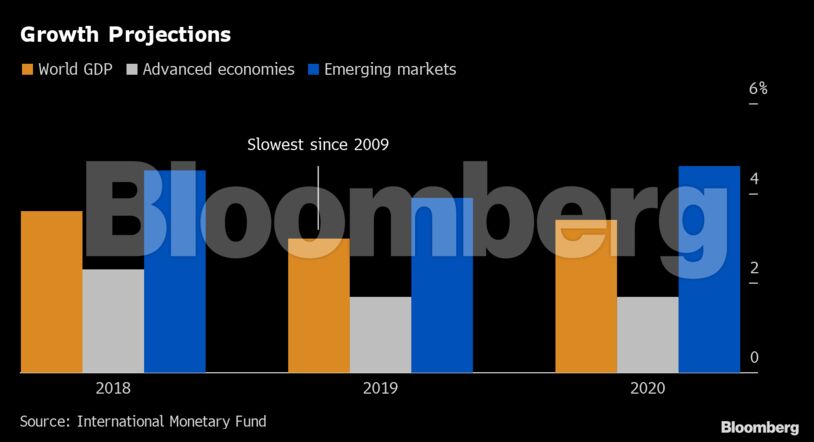

The International Monetary Fund cited a broad deceleration across the world’s largest economies as it cut its growth forecast for 2019 to the lowest in a decade on Tuesday, and also lowered its projection for next year. Elevated tanker costs are causing some Asian refiners to hold off from spot crude purchases and consider running their plants at lower capacity, while the Energy Information Administration said it sees an increase in U.S. output in November.

“The oil market is struggling to shake off the shackles of the current gloom,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

West Texas Intermediate for November delivery rose 35 cents to $53.16 a barrel on the New York Mercantile Exchange as of 8:34 a.m. local time. It fell 1.5% on Tuesday.

Brent crude for December settlement rose 15 cents to $58.89 a barrel on the London-based ICE Futures Europe Exchange after falling 1% on Tuesday. The global benchmark traded at a premium of $5.72 to WTI for the same month.

The EIA sees production at major U.S. shale plays rising by 58,000 barrels a day to 8.97 million barrels in November from the previous month. It’s also due to release American crude stockpiles data on Thursday, with analysts forecasting a 3 million-barrel increase last week.

The oil market continues to be affected by the prolonged U.S.-China trade war. Beijing wants a rollback in tariffs before it agrees to buy as much as $50 billion of American agriculture products that President Donald Trump claims are part of an initial deal, people familiar with the matter said. China also threatened to retaliate if the U.S. Congress passes a law on Hong Kong.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS