By Sharon Cho and Grant Smith

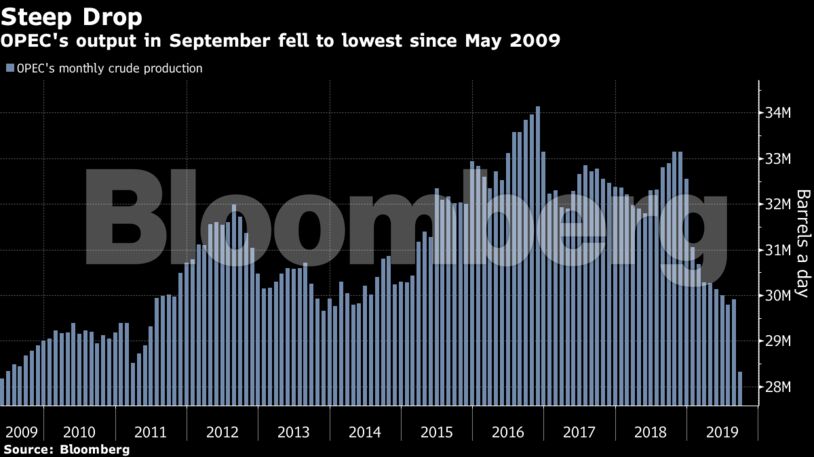

Crude prices are now below where they were before the Sept. 14 attacks on Saudi Arabia that temporarily halved the kingdom’s production. The strikes slashed daily output from the Organization of Petroleum Exporting Countries by 1.6 million barrels a day last month, the biggest drop in 16 years, according to a Bloomberg survey. Meanwhile, a U.S. manufacturing gauge that fell to a 10-year low is adding to pessimism over the demand outlook.

“Crude markets remain tight, but the dominating force right now is simply the gloomy economic-demand outlook,” analysts at consultant JBC Energy GmbH said. The oil market has “so many things to worry about.”

West Texas Intermediate for November delivery rose 19 cents, or 0.4%, to $53.81 a barrel on the New York Mercantile Exchange as of 8:42 a.m. local time. It closed down 0.8% on Tuesday after losing 7.5% in the third quarter.

Brent for December settlement gained 6 cents, or 0.1%, to $58.95 a barrel on the ICE Futures Europe Exchange after slipping 0.6% on Tuesday. The global benchmark crude traded at a $5.23 premium to WTI for the same month.

If the API figures are confirmed by the EIA data, it will be the first drop in U.S. stockpiles in three weeks. A Bloomberg survey of 12 analysts sees an increase in inventories of 2 million barrels in the week ended Sept. 27.

The 1.6 million-barrel-a-day slump in OPEC output in September was the biggest month-on-month decline since labor strikes briefly paralyzed Venezuela’s oil industry in 2002. Saudi production fell by 1.47 million barrels a day to 8.36 million, the lowest average monthly output since 2010.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS