By Sharon Cho and Grant Smith

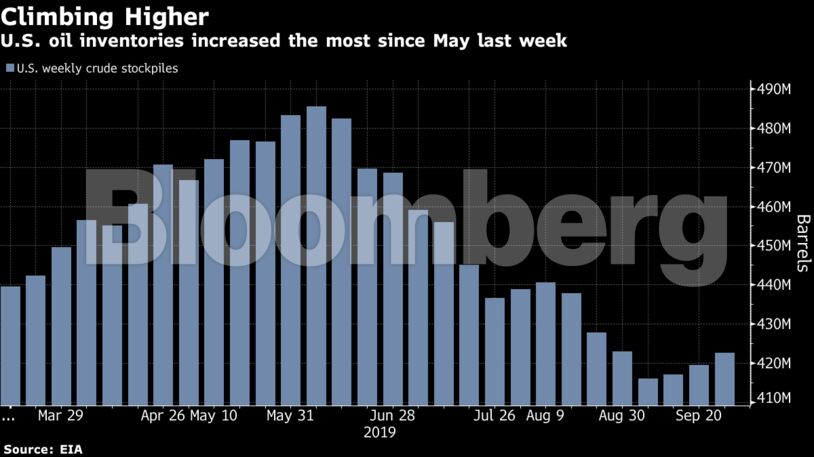

Futures fell 1.4% in New York after settling 1.8% lower on Wednesday. U.S stockpiles swelled by a more-than-expected 3.1 million barrels last week, according to Energy Information Administration data. American private payrolls for September fell short of estimates, a day after a manufacturing gauge slumped to the lowest in a decade, spurring losses in financial markets.

Crude was heading for eight straight days of decline — the longest losing streak in almost a year — on increasing signs that the U.S.-China trade war is pushing the global economy toward recession. Saudi Arabia’s speedy recovery from Sept. 14 attacks on its oil infrastructure, as well as an easing of tension in the Persian Gulf, has also undermined prices.

“It is a bear’s world,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. “It is simply impossible to predict where the next significant price support will come from as the focus is firmly on economic developments. And those are anything but optimistic.”

West Texas Intermediate for November delivery slipped 73 cents to $51.91 a barrel on the New York Mercantile Exchange as of 9:06 a.m. local time. It lost 10% in the seven trading sessions through Wednesday.

Brent for December settlement dropped 50 cents to $57.19 a barrel on the ICE Futures Europe Exchange, after declining 2% on Wednesday. The global benchmark crude traded at a $5.39 premium to WTI for the same month.

READ: In a Sated Oil Market, Saudi Arabia Attack Sinks Without Trace

U.S. crude inventories increased for a third week, to about 423 million barrels in the week through Sept. 27, the EIA data showed Wednesday. That was more than the median estimate for a 2 million-barrel gain in a Bloomberg survey. American Petroleum Institute figures released earlier had indicated a 5.9 million-barrel decline.

The August gain in U.S. payrolls was also revised lower, the ADP Research Institute said, suggesting a manufacturing recession. Meanwhile, the White House imposed tariffs on European exports including civil aircraft and dairy products, raising concern that another trade-war front is being opened and weighing on financial markets.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS