By Grant Smith and Sharon Cho

Saudi Arabia’s recovery from the attacks and the concerns over growth in oil consumption have driven crude prices back to where they were before the Sept. 14 attacks. This means that while oil gained on Tuesday, the increase could be temporary, said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA.

“The bounce back in oil prices this morning looks more technical than fundamentally or macro-driven, and it is building on what was a very weak close” on Monday, Tchilinguirian said. “I am not sure that the very short-term momentum is there to sustain it.”

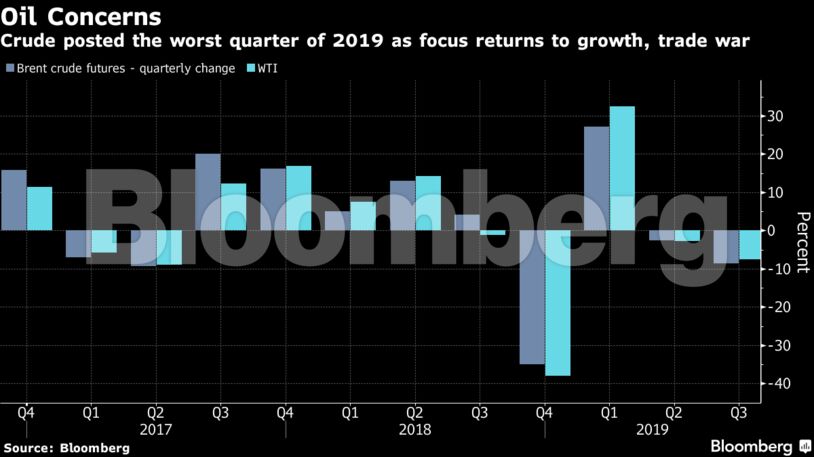

West Texas Intermediate for November delivery rose 57 cents to $54.64 a barrel on the New York Mercantile Exchange as of 11:14 a.m. in London. The front-month contract fell $1.84 on Monday to cap a 7.5% decline last quarter.

Brent for December settlement gained 54 cents, or 0.9%, to $59.79 a barrel on the ICE Futures Europe Exchange. The November contract, which expired Monday, ended the session 1.8% lower. The global benchmark crude on Tuesday traded at a $5.29 premium to WTI for the same month.

Saudi Output

Saudi Aramco returned productionto 9.9 million barrels a day on Sept. 25 and output is now a “little bit” higher than that, said Ibrahim Al-Buainain, chief executive officer of the company’s trading unit, said Monday. The world’s top oil exporter has also restored some spare capacity following the attacks on its energy infrastructure and hasn’t missed any contracted shipments, he said.

Ahead of the expected Washington-Beijing talks next week, Asian manufacturing sentiment remained mostly bleak in September due to the U.S.-China trade conflict and waning global demand. The euro area’s manufacturing sector slumped last month.

“In view of subdued global economic prospects and rising U.S. oil production, any concerns” about oil supply tightening have evaporated, said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS