By Grant Smith

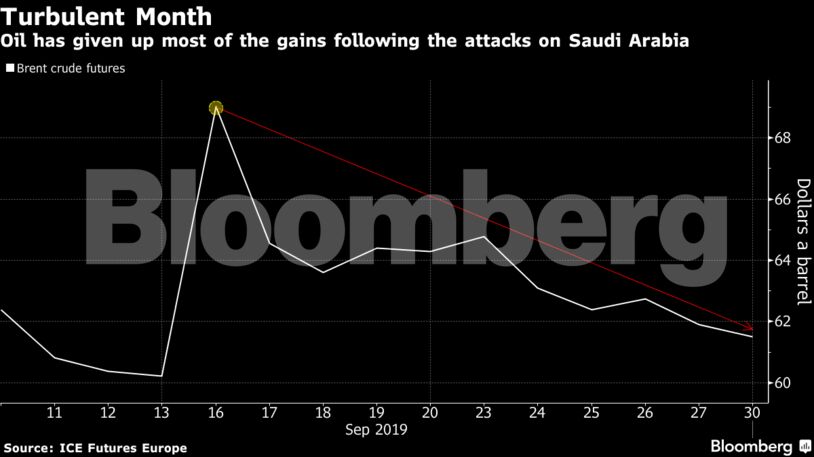

Brent futures have slumped about 8% since the end of June as a brief spike following the strikes on the Abqaiq processing facility and Khurais oil field — which knocked out 5% of world oil output — soon fizzled out. While that’s partly because the Saudis are restoring supply quicker than expected, it also reflects pressure on fuel demand from weak economic growth and the protracted U.S.-China trade war.

“The market has not suffered a supply disruption, as the material damage to the Abqaiq facility appears to have been limited and the kingdom continues to meet obligations to customers,” said Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas SA in London. “The slowdown in global economic growth resulting from the trade war, and high U.S. crude exports, is also capping the market.”

Political tensions have abated somewhat since the Sept. 14 strike on Saudi Arabia as the powers involved take a cautious approach, Tchilinguirian said. The kingdom’s Crown Prince Mohammed Bin Salman warned that war between his country and Iran would bring a “total collapse of the global economy” and said he prefers non-military pressure to stymie Iranian ambitions. The U.S. and Saudi Arabia blame Iran for the attacks, and the Persian Gulf nation denies it.

Brent for November settlement, which expires Monday, fell $1.01 to $60.90 a barrel on the London-based ICE Futures Europe Exchange as of 1:38 p.m. local time. Prices are up 0.7% this month. The more-active December contract was down 80 cents at $60.24. The global benchmark crude traded at a premium of $5.84 to West Texas Intermediate.

WTI for November delivery lost 83 cents to $55.08 a barrel on the New York Mercantile Exchange. Prices are little changed this month, and down 5.8% for the quarter.

Yemen Cease-Fire

Saudi Arabia has agreed to a limited cease-fire in several areas of Yemen including the capital Sana’a, which is controlled by Iran-backed Houthi rebels, a Yemeni government official said last week, easing tensions in the region. Still, some hostilities continue after the Houthis, which claimed responsibility for the Saudi attacks, said they had captured soldiers from the kingdom during an operation near the border of the countries.

QuickTake explainer: Understanding the Conflicts Leading to Saudi Attacks

The oil market has also been driven by the prolonged clash between Washington and Beijing over trade, and the knock-on effects on economic growth. Their dispute has already almost halved oil-consumption growth, Citigroup Inc. said earlier this month.

The world’s two largest economies will head into another round of high-level trade talks following China’s week-long national holidays starting Oct. 1. Beijing said it would continue to open up its financial markets amid reports that the U.S. is considering restrictions on fund flows to China.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS