By William Mathis

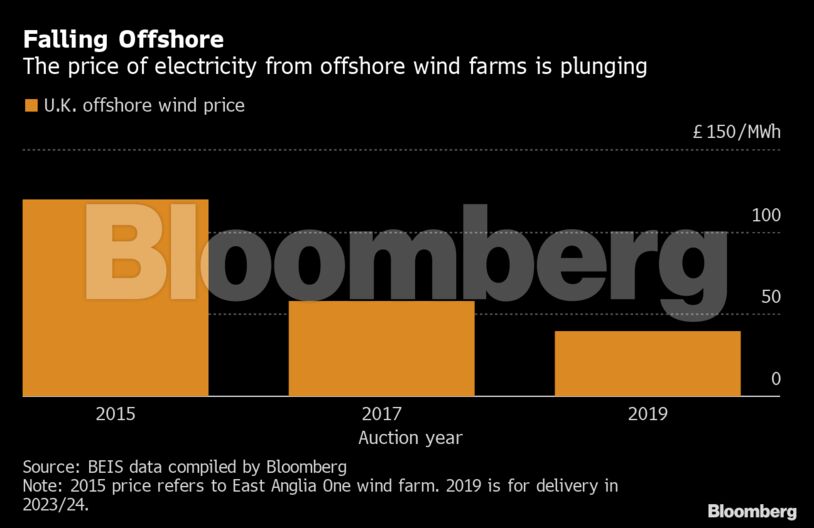

A number of offshore wind projects won contracts to sell power at guaranteed prices in a U.K. auction Friday. The price of 39.65 pounds per megawatt-hour ($49.70) was 31% below the level in a similar auction two years ago.

The plunge highlights how offshore wind, which only a few years ago was a niche technology more expensive than nuclear reactors, is changing the economics of energy around the world. Both utilities and, increasingly, energy majors, are planning to spend $448 billion through 2030 on an eightfold capacity increase, according to BloombergNEF.

Projects from developers including SSE Plc, Equinor ASA and Innogy SE won offshore wind power-purchase contracts that will have the capacity to generate as much as 5.5 gigawatts of power, the government said. That includes a joint SSE-Equinor project off England’s east coast to build the biggest single offshore wind park in the world.

“The auction results today show offshore wind is in line with current power prices – it is already competitive with existing fossil fuel plants, let alone new fossil fuels,” said Deepa Venkateswaran, an analyst at Sanford C. Bernstein & Co. in London. “In the next auction in 2021 we will see costs go well below that of existing fossil fuel plants.”

One of the winning areas, known as Dogger Bank, is off the coast of Yorkshire. Three projects by Equinor and SSE were approved in the zone for a total generation of 3.6 gigawatts. Another 1.4 gigawatt project developed by Innogy was also approved in the same area.

Equinor’s success at the auction is a key step in its transition to becoming a broader energy company than just an oil and gas major. The state-controlled Norwegian company has a target of investing as much as 20% of its capital in new energy solutions by 2030.

“Dogger Bank, together with the recent award for Empire Wind in the U.S., positions Equinor as an offshore wind major,” said Pal Eitrheim, Equinor’s executive vice president for new energy solutions. “These projects provide economies of scale and synergies, making us an even stronger competitive force in offshore wind globally.”

Equinor Races Ahead of Big Oil Pack in Bet on Offshore Wind

SSE winning capacity will accelerate its shift away from a traditional utility to an energy company focused on renewable power and grids. The Scottish company has agreed to sell its U.K. domestic supply business to Ovo Energy Ltd.

The agreements give the projects a guaranteed buyer through what’s known as a contracts-for-difference mechanism. If the wholesale rate is lower than the set price, the government pays the developer the difference. If it’s higher, the company pays it back. U.K. month-ahead power is trading at 42.05 pounds per megawatt-hour, down 34% this year.

Even as wind power moves away from a reliance on government subsidies, the contracts could still play an important role going forward. The guarantee helps developers secure financing and also make the assets more attractive to institutional investors who want reliable returns. The next U.K. auction round is set to take place in 2021.

The Crown Estate said Thursday it plans to open the first contest in a decade for sites around the British coast that could draw as much as 20 billion pounds of investment in offshore wind.

For Sale

The contracts also open up a track for investors to take stakes in some of these projects. Earlier this year, Iberdrola sold a stake in its 714-megawatt East Anglia One project to Macquarie Group Ltd. for 1.63 billion pounds. Projects that have the backing of government-supported purchase agreements are often more attractive to investors who favor the guaranteed prices.

Innogy will likely sell a stake in it 1.4 gigawatt Sofia Offshore Wind Farm development in the Dogger Bank Area, according to Richard Sandford, the company’s director of offshore investment and asset management. The company hasn’t decided how big of a stake it will sell, but plans to make a final decision sometime next year. SSE also said it will look to sell equity in a 454-megawatt project in Scotland that it won a contract for in the auction.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS