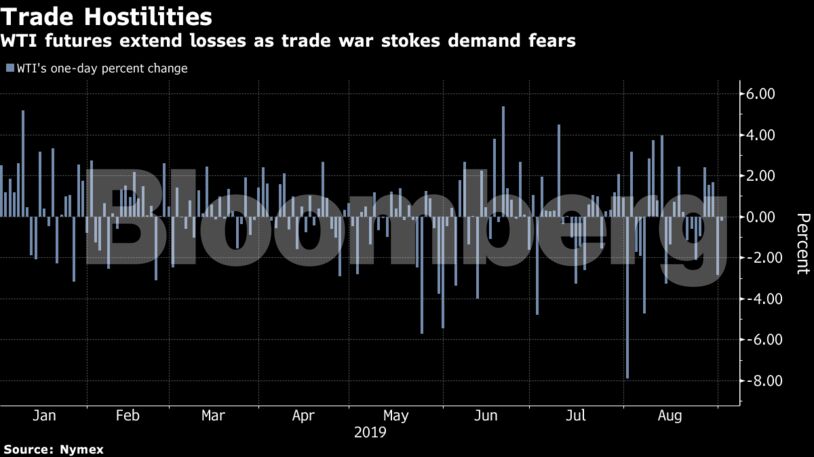

By Sharon Cho and Grant Smith Futures dropped to trade near $55 a barrel in New York, having lost 5.9% in August. U.S. tariffs on a further $110 billion of Chinese imports took effect on Sunday, and additional Chinese levies on American products — including oil for the first time — also kicked in.

The outlook for Chinese manufacturing deteriorated further in August, the latest evidence that the U.S.-China trade conflict is taking a toll on the global economy. Face-to-face talks between American and Chinese negotiators scheduled for this month are still on, President Donald Trump said Sunday, but investors see very little chance of a near-term breakthrough. “Economic uncertainty will continue to dominate the oil market’s agenda as new U.S. and China trade measures come into effect,” said Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas SA. “The market is more and more resigned to a protracted stand-off and will be looking toward central-bank easing to shore up risk appetite to help overcome the prevailing hesitancy in going long oil.”

West Texas Intermediate for October delivery fell 7 cents to $55.03 a barrel on the New York Mercantile Exchange as of 8:57 a.m. local time after falling as much as 1.1% earlier. The contract lost $3.48 in August.

Brent for November settlement slid 23 cents to $59.02 a barrel on the ICE Futures Europe Exchange, and traded at a $4.21 premium to WTI for the same month. The October contract expired on Friday, having lost 7.3% last month.

The U.S. imposed previously announced duties of 15% on a wide range of Chinese consumer goods. Another batch of about $160 billion of China’s products — including laptops and mobile phones — will be hit with 15% levies on Dec. 15.

Share This:

Oil Falls as Deepening Trade War Stokes Growth Concerns

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS