By Kevin Crowley and Brandon Kochkodin

“The oil sector has gone from being the leader of the world economy to a laggard,” said Tom Sanzillo, director of the Institute for Energy Economics and Financial Analysis, who traces Exxon’s presence in the S&P top 10 back to the 1920s.

| S&P 500 Rank | 2009 | 2019 |

|---|---|---|

| 1 | Exxon | Microsoft |

| 2 | Microsoft | Apple |

| 3 | JPMorgan Chase | Amazon |

| 4 | Johnson & Johnson | |

| 5 | IBM | Berkshire Hathaway |

| 6 | Bank of America | Alphabet (Class C) |

| 7 | Procter & Gamble | Alphabet (Class A) |

| 8 | AT&T | JPMorgan Chase |

| 9 | Apple | Johnson & Johnson |

| 10 | General Electric | Visa |

| 11 | Chevron | Procter & Gamble |

| 12 | Wells Fargo | Exxon |

The growth of technology giants like Facebook Inc., Amazon.com Inc. and Microsoft Corp. over the past decade coincided with the shale revolution that created an abundance of oil globally, weighing on energy companies. Exxon, once the gold standard in Big Oil, also has made some missteps: betting on Russia just before the country was slapped with sanctions and plowing money into U.S. natural gas in 2010 as prices collapsed.

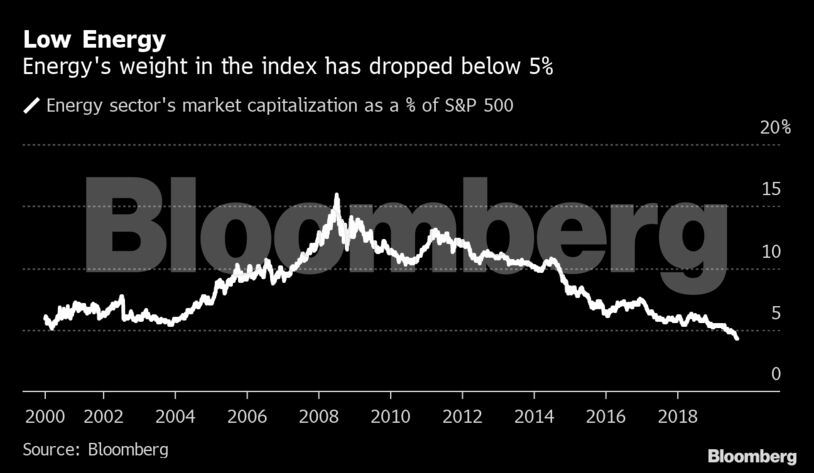

With many investors betting on a post-hydrocarbon world, energy faces a battle to stay relevant to generalist investors. The sector makes up just 4.4% of the S&P 500 Index compared with 11.7% a decade ago.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein