By Justin Fox

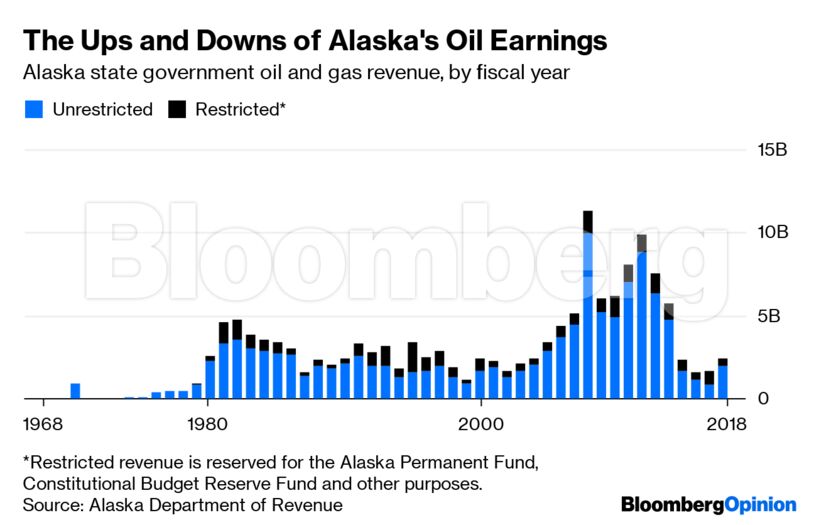

Many of the details here (such as the fact that the Alaska House of Representatives, while mostly Republican, is led by a majority coalition composed mostly of Democrats) involve quirks of Alaska politics that I’m not really the guy to explain. But the clearest reason why the state is having these budget troubles — and it’s been having them for a while — is that its revenue from oil and gas taxes and royalties fell by 50% in 2015, and has recovered only slightly since:

Instead of paying taxes to fund state government, Alaskans have since the early 1980s been able to rely upon taxes and royalties from North Slope oil and gas production to pay for both (1) state government and (2) a sort of universal basic income for residents, with “dividend” checksaveraging an inflation-adjusted $1,718 a year since 1982. Alaska levies no statewide property, sales, or personal income taxes, has the lowest state and local tax burden of any state, spends more per resident than any other state government and has over the past four decades relied on oil and gas for 83% of the unrestricted state general fund revenue with which most state operations are funded. But since 2015, the oil revenue hasn’t been nearly enough to pay the bills.

Oil prices have been a big part of the story. They hit an all-time high in 2008, plummeted at the end of 2014, and have recovered only partly since.

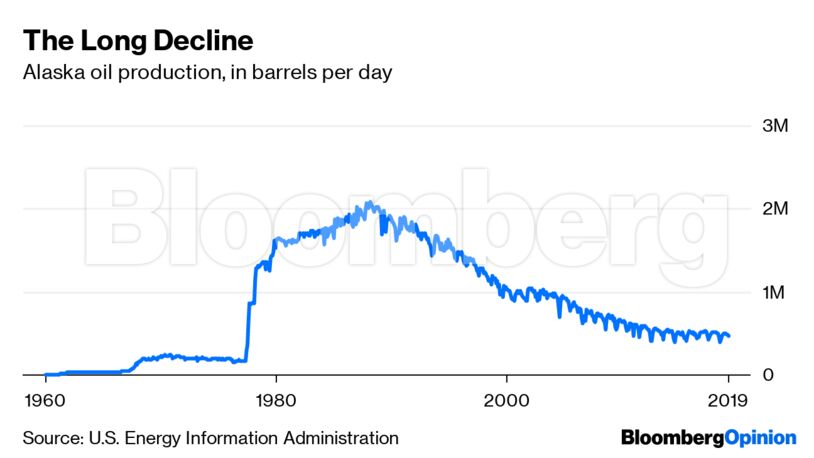

But the underlying problem is that Alaska isn’t producing nearly as much oil as it used to.

Among U.S. states, Alaska is now only No. 6 in crude oil production, ranking behind Texas, North Dakota, New Mexico, Oklahoma and Colorado in April. This diminished status may prove temporary — recent oil discoveries, plus moves by Congress and the Trump administration to open previously off-limits parts of the North Slope to drilling, seem likely to bring at least a partial revival of Alaska oil production. July’s record-shattering heat wave in Alaska is a reminder, though, that demand for that oil (and the prices paid for it) may come under increasing pressure from efforts to combat climate change — as my Bloomberg Opinion colleague Liam Denning wrote this week, financial markets already seem to think the “end of the hydrocarbon era” is looming. Regardless of what happens next, Alaska’s current budget struggles illustrate the downsides of relying on a natural resource windfall to pay ongoing bills.

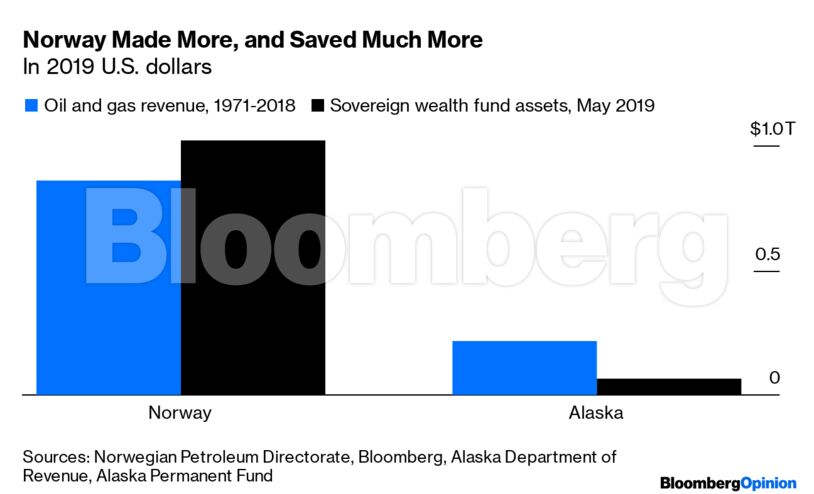

An obvious comparison here is to Norway, which also experienced an oil and gas boom that started in the 1970s and is now fading. Far from struggling, though, Norway has been pivoting to a post-hydrocarbon future bankrolled by the world’s largest sovereign wealth fund, originally called the Government Petroleum Fund but now the Government Pension Fund Global, which has more than $1 trillion in assets. Alaska has a sovereign wealth fund fueled by oil and gas revenue too, the Alaska Permanent Fund, but it’s the world’s 20th largest, with one-fifteenth the assets of Norway’s. Norway has produced more oil and a lot more natural gas over the years than Alaska — by my calculations a little more than twice as much, on an energy-equivalent basis. It has taken in four times as much oil and gas revenue, in part because, as sovereign nation rather than one of 50 states, it doesn’t have to share revenue with another government entity (as Alaska does with the federal government) and had more maneuvering room to strike a tough bargain with oil companies. But again, Norway’s advantage in revenue is a lot smaller than its advantage in wealth-fund size.

The big difference is that Norway has treated its oil and gas revenue as a one-time windfall to be shepherded for future generations, while continuing to tax its residents to pay for the day-to-day functions of government. Thanks to the windfall it has been able to keep its taxes lower than those of its Nordic neighbors, but they’re still above the rich-country average as a percentage of gross domestic product.

Alaskans can perhaps be forgiven for thinking less in terms of future generations than Norwegians do, given that it’s not entirely clear that its future generations will be related to current ones. As of 2017, only 18.9% of Alaska residents 25 and older were born there, and since 2011 Alaska has experienced a net loss of more than 50,000 residents (about 7% of the 2011 population) to other states. Alaska also has a much smaller population than Norway (737,438 to 5.3 million), meaning that a trillion-dollar wealth fund might be a tad excessive.

So let’s compare Alaska to another state, North Dakota, with a similar population (760,077, of whom about a quarter, it seems worth noting, are of Norwegian ancestry) and similar annual revenue from oil and gas (about $2.4 billion in 2018). North Dakota has gone from nowhere to No. 2 in U.S. oil production over the past decade thanks to the hydraulic-fracturing-enabled exploitation of the Bakken shale formation. Its oil and gas revenue is about the same as Alaska’s even though production is higher in part because less of North Dakota’s oil is under public land, meaning the state can count on fewer royalty checks.

Thirty percent of North Dakota’s oil and gas revenue goes straight into the state’s new sovereign wealth fund, the Legacy Fund, compared with 25% in Alaska into the Permanent Fund. The really big difference, though, seems to be that in North Dakota most of the rest is siphoned into a dizzying array of special funds for schools, tax relief, budget stabilization, disaster relief, strategic investments, renewable energy and other purposes. As a result, while oil and gas taxes and royalties have in recent years accounted for about half of state revenue, they formally amount to only 6% of the general fund out of which state operations are funded. Sales taxes and personal income taxes contribute much more.

This small oil and gas share is to some extent a fiction, as sales and income tax receipts follow the fortunes of the oil and gas industry, while direct oil and gas revenue leaks into state spending by way of the other funds. North Dakota politicians spent heavily and cut taxes when oil prices were high a few years ago, and have had to cut spending repeatedly since. Still, the state does continue to have major revenue sources other than oil, and appears to be in much less dire straits than Alaska.

Alaska politicians did set up some other rainy-day funds apart from the Alaska Permanent Fund, and those have so far enabled the state to finance the yawning gap between revenue and spending that opened up in 2015. State officials have also diverted some Permanent Fund income away from dividends and into state operations. But the reserves available have dwindled from more than $20 billion in 2014 to less than $5 billion now, and stopping the dividend diversions was a key campaign promise of Gov. Mike Dunleavy (no relation to the famous basketball Dunleavys, although he did play Division III college hoops) in last year’s election. No new taxes was another. “The days of spending everything we have and avoiding the tough decisions for our future must end,” Dunleavy said when he unveiled his budget in February. But continuing to depend on oil to pay state government’s bills and then some seems like avoiding a tough decision for Alaska’s future’s too.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS