By Saket Sundria and Alex Longley

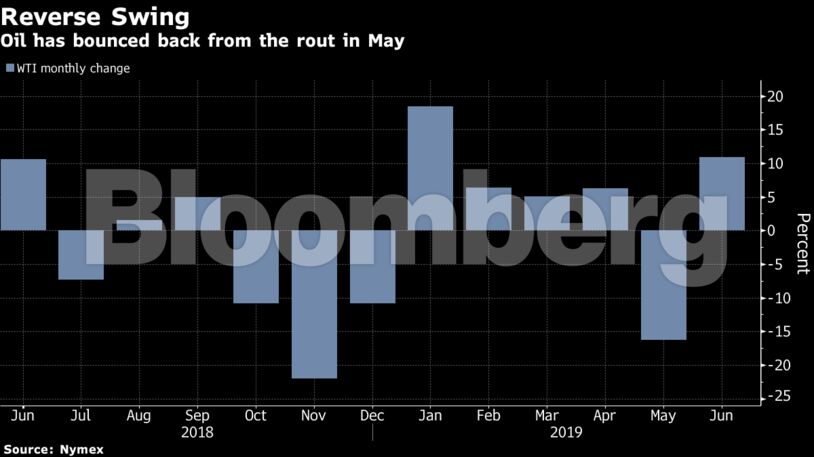

Futures in New York declined Friday, paring their advance in June to about 11%. Investors are focused on the meeting Saturday in Osaka between the U.S. and Chinese leaders for any progress on defusing the trade war. OPEC and its allies will then gather in Vienna on Monday and Tuesday to decide on the group’s production levels. Russia’s energy minister said his country is still in talks on the future of the group’s supply cuts deal.

Growing gloom over the global economic outlook spurred by the trade war snubbed out oil’s rally in late April, and pushed it down more than 20% before attacks on tankers in the Middle East gave prices a lift. While President Donald Trump has threatened this week to impose more tariffs on Chinese goods, there is some hope he may agree to another truce while negotiations resume. Meanwhile, most analysts expect the Organization of Petroleum Exporting Countries to roll over their output cuts for the rest of the year.

“In the search for longer term direction, all eyes will be on the G-20 this weekend as oil markets wait to see if the summit will produce a breakthrough on trade,” said Callum MacPherson, head of commodities at Investec Plc. “If U.S. production continues to grow this year, OPEC may find itself in the impossible position of having to make even further cuts to balance the market when it meets again in the Autumn.”

West Texas Intermediate for August delivery fell 7 cents, or 0.1%, to $59.36 a barrel on the New York Mercantile Exchange at 10:36 a.m London time. The contract has risen 3.4% so far this week and 11% in June.

Brent for August settlement declined 2 cents, to $66.53 on London’s ICE Futures Europe Exchange and is up 3.2% this month. The August contract expires Friday. The global benchmark crude is trading at a premium of $7.13 to WTI.

After initially indicating the U.S. may delay further tariffs on Chinese goods, Trump appeared confrontational when he warned of more tariffs in a interview with Fox Business Network earlier this week. Chinese President Xi Jinping condemned protectionism and “bullying practices” in a meeting with African leaders on Friday.

OPEC+ Deal

OPEC members, including Iraq, have voiced support for Saudi Arabia’s push for extending production cuts, with even Russian President Vladimir Putin saying the agreement had a positive effect on the market. Russian Energy Minister Alexander Novak said Friday that the country is still in talks on the OPEC+ deal.

OPEC Keen to Extend Cut, Russia Is Circumspect: Reality Check

The output reductions are likely to be rolled over but not deepened, Goldman Sachs Group Inc. said in a note Thursday. The Saudis will probably push for more extensive cuts, according to a note from JPMorgan Chase & Co.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS