By Rachel Adams-Heard

In 2014, oil and gas companies made up almost 11% of the S&P 500 Index. Now, that’s just over 5% as some investors appear to have given up on the sector.

Shareholder antipathy stems at least in part from questions over the profitability of shale drilling. While the five big, publicly traded integrated major producers — BP Plc, Chevron Corp., Exxon Mobil Corp., Royal Dutch Shell Plc and Total SA — resumed generating free cash flow as a group in 2017, independent U.S. drillers only became cash-flow-positive (based on an average of 12 such companies compiled by Bloomberg) in 2018 — and they were back in the red in the first quarter of 2019.

One fundamental difference is that independents get most, if not all, their crude from shale wells, which go through a much quicker drop-off in production than conventional wells. That compels them to constantly spend on new prospects to keep growing. After oil prices dropped at the end of last year, investors doubled down on their demands for drillers to slash capital budgets.

It’s not just capital spending, though. Shareholders are now asking independent producers to trim the fat. General and administrative costs, the bulk of which come from salaries, have been creeping up in the last couple of years.

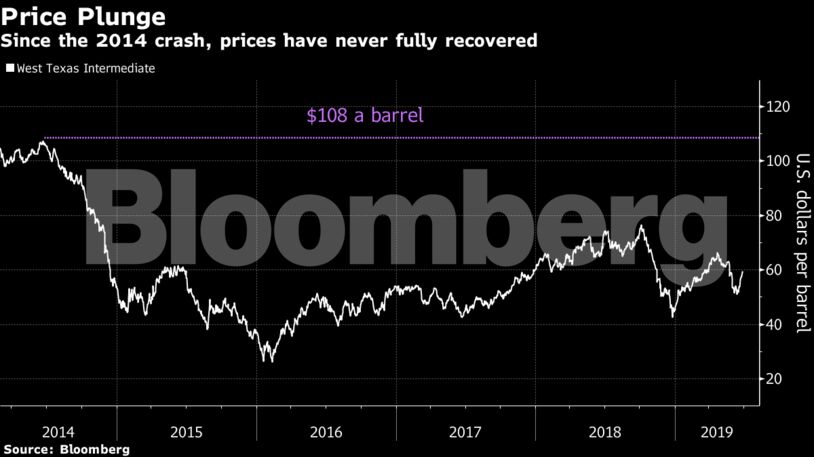

While the larger players have been able to weather the 2014 crude collapse and another price downturn late last year, some smaller companies weren’t so lucky. The energy sector has made up almost a quarter of all U.S. bankruptcies in the past year.

Still, one area where U.S. drillers have been unarguably successful in recent years is in expanding production.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS