By Dorothy Neufeld | Graphics/Design: Amy Kuo

Key Takeaways

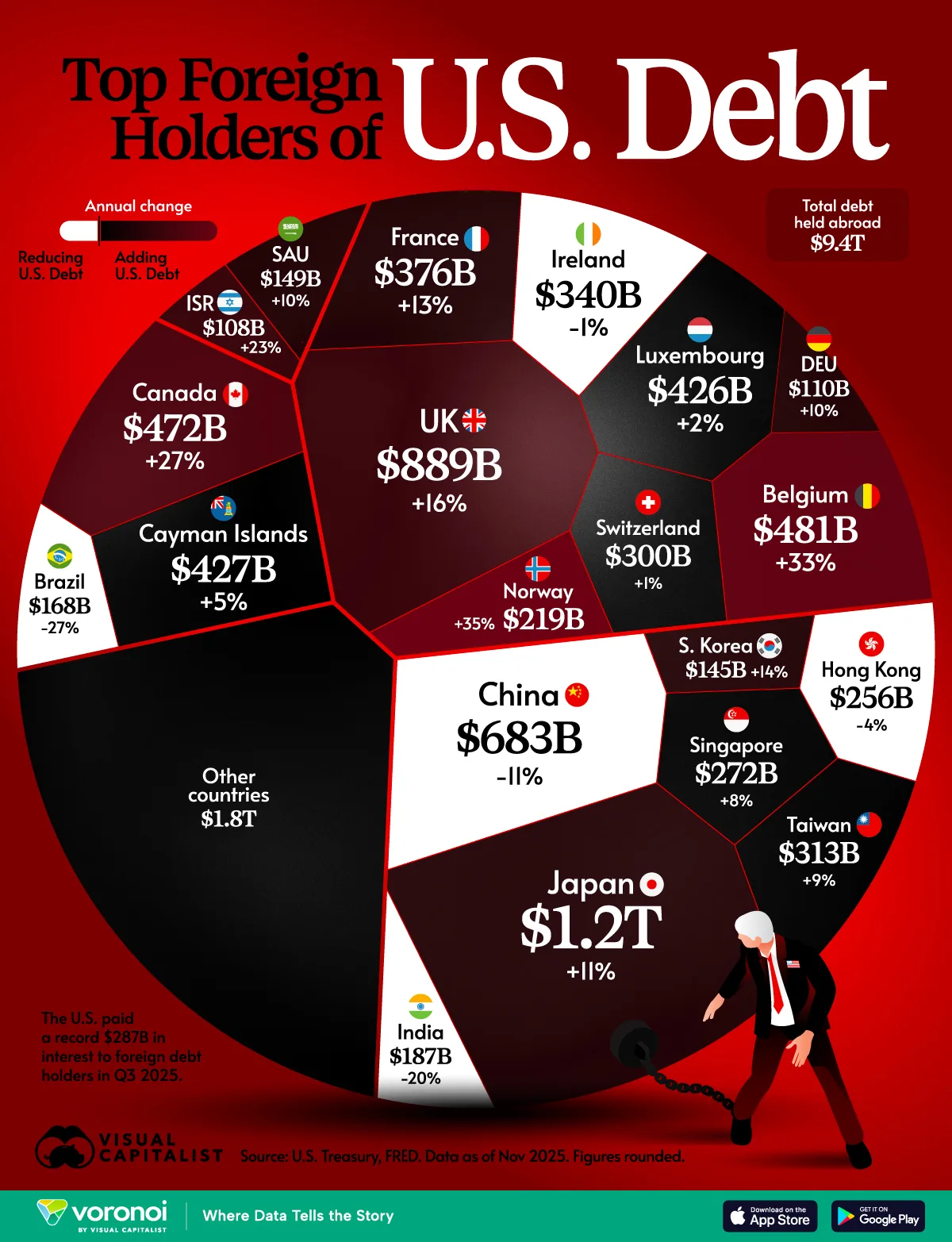

- Foreign holdings of U.S. Treasuries hit an all-time high of $9.4 trillion in November, despite notable selloffs from China and India.

- Japan’s holdings of U.S. debt increased 11% annually to reach $1.2 trillion, while Canada’s purchases climbed 27% over the period, with the total now at $472 billion.

Each year, the U.S. needs to sell more Treasuries to finance its growing budget deficit.

Both domestic and overseas investors buy this debt, with foreign holders of U.S. Treasuries owning a record $9.4 trillion of the total. Overall, European countries collectively hold close to 40% of foreign-owned U.S. debt.

This graphic shows which countries hold U.S. debt, based on U.S. Treasury data.

With $1.2 trillion in U.S. Treasuries, Japan is the largest foreign holder of U.S. debt.

In 2019, Japan overtook China, marking a major shift from a decade earlier, when China held nearly $1.3 trillion. Since then, China’s Treasury holdings have been nearly cut in half, while Japan’s have risen more modestly, up $61 billion over the same period.

The UK ranks next, with $888.5 billion in U.S. federal debt. In the past 12 months, these debt holdings increased by the double-digits, a pattern echoed across several European nations, including Belgium, France, and Norway.

By contrast, BRICS countries saw significant selloffs. Brazil’s holdings fell 27%, outpacing India’s 20% decline and China’s 11% reduction. At the same time, gold’s share of global central bank reserves surpassed U.S. Treasuries in late 2025 for the first time since 1996.

While U.S. Treasury demand is shaped by many complex factors, 2025 underscored a clear divergence. Traditional U.S. allies continued to build their positions, while others increasingly diversified away, likely reflecting growing geopolitical considerations.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS