By Ron Bousso

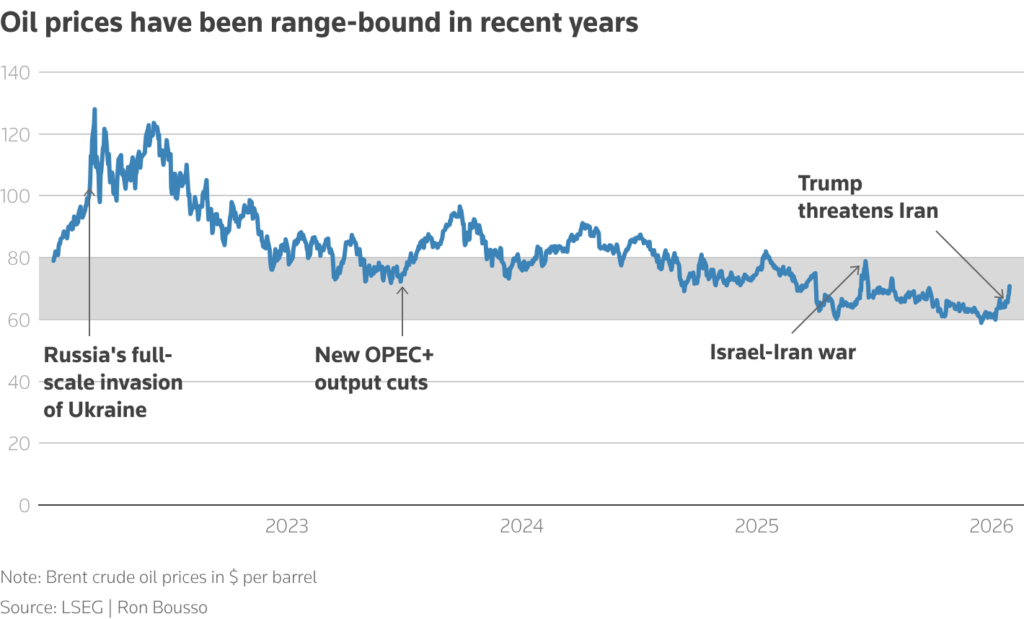

LONDON, Jan 30 (Reuters) – Oil prices remain stuck in a narrow band even after soaring 15% in January, partly on fears of a fresh U.S. strike on Iran. Tough talk on either side is unlikely to push crude prices much higher, given today’s well-supplied market. What would be needed is big-time action that results in a meaningful, sustained hit to the global supply-demand balance.

This month so far, Brent crude futures have climbed above $70 a barrel, their highest since last July. That puts the global benchmark on track for its biggest monthly gain since January 2022, when Russian forces were preparing to invade Ukraine, as a series of major supply disruptions have collided with escalating geopolitical risk in the Middle East.

First, there was the drop in Venezuelan exports following the U.S. arrest of Nicolas Maduro. Caracas’s oil shipments averaged just 605,000 barrels per day (bpd) in January, below the 2025 average of 780,000 bpd, according to data analytics firm Kpler, as the country struggles to revive its industry.

Next, over in Kazakhstan, output at the giant Tengiz field – one of the world’s largest – was halted on January 18 by a power outage. While operations have restarted, the field is unlikely to return to its pre‑outage production level of more than 900,000 bpd before mid‑February.

Meanwhile, U.S. production is still recovering after plunging by up to 2 million bpd – roughly 15% of national supply – during last weekend’s severe winter storm.

These setbacks delivered a substantial hit to global supply in January, and some outages are likely to linger for weeks or even months.

While the combined impact has helped to lift prices, the gains have been capped by rising output in other parts of the global market, including from key OPEC producers. That surge in supply has put downward pressure on prices in recent months.

Indeed, the International Energy Agency forecasts a massive 3.7 million bpd oversupply in 2026. Growing onshore and offshore inventories lend credence to this projection.

Brent crude oil

IRAN TENSIONS ON THE RISE

Nevertheless, President Donald Trump’s increasingly explicit threats to strike Iran, as well as the large U.S. military buildup in the region, have added upward pressure to oil prices in recent days.

How events will unfold here remains uncertain, of course. Will Washington attack Iran at all? If so, how forcefully? And, then, how would Tehran retaliate?

What is known, however, is that the stakes for oil markets are very high.

Iran, OPEC’s fourth‑largest producer, pumped 3.3 million bpd in 2025, roughly 3% of global crude. Tehran has vowed to retaliate against any U.S. strike, including by hitting neighbouring states, raising the prospect of broader disruptions across a region whose energy exports supply nearly 20% of global consumption.

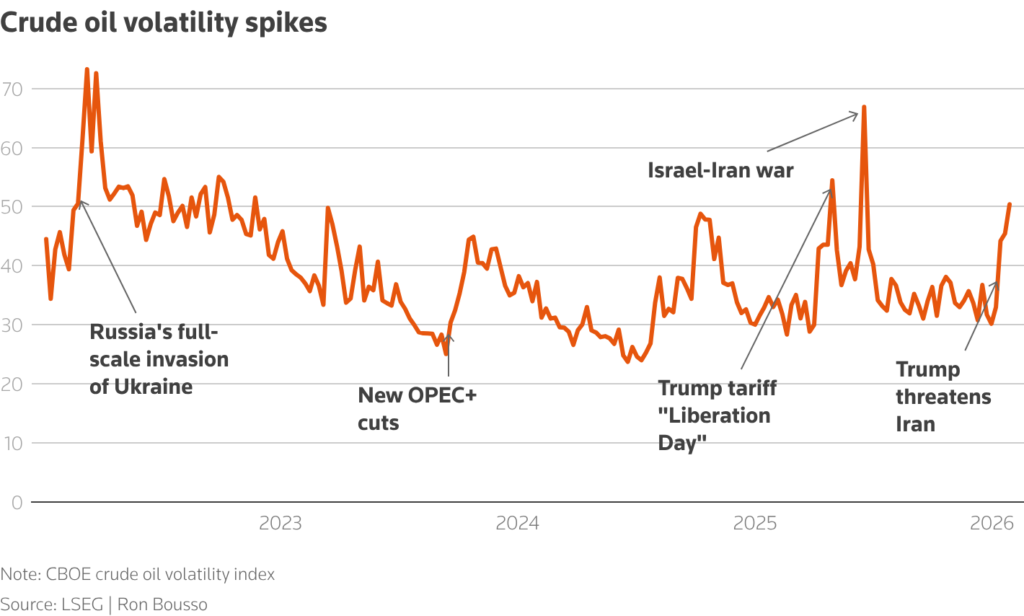

Markets are without a doubt on edge. The CBOE crude oil volatility index (.OVX), which measures the market’s expectations of volatility based on a range of put and call options, rose sharply from 30 at the start of the year to over 50 on Thursday, its highest since the Israel-Iran war last June, when it reached 77.

Crude oil volatility spikes

GEOPOLITICAL RISK PREMIUM

Taken together, the recent physical outages and rising Middle East tensions create a strongly bullish backdrop for crude. So why hasn’t it been enough for Brent to break out of its $60 to $80 per barrel band that it’s been trapped in for nearly two years?

In short, investors are only pricing in a modest geopolitical risk premium, given the prevailing global supply glut.

As a reminder, prices remained confined to this narrow range last year as well despite the Israel‑Iran war, a wave of Ukrainian attacks on Russian oil facilities, and Trump’s “Liberation Day” tariff announcement.

So what would it take to propel prices into triple‑digit territory? It would likely need to be a doomsday scenario – a regional conflagration that severely disrupts flows.

Otherwise, the oil market is simply less responsive to escalating political tensions than it may have been in the past. Today, traders need to see supply losses big enough to outweigh the supply overhang – and that’s a big ask.

Ron Bousso Editing by Marguerita Choy

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS