LITTLETON, Colorado, Dec 23 (Reuters) – Like any industry, wind energy has had its good and bad years. But 2025 may be one of the worst: a toxic stew of major policy reversals, corporate upheaval and sub‑par generation in key markets.

U.S. President Donald Trump’s policy U-turn on renewable energy likely ranks as the most damaging development. It sparked a freeze on offshore project work in the Atlantic and dealt a heavy blow to power developers and specialist wind firms alike.

Disappointing auctions for new wind power capacity across Europe – some in Germany and Denmark with no bids at all – highlight that wind’s woes extend well beyond U.S. shores.

Throw in mass layoffs, project pull-outs by prominent developers and months-long stretches of below-normal output in key markets, and 2025 becomes a year to forget for the industry.

That said, there are reasons to expect some improvement in 2026 as changes to auction incentives, supply chain adjustments and demand growth for power from all sources spur continued wind energy uptake around the world.

Below is a breakdown of the major factors that impacted the wind sector in 2025, and what to look out for in 2026 and beyond.

SLOWEST GROWTH IN DECADES

On top of all the external factors that bashed wind developers in 2025, the performance of existing wind farms did little to bolster the sector’s reputation as a reliable power source.

Indeed, global electricity generation from wind farms this year is on track to register its smallest growth rate in more than 20 years, thanks in large part to sustained stretches of sub-par generation in Europe and North America.

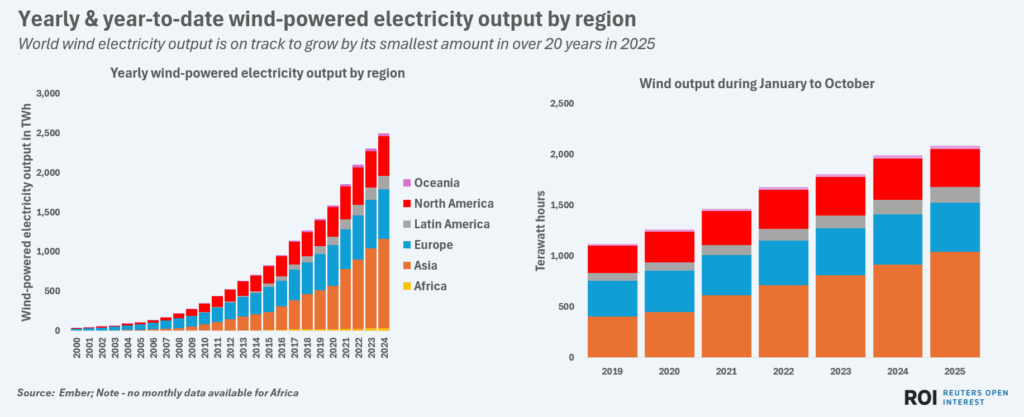

World wind electricity output is on track to grow by its smallest amount in over 20 years in 2025

Global wind-powered electricity production through the first 10 months of 2025 amounted to 2,158 terawatt hours (TWh), data from think tank Ember showed.

That is a record, but only 7% higher than the same period in 2024, compared with an average annual growth rate of 14% from 2015 through 2024.

Four straight months of year-over-year declines in wind generation in Europe – the second-largest wind-producing region after Asia – were a key factor in hobbling global wind output growth right at the start of 2025.

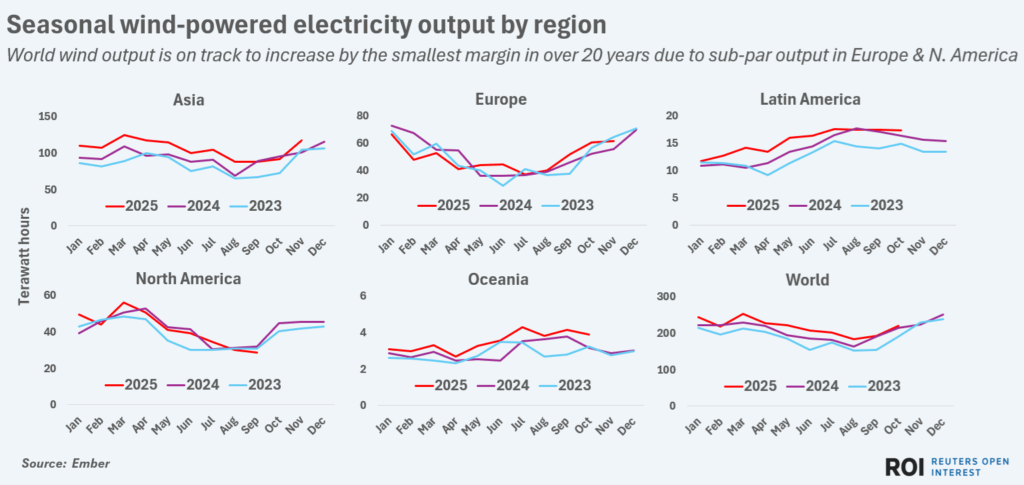

World wind output is on track to increase by the smallest margin in over 5 years due to sub-par output in Europe & N. America

Mid-year declines in wind generation in North America – the third-largest wind production region – then weighed further on global wind output as the region recorded output declines from the year before in April, May, June, August and September.

Even Asia – which accounts for around 45% of global wind power production – registered rare year-over-year drops in wind generation in September and October, further stifling global output growth.

POLICY AND COMPANY TURBULENCE

Just as existing wind farms were struggling to perform as expected, planned future projects were being buffeted by major sudden shifts to key policies and power auction participation levels.

In the U.S., the Trump administration’s scrapping of federal support for wind power accelerated the phase-out of tax credits, tightened start-of-construction rules and imposed tougher limits on foreign-made components. Those changes look set to slow both onshore and offshore project growth for years.

In Europe, the string of dismal wind power auctions spurred key developers, including Denmark’s Orsted (ORSTED.CO) and Vestas (VWS.CO), to push for faster permitting and better auction terms in order to boost investments.

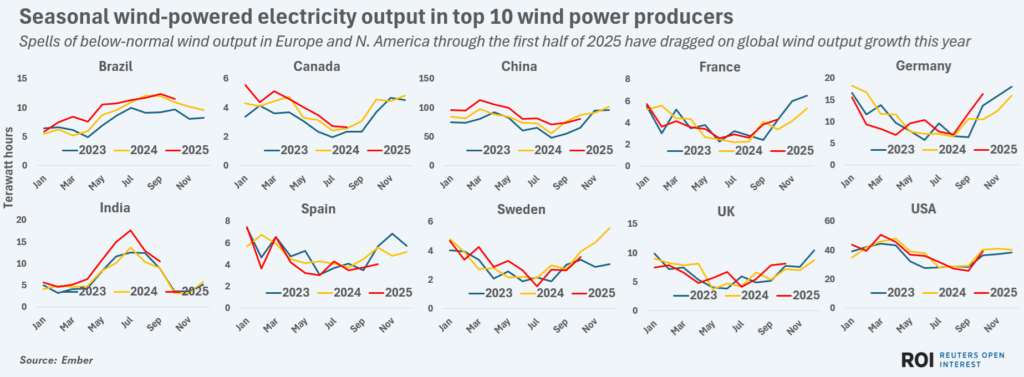

Spells of below-normal wind output in Europe and N. America through the first half of 2025 have dragged on global wind output growth this year

Some of those proposed changes are likely to take effect in 2026, and could ignite broader interest in the build-out of new wind capacity across the region.

In Japan, soaring cost estimates for planned offshore projects caused Mitsubishi (8058.T) to pull out of three projects that were slated to start operations by 2030.

However, the Japanese government has since made changes to wind project policies that are designed to allow greater flexibility for developers, provide more financial support and expand the area eligible for offshore wind projects.

As with Europe’s policy tweaks, these changes are likely to rekindle interest in expanding Japan’s wind power footprint in 2026 and beyond, despite the tough going so far in 2025.

CHINA-LED

Even as wind developers endured setbacks elsewhere, wind power output in China – by far the world’s top deployer and producer of wind power and its components – is on track to post more than 10% growth in wind energy for the 25th year in a row.

China’s share of global wind power output is set to rise to a record above 41% in 2025, from just under 40% in 2024.

The sheer scale and pace of China’s ongoing wind farm expansion means global wind production will likely keep hitting new highs in the coming years, even if growth grinds to a halt in the U.S. and stays weak in Europe.

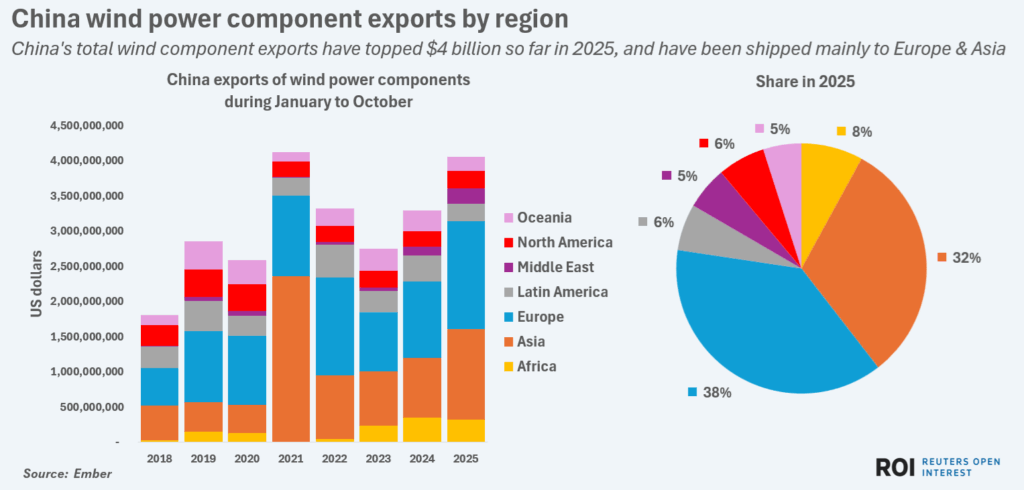

China’s steady flow of wind component exports – up more than 20% to over $4 billion so far in 2025, per Ember data – also means supplies of wind parts are climbing in almost every region.

China’s total wind component exports have topped $4 billion so far in 2025, and have been shipped mainly to Europe & Asia

Combined with the ongoing need to boost power output in almost every country, those swelling wind power supplies look set to ensure that wind power’s global footprint keeps growing in 2026 and beyond – despite 2025’s heavy turbulence.

The opinions expressed here are those of the author, a columnist for Reuters.

Reporting by Gavin Maguire; Editing by Marguerita Choy

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS