- Mild weather has sent US natural gas prices tumbling

- EQT cut production by 1 bcf per day starting in late February

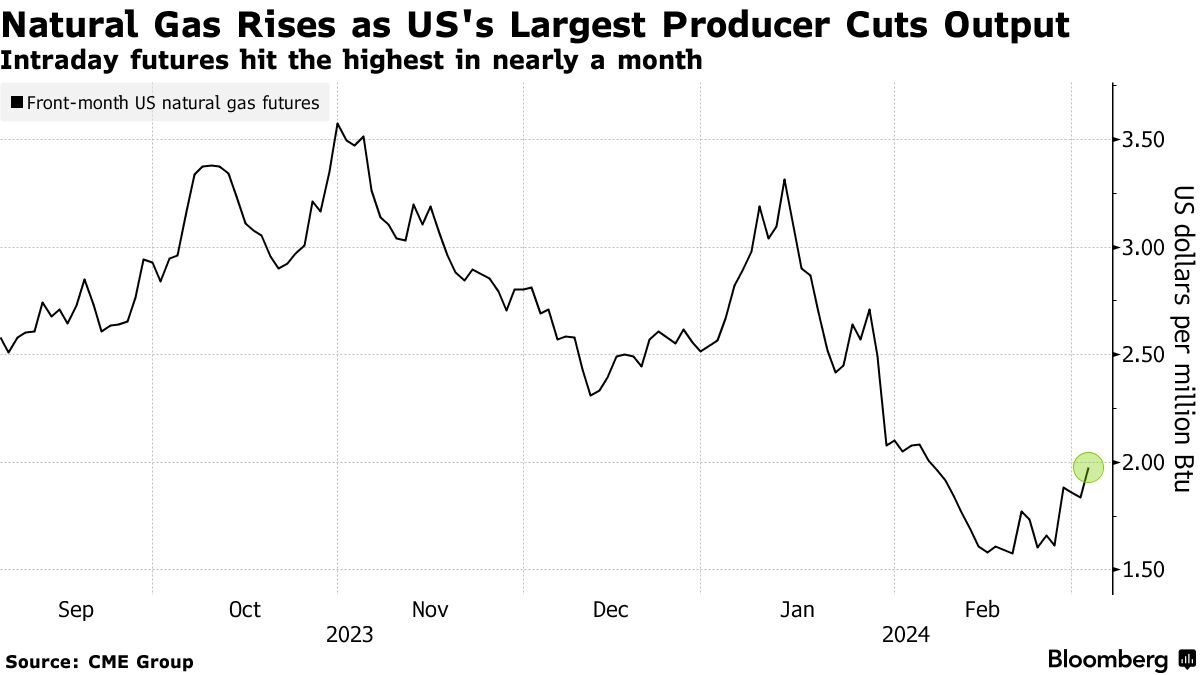

US natural gas prices surged after EQT Corp., the nation’s largest producer, said it will slash output after an unseasonably warm winter and the resulting supply glut triggered a price collapse.

EQT will curtail about 30 to 40 billion cubic feet of net production through March in response to low prices, it said in a statement Monday. That’s 5% to 7% of the company’s quarterly output, based on fourth-quarter results. Total US gas production is about 100 billion cubic feet per day, down slightly from a record earlier this year.

The company’s move is the latest sign that prices aren’t sustainable at current levels. US gas futures have touched pandemic-era lows in recent months, with a mild winter curbing demand amid soaring production from shale drillers. Now companies are having to adjust. Last month, Chesapeake Energy Corp. and Comstock Resources Inc. both announced they would reduce output.

Benchmark Henry Hub futures rose to the highest in nearly a month after markets opened. The month-ahead contract has declined more than 20% since the start of the year and remains well below the seasonal average. US gas stockpiles, meanwhile, are 27% above normal for the time of year.

EQT, which drills for gas in Appalachia, made the decision to cut 1 bcf per day of gross output starting in late February. It will reassess market conditions after the end of this month.

The production cuts are “in response to the current low natural gas price environment resulting from warm winter weather and consequent elevated storage inventories,” EQT said.

Appalachian production is “starting to move lower to unwind oversupply, though early March weather forecasts show limited demand potential,” Energy Aspects Ltd. said in a note last week. “Total US production is showing initial signs of weakness.”

Prices:

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein