- Texas Permanent School Fund to pull $8.5 billion from firm

- Law restricts business with companies deemed oil boycotters

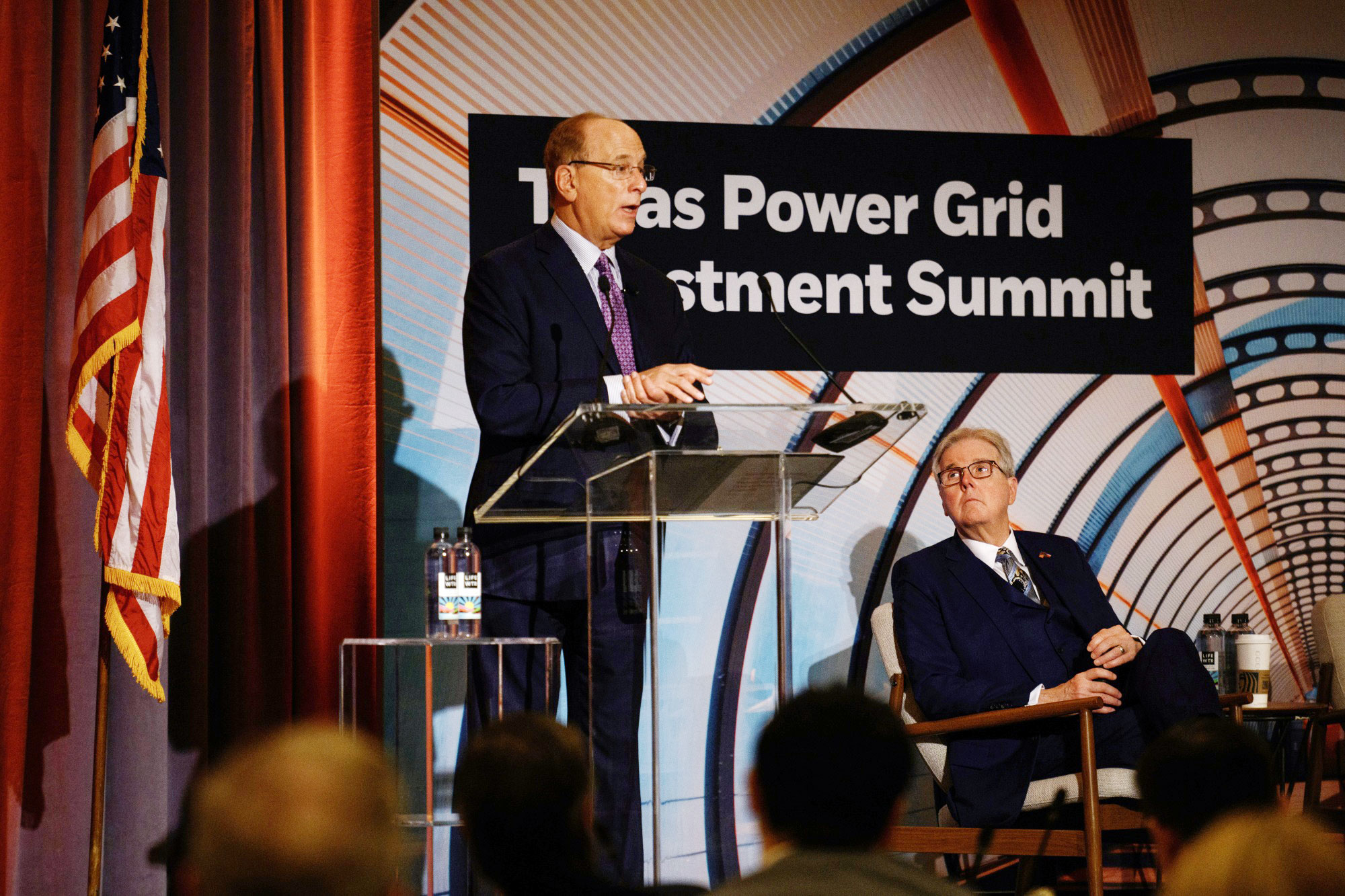

It was just weeks ago when BlackRock Inc. Chief Executive Officer Larry Fink took the stage with Texas Lieutenant Governor Dan Patrick at an industry event in Houston.

The chummy meeting between the Republican politician and the head of the investment behemoth — Patrick praised Fink as the “King of Wall Street” — led to speculation that the state’s tensions with BlackRock over its fossil fuel policies were easing, if not over.

Aaron Kinsey didn’t get that memo. The chairman of the Texas State Board of Education on Tuesday delivered notice to BlackRock that the state’s $53 billion fund for schools would be terminating the firm’s management of about $8.5 billion in assets.

The notice came as a surprise — even amid a steady drumbeat of news surrounding Republican states’ anti-ESG fight over the last three years. One of the few comparable moves was in late 2022, when Florida said it would pull $2 billion from BlackRock, the world’s largest money manager.

Kinsey said BlackRock was terminated by the fund’s leadership to comply with a 2021 Texas law that restricts investments with companies that engage in so-called boycotts of the fossil fuels industry. The firm is on a list of companies that State Comptroller Glenn Hegar considers to be violators.

The announcement elicited a sharp rebuke from BlackRock, which described the decision as “unilateral” by Kinsey and one that would hurt Texas schools. The New York-based firm has repeatedly said that it doesn’t boycott the energy industry. In fact, it boasted about its ties, saying it’s one of the largest investors in energy companies – including in Texas. Last year, BlackRock announced a $550 million investment into a project with Houston-based Occidental Petroleum Corp.

“At a time when investors should be more discerning about their best long-term partners, Texas today took a huge step backwards,” said Terrence Keeley, a former senior BlackRock executive, critic of ESG strategies and CEO of 1PointSix LLC. “Politics and finance should remain as separate as church and state. Texans, above all others, should know better.”

The Texas State Board of Education directs the investments of the Permanent School Fund. The fund, for its part, had released no statement of its own on the matter hours after the announcement on Tuesday. It’s unclear if its board or the state board of education met to discuss the divestment — there were no public meetings on either calendar scheduled.

“Today’s unilateral and arbitrary decision by Board of Education Chair Aaron Kinsey jeopardizes Texas schools and the families who have benefited from BlackRock’s consistent long-term outperformance for the Texas Permanent School Fund,” a BlackRock spokesperson said in an emailed statement.

Books, BlackRock

Kinsey, who has longstanding ties to Texas oil and gas, declined to comment beyond his statement Tuesday. He’s the CEO of American Patrols, an aviation oilfield services company based in Midland — the center of West Texas’ oil industry.

Kinsey’s campaign website noted his view on ESG and BlackRock, saying he is dedicated to ending the board’s involvement in environmental, social and governance investing. He also supports a “no woke curriculum” in schools to make sure it aligns with “traditional American values.”

He’s previously criticized the depiction of the oil and gas industry in proposed science textbooks, according to the Austin-American Statesman. The board of education in 2023 removed proposed science books from consideration.

A spokesperson for the Permanent School Fund said that the decision would affect an international equity fund and the Navarro 1 Fund LLC, which is managed by BlackRock. The divestments will be effective April 30. Created in 1845, the fund helps finance schools in Texas and was formed through oil and natural gas royalty revenue.

Holland Timmins, the former CEO of the school fund, said in a 2023 board meeting that an international equity fund run by BlackRock offered an attractive fee and strong performance. He noted at the time that the school fund had already moved out of a cash fund offered by BlackRock because there were other alternatives available. Timmins, a 23-year veteran of the school fund, has since retired.

The move is a win for the proponents of the anti-ESG movement in Texas. Wayne Christian, who is part of a three-person panel that regulates oil and natural gas drilling in the nation’s biggest crude-producing state, cheered the decision, saying BlackRock “wants to end oil and gas, brainwash kids to hate fossil fuels, and jeopardize our energy freedom.”

Patrick, the state’s second-ranking Republican official, was quiet.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS