The high-wire act reflects the dramatic politicization of the $8.4 trillion ESG market, with Republicans firing broadsides at anything connected with pursuing environmental, social or good governance goals. Florida Governor Ron DeSantis, a likely 2024 presidential candidate, said last week that he’s leading an alliance of about 20 states intent on banning ESG investing outright.

Arthur Krebbers, who runs ESG capital markets for corporates at Edinburgh-based NatWest Group Plc, said fund managers he speaks to are becoming “coy” about referring to their climate goals to US clients. There are “regional nuances” in the choice of words, “particularly in the US,” he said.

Anti-ESG rhetoric in the US is “absolute madness,” said Ioannis Ioannou, associate professor of strategy and entrepreneurship at London Business School. The “appeasement approach” that the finance industry seems to be resorting to “may be unsettling in principle,” but it’s arguably a case of the “long-term benefits” outweighing the “short-term compromises,” he said.

DeSantis’s own actions — in some ways — undermine his efforts to bash ESG. When he proposed spending close to $1 billion on conservation projects such as protecting clean water in his own state, he was ostensibly embracing what ESG stands for while telling voters to fight its “pernicious effects.”

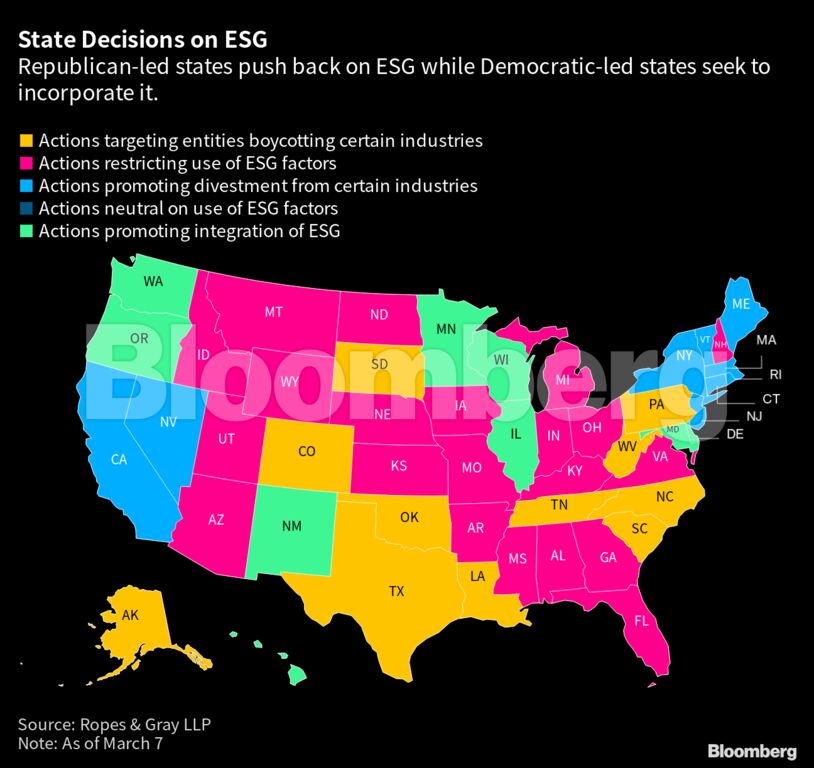

In response to the GOP, Democratic-led states have started imposing counter-measures to support ESG. And on Monday, Joe Biden used the first veto of his presidency to block Republican efforts that would have prevented managers of retirement funds from taking ESG into account.

A survey published this month by Robeco found that almost half of North America’s biggest investors worry that the politicization of ESG in the US exposes them to legal risks. That’s very different from the mood around the investing strategy in Europe and the Asia-Pacific region, where investors are more worried about the ramifications of not being sustainable enough, Robeco said.

Some investors started adapting last year. Trey Welstad, a money manager at Integrity Viking Funds, removed the ESG label from a $72 million socially responsible fund, Integrity Growth and Income, in October. “The term ESG just became too politicized,” said Welstad, who helps oversee $900 million at the North Dakota-based firm.

In San Francisco, an asset manager who asked not to be named said he started to reword the emails he sends his clients. Before ESG became a punching bag for Republicans, his firm discussed environmental issues associated with their investments. Now, client emails focus more on navigating the financial markets.

A person who works at a too-big-to-fail global bank said the lender’s clients told the bank they were wary of saying too much about sustainability in their quarterly results for fear of attracting political backlash.

And corporate executives are shying away from talking about ESG, climate change and net-zero emissions targets. So far this quarter, their use of such terms on calls with analysts and investors is down by more than half from a year ago, according to data compiled by Bloomberg.

None of the representatives from the banks or asset managers interviewed by Bloomberg said they were changing their investment strategies, just the language. And some pointed to the inevitability of ESG becoming entrenched in financial markets. They noted the impact of legislation such as the Inflation Reduction Act and regulatory changes such as those planned by the US Securities and Exchange Commission. Some also referred to the demographic shift that’s set to shape portfolio strategies, with younger investors much more likely to demand ESG products.

“When I speak to some of the fund managers who have been blacklisted by certain Republican party run states such as Texas and West Virginia, they generally say they aren’t going to change course because for every anti-ESG mandate that they lose, they gain multiple other mandates that do care about this topic,” NatWest’s Krebbers said.

There are still ESG proponents who refuse to be brow-beaten by the GOP and are emphatic in their embrace of the investment approach. A group that includes Al Gore’s Generation Investment Management, New York pension plans and companies such as Patagonia Inc. and Seventh Generation are pressing policymakers to “protect the freedom” to invest responsibly.

Megan Starr, partner and global head of impact at Carlyle Group Inc., said that nomenclature aside, C-suites that ignore ESG face a difficult future.

At Carlyle, “we talk about the net-zero domino effect,” Starr said during a recent Bloomberg panel discussion in New York. “What we’re seeing is 90% of GDP is covered by net-zero commitments,” so “if our portfolio companies want to sell into companies anymore, they better know their carbon emissions, and they better be slightly better than their nearest competitors.”

Larry Fink, the chief executive officer of BlackRock Inc., used his latest letter to stakeholders to underline the importance of backing the transition to clean energy. And despite consistent attacks by the GOP, BlackRock, the world’s largest asset manager, drew in almost $400 billion in long-term net new assets last year, he said.

“Anyone can see the impact of climate change in the natural disasters in California or Florida, in Pakistan, across Europe and Australia, and in many other places around the world,” Fink said. “In fact, it’s hard to find a part of our ecology — or our economy — that’s not affected. Finance isn’t immune to these changes.”

One asset manager Bloomberg spoke with said ESG factors — whether they’re labeled as such or not — are now embedded in everything the firm does. It’s just easier to strike a deal in a red state if it’s pitched as targeting issues such as flooding or clean water, rather than ESG, the person said.

All the financial market representatives Bloomberg spoke with said the political backdrop made ESG an investment field like few others, requiring considerably more caution in marketing and general communication.

Or, as the ESG research firm Util put it in a recent note: “The first rule of ESG is, don’t talk about ESG.”

–With assistance from Aaron Kirchfeld and Natasha White.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS