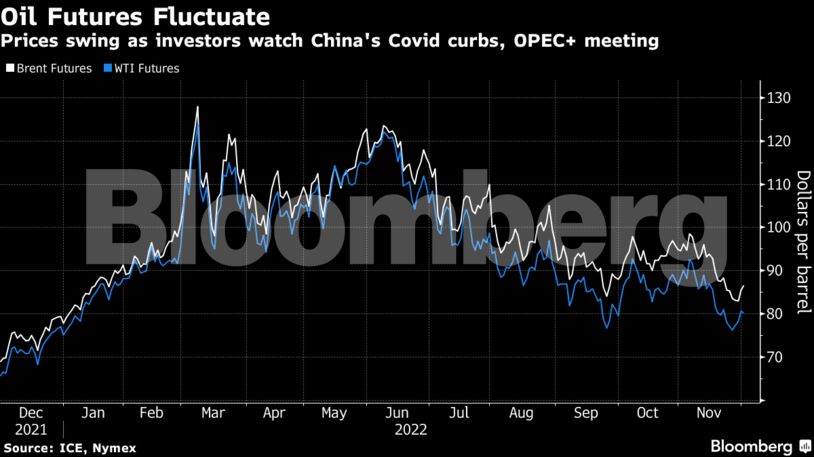

West Texas Intermediate slipped below $81 a barrel after climbing more than 5% in the week’s first three sessions. Markets gained across the board Thursday as fresh signs emerged of a softening in China’s Covid stance and as Federal Reserve Chair Jerome Powell confirmed the pace of interest rate hikes was set to slow.

After hitting the lowest level since late 2021 on Monday, crude is now headed for a weekly gain as demand prospects brighten. The market’s latest shift will form the backdrop to a weekend meeting of the Organization of Petroleum Exporting Countries and its allies, while traders are also awaiting news of the plan to cap the price of Russian crude, which could now be set at $60.

“All risk assets got a leg up as the US Fed signaled smaller rate hikes this month,” said Keshav Lohiya, founder of consultant Oilytics. “We continue to believe that the market has priced too much on the bearish side on these China Covid developments.”

Prices:

- WTI for January delivery dropped 0.3% to $80.35 a barrel at 9:53 a.m. in London.

- Brent for February settlement fell 0.4% to $86.61 a barrel.

Powell’s comments, in which he presented a case for achieving lower inflation without tipping the US economy into a deep recession, helped to weaken the dollar. That made commodities such as crude that are priced in the currency cheaper for overseas buyers.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS