West Texas Intermediate dropped near $88 a barrel, falling as much as 4.3%, with markets selling off as China’s surprise cut in key interest rates boosts support for an economy hit by virus lockdowns and property woes. The nation’s apparent oil demand last month was about 10% lower year-on-year.

“We’re really seeing where China’s economy is at and it’s a lot less rosy than people had hoped, consumption is going to be lower than anticipated, certainly for oil,” Sucden Financial head of research Geordie Wilkes said by phone.

After over a year of stalled and cancelled talks, a nuclear deal with Iran looks more likely on Monday. A spokesperson for the Iranian foreign ministry said there could be a basis for a signed agreement “in the very near future,” while Foreign Minister Hossein Amirabdollahian said in a separate briefing that the country would inform the European Union tonight of it’s position while striking a more conciliatory tone than in recent months.

Some of the potential additional flow of Iranian oil to the global market will have already been priced in said Saxo Bank head of commodity strategy Ole Hansen, but “any additional supply news will give ammunition to funds selling oil as a hedge against an economic slowdown,” he said.

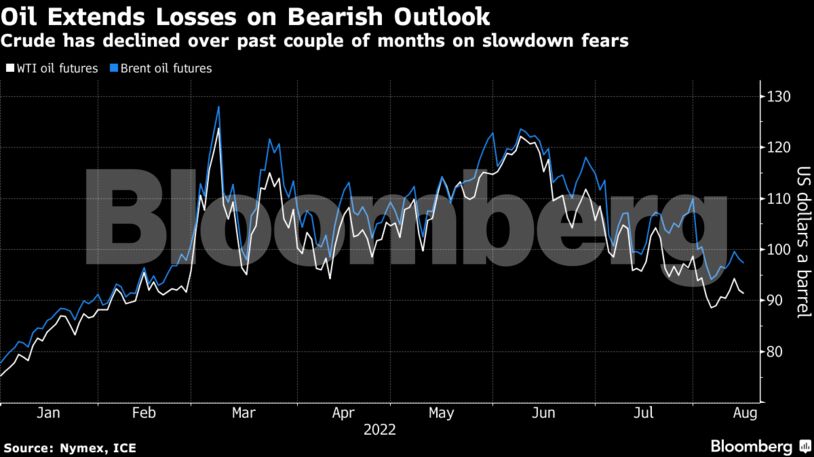

Crude has ticked lower over the past couple of months on concerns about an economic slowdown, shedding all the gains put on following Russia’s invasion of Ukraine. Money managers have cut their bullish bets on WTI to the lowest in over two years, according to the Commodity Futures Trading Commission.

China’s economic recovery unexpectedly weakened in July as fresh Covid-19 outbreaks impacted consumer and business spending. Industrial output rose 3.8% from a year ago, lower than June’s 3.9% and missing economists’ forecast of a 4.3% increase. Oil refining also fell as plants shut for maintenance.

| Prices: |

|---|

|

Oil is still up around 20% this year and the surge in energy prices over the first half has underpinned record earnings for producers. Saudi Aramco posted the biggest quarterly adjusted profit of any listed company globally, following its big oil rivals such as Shell Plc and Exxon Mobil Corp.

The outlook for the oil market remains mixed. The International Energy Agency last week raised its forecast for global demand growth this year, while OPEC expects the market to tip into a surplus this quarter. The cartel trimmed its forecasts for the amount of crude it will need to pump.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS