West Texas Intermediate rose toward $94 a barrel, reversing an earlier decline, after gaining 2.5% last week. In Libya, clashes between militias in the capital left at least 23 dead, sparking fears of further upheaval in the OPEC nation. While Libya’s output so far remains stable, investors are watching for signs that the violence may again put oil shipments at risk just as Europe reels from an energy crisis.

Iran, meanwhile, said exchanges with the US over a European Union proposal to revive a nuclear deal will drag on into next month, undercutting speculation that an agreement paving the way for increased oil flows is imminent.

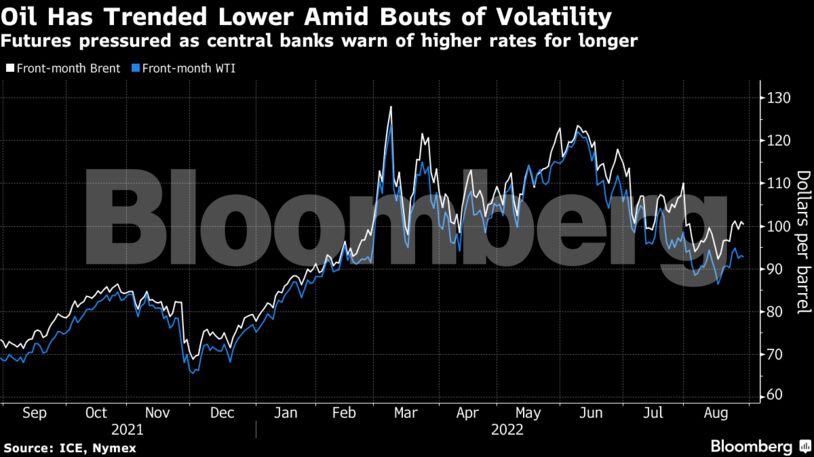

Crude is on course for a third straight monthly drop on concern global growth will slow as central banks tighten policy aggressively, hurting consumption. Federal Reserve Chair Jerome Powell has warned of the need for higher rates, while a top European Central Bank official said that there was “little choice” but to press on even if the region’s economy dipped into recession.

To counter that weakness, Saudi Arabia raised the possibility last week that the Organization of Petroleum Exporting Countries and its allies could cut output, drawing support from fellow members. Separately, loadings from an export terminal for Kazakhstan crude have seen interruptions.

“There are many risks that could potentially lead to supply disruptions,” including the situation in Libya and a longer timeframe for the Iran nuclear talks, said Giovanni Staunovo, a commodity analyst at UBS Group AG. Investors and traders are also focused on “what OPEC might do next week and ongoing substitution of oil for natural gas.”

The producers’ group and partners, known collectively as OPEC+, meet Sept. 5 to consider production levels for October and to review the outlook for the rest of the year. Meanwhile in Europe, future power prices hit a record of more than 1,000 euros ($993) a megawatt-hour for the first time as Russia squeezes flows of gas to the continent.

| Prices: |

|---|

|

In a bullish note on commodities, Goldman Sachs Group Inc. said that crude oil had scope to push higher, especially amid shortages of other energy raw materials including natural gas.

“With oil the commodity of last resort in an era of severe energy shortages, we believe the pullback in the entire oil complex provides an attractive entry point for long-only investments,” analysts including Sabine Schels wrote.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein