For Floyd Stanley, a 66-year old retired software marketer in Dallas, keeping up with electricity rates is akin to a full-time job: He tracks them in a spreadsheet. Shopping around, he found that prices can swing by as much as 10% depending on the time of day.

“You are being asked to play the market out a year to three years, and that is not a comfortable decision,” said Stanley, whose home state of Texas has a deregulated electricity market and allows customers to choose from power companies.

Stanley recently switched to a different provider and signed a three-year contract to try to cap his costs, which soared by 145% in July over the previous year. He’s still keeping an eye out on the markets, because he wants to get the best plan for his 100-year-old father-in-law come October.

With the price of gas, electricity and heating oil soaring, monthly utility bills have reached records. The surge is sparing no one, but for many Americans who live in states with competitive utility markets, there’s the added anxiety of having to figure out whether energy costs will keep rising, by how much and until when.

That’s because under so-called customer-choice programs that predominate in these states, consumers have the option to go with a variable rate of electric, oil or natural gas — usually the priciest option — or lock in a fixed rate that comes with a term ranging from six months to as many as five years.

These previously ho-hum decisions are far more nerve-wracking and consequential this year. Wrong-way bets could cost hundreds of dollars or more.

“It’s terrifying. I don’t know how to shop either, and I’m grateful to be on city of Austin’s contracts right now,” Alison Silverstein, an energy consultant and former adviser to chairman of the Public Utility Commission of Texas, said on a conference call this month about the effects of energy costs on low-income Texans.

Although Europeans are facing a much deeper energy crisis than Americans, soaring home power costs are taking a toll on budgets already strained by decades-high inflation. Some 20 million households across the US — about one in six — have fallen behind on their utility bills, the worst the National Energy Assistance Directors Association has ever recorded. Many are facing shutoffs.

Until recently, power demand had flattened across much of the nation, driven in part by more efficient light bulbs and appliances. The Covid-19 pandemic exacerbated the slowdown, idling factories and restricting activities. However, consumption rebounded this year with the economic recovery and a heat wave that led people to crank up their air conditioners.

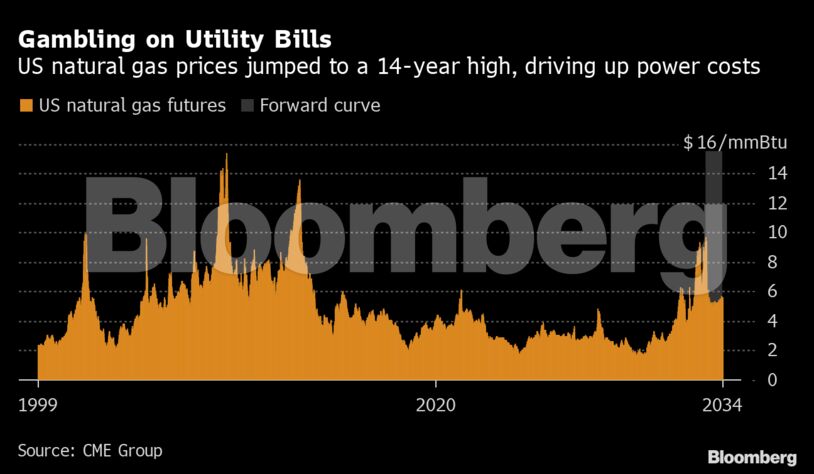

In addition, with Europe scrambling to secure alternative sources of energy as Russia wages war on Ukraine, US providers have responded by sending vast amounts of liquefied natural gas overseas, limiting the amount being funneled into storage for the peak winter heating period. Gas production growth hasn’t kept pace with demand.

Since natural gas is the No. 1 driver of electricity rates, the result has been a sticker shock, making for thorny decisions come contract renewal time.

It’s made utility customers like Ramona Sandro, 51, de facto natural-gas forecasters.

Sandro is gambling that the US will remain in its current energy funk for a while. So she locked in a two-year term with her natural gas provider, Gas South, even though her rate is more than 60% higher than her previous contract.

Accustomed to paying up to $225 a month in winter, she’ll have to adjust her budget to pay over $350. If necessary, Sandro, her husband and two high-school children may have to add an extra layer of clothing this winter to keep their heating bill down.

“Both me and my husband are hard-working people,” Sandro said. “But a budget is a budget.”

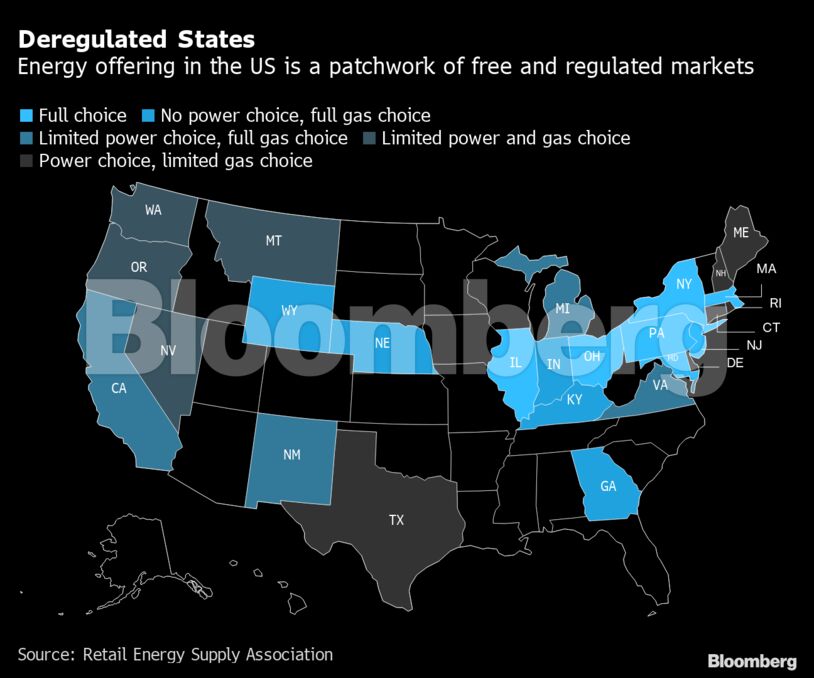

Millions of Americans have some choice to select their electricity or gas provider, or both. It’s difficult to pinpoint how many exactly due to patchwork records across the country.

More than 20 states offer at least some competition, according to trade group Retail Energy Supply Association. In Texas, which has been deregulated since 2002, just shy of 7 million households can choose from retail energy companies, according to data provided by the state’s Alliance for Retail Markets. In Georgia, roughly 1.6 million customers participate in the competitive natural-gas market to heat their homes, according to the American Gas Association.

Ohio allows millions of customers to choose for both electric and gas, and also offers a hybrid approach whereby some local governments negotiate with retail providers on behalf of consumers. In the Northeast, people can choose among local heating-oil companies.

Typically, retail energy marketers will let people escape from bad contracts if, say, the wholesale price of natural gas plummets and the retail prices of gas or electricity drop well below their locked-in rate — with an early-termination fee.

At Houston-based Champion Energy Services, it costs $250 to exit short-term contracts or as much $450 for long ones, said Vice President John Ballenger. Figuring gas prices are bound to fall, he’s thinking about ways Champion might let contract customers benefit from declining rates without incurring a hefty fee.

“We’ve never had a market like this in Texas,” Ballenger said.

Some residents like Stanley, the Texan retiree, prefer to have the choice to shop around for electricity, regardless of the risks. Stanley said he wishes the same option was available for natural gas.

Jeff Bowman, an information-technology professional from Suwanee, Georgia, is going the opposite route: He’s willing to accept some temporary pain in the form of high rates so he doesn’t get trapped in a long-term contract.

In his state, prices per therm, a unit equal to 100 cubic feet of natural gas, have soared to more than 90 cents for fixed-rate contracts, excluding some charges, up from a typical 55 cents in previous years. Variable rates have risen much higher, above $2 a therm.

“I don’t want to lock myself in, because when I lock myself in, I’m going to be paying 98 cents a therm, and I’m going to be paying them that for two years,” he said.

In essence, Bowman is betting on a drop in prices.

“This is like the storm,” Bowman said. “I’m riding it out.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein