(Bloomberg)

The energy crisis that’s sent inflation soaring across the world is getting worse each week, leaving stock traders with a challenge to figure out where to put their money.

The nightmare scenario that’s developed this year has already walloped equities, which suffered a bruising first half. A rally over the summer helped to reduce losses, but the worsening crisis, which appears nowhere near over, is putting up a huge hurdle to further gains.

The surge in power prices, along with threats to supply, is affecting businesses from China to Germany to the US. It jacks up costs and threatens margins, while also sucking money out of their customers’ pockets, destroying demand. And from industrial gas guzzlers to retailers who rely on consumers with money to spend, the damage is proving widespread.

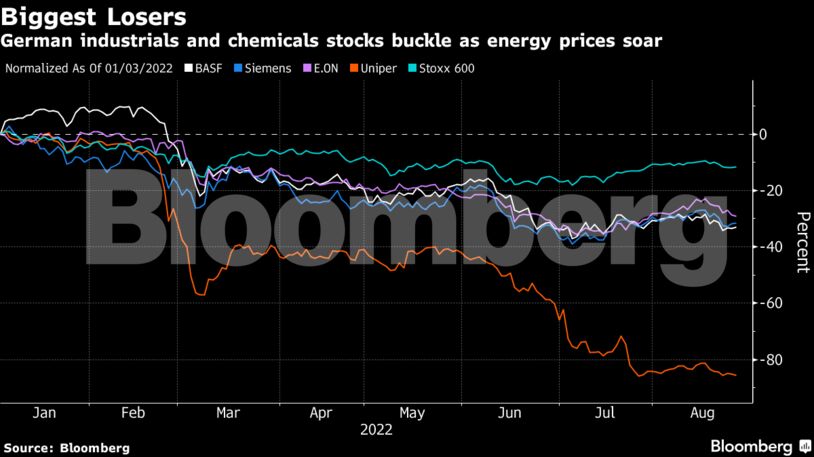

Germany’s heavy reliance on Russian fuels has left its corporate heavyweights particularly vulnerable. A Citigroup Inc. basket of stocks sensitive to a gas shock that includes Covestro AG, Thyssenkrupp AG and Siemens AG has underperformed Europe’s broader Stoxx 600 market this year.

As the squeeze intensifies, retail looks like another loser. In the US last week, two big names reminded investors that any worries are well founded. Nordstrom Inc. plunged 20% on one day alone after slashing its full-year outlook, while Macy’s Inc. also cut its forecast. In the UK, a retail stock gauge has slumped about 35% so far this year.

“The energy crisis brings a huge amount of unknowns and concerns in the market,” said Clive Burstow, Barings’ London-based head of global resources. “High prices are driving inflation and pushing industrial capacity offline, which is worsening an already constrained supply chain.”

The inflation surge has also prompted an aggressive response from the world’s major central banks, which have been jacking up interest rates to get the situation under control.

Federal Reserve Chair Jerome Powell signaled on Friday that the US central bank will keep tightening policy and pushed back against the idea it would reverse course soon. Some European Central Bank officials want to discuss a hike of 75 basis points in September.

“Consumers are faced with higher prices for, frankly, everything,” said Ben Powell, an investment strategist at the BlackRock Investment Institute. Earnings “look at little bit wobbly over the next several quarters,” he said.

Investor worries were on show in the latest flow numbers from EPFR Global data. Global equity funds had outflows of $5.1 billion in the week through Aug. 24, with US stocks seeing their first redemptions in three weeks.

Russia’s chokehold on gas supplies to Europe means that power prices there are spiralling out of control. UBS Group AG economists say the euro-area economy has already entered a recession, and Morgan Stanley last week cut its growth forecast. In the UK, energy bills are set to almost triple this winter, adding to the squeeze in a country where inflation is already the highest in four decades.

But the pain from higher prices is being felt everywhere, and governments are looking at dramatic options. Japan is planning to shift back to nuclear power, and Germany is reviving old coal-fired plants. Kosovo has started rolling blackouts, something that could spread to other countries as the need to conserve resources becomes more pressing.

Power rationing would affect multiple sectors, including chipmakers which use vast amounts of electricity to make ever-smaller semiconductors.

The damage is already ripping through industrial and chemical firms. Yara International ASA and Grupa Azoty SA have slashed output, and lower fertilizer supply could hit agriculture, with repercussions for food costs. UK carmakers said soaring energy costs are threatening output, while a Honda Motor Co. plant in China has been shut amid an order to curb power use.

“Governments will print money to help out, but they can’t print gas,” said Beata Manthey, global equity strategist at Citigroup Inc. “Aside from industrials and chemicals, I’m worried about cyclical growth stocks that still trade at high multiples, particularly in the consumer, technology and retail sectors.”

Picking Winners

Avoiding pitfalls is only half the battle in any crisis, and identifying potential winners is high on the list of stock traders’ priorities. The most obvious are commodities companies, from oil and gas producers to miners. In Europe, the energy sub-index is up 26% this year.

“We are looking for buying opportunities in the energy sector,” said Gary Dugan, chief executive at the Global CIO Office. “We could see very robust profits with good dividend payments making it particularly attractive in the US, where there is less risk of windfall taxes on the sector.”

Bank of America Private Wealth Management is sticking to the so-called FAANG 2.0 strategy — fuels, aerospace & defense, agriculture, nuclear and renewables, and gold and metals.

“It’s a play on hard assets and hard power,” said Joseph Quinlan, chief market strategist. “That’s where we’ve been hiding out, it’s been working out well relatively speaking to the rest of the market.”

Governments and the corporate world have turned en masse to renewables in their scramble to cut dependence on fossil fuels, boosting prospects for the sector. But in the short term, the investment case is murkier. Building capacity, infrastructure and updating the grid to accommodate green energy will take time and industrial equipment like steel and aluminum, which is currently in short supply.

Meantime, for all the daily headlines highlighting the surge in energy prices and its impact on households, businesses, economic growth and profits, ultimately, stock pickers will just have to accept they’re in a new world that isn’t going away.

“The energy crisis, I feel the market has somewhat come to terms with it,” said Mehvish Ayub, senior investment strategist at State Street Global Advisors. “It was a very big shock at the beginning of the year, and it’s now a staple of the macro backdrop and we are able to focus on the fundamentals of the equity earnings.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS