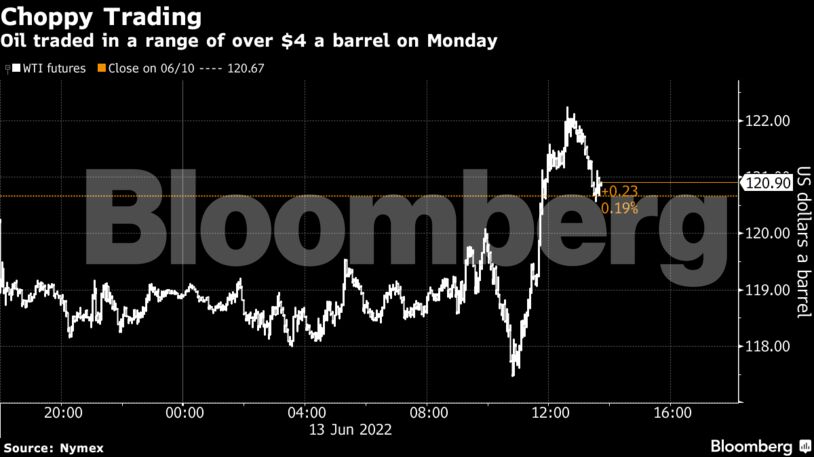

West Texas Intermediate futures rose to near $121, erasing over $3 of losses during the session. A growing chorus of market watchers believe that inventories are so fundamentally stretched even a recession wouldn’t cut demand enough to restore balance.

Supplies are tighter than during other recessionary periods, said S&P Global Inc. Vice Chairman Daniel Yergin. “The supply situation is so razor thin,” he said in an interview on Bloomberg Television.

Read more: Yergin says this time it’s different

Oil is up almost 60% this year as rebounding economic demand coincided with a tightening market following Russia’s invasion of Ukraine. The war has fanned inflation, driving up the cost of everything from food to fuels and some analysts are calling it the most bullish market they’ve ever seen.

“Even faced with US economic slowdown, fundamentals for a tight crude market remain, said Pavel Molchanov, an analyst at Raymond James & Associates Inc.”

Adding current pressure, a plunge in Libyan output is putting more strain on already-tight markets for light sweet oil. On Monday the North Sea’s Brent, Forties and Ekofisk grades were all being bid at higher levels than Friday — when Forties traded at its highest level in more than a decade.

Brent’s nearest futures contract was trading more than $3 above the next month, a premium that indicates extraordinarily scarce supply of the crudes that underpin the global benchmark, including those from the North Sea.

| Prices |

|---|

|

Goldman Sachs Group Inc. reiterated on Friday that energy prices need to climb further for Americans to start cutting consumption. US retail gasoline precently hit a national average of $5 a gallon. Gasoline prices will likely only begin to fall next year when Covid-19 recovery demand dwindles, said Darwei Kung, portfolio manager and head of commodities at DWS Group, in a Bloomberg TV interview.

The US has repeatedly asked OPEC to pump more crude to help tame rising gasoline prices and the hottest inflation in decades. President Joe Biden said on Saturday that he hasn’t yet made a decision about visiting Saudi Arabia, but that if he went it would be to take part in meetings that go beyond energy topics. A visit would reflect a shift in diplomatic priorities.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire