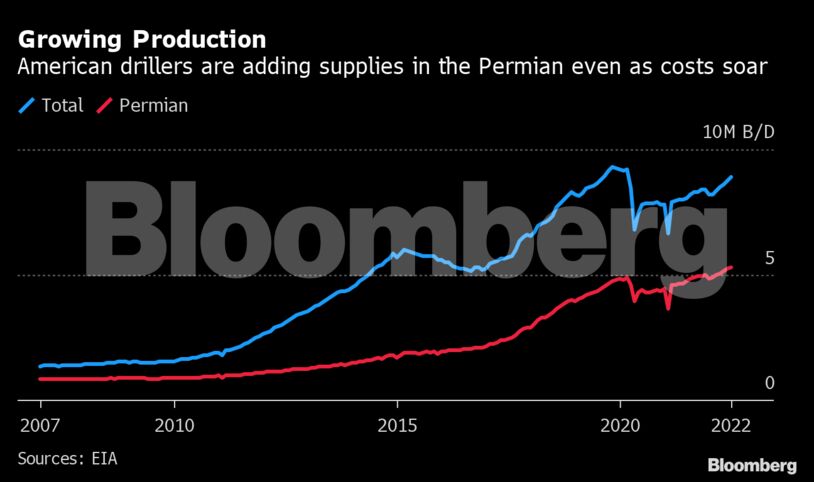

For months, the Biden administration has been pushing the industry to add more output as it battles historically high fuel costs and the worst supply crisis in decades triggered by Russia’s war. The government faces an uphill battle with publicly traded explorers expressing reluctance to increase drilling as they focus on boosting investor returns despite oil trading over $100 a barrel.

Still, a lack of refining capacity will blunt much of the impact that growing domestic crude output will have on fuel prices. At pumps across America, some motorists are paying record prices.

Meanwhile, in the Permian, the number of drilled but uncompleted wells, known as DUCs, is at the lowest level in at least 5 years, the agency said. Producers are using up their existing inventory of DUCs to avoid spending on new drilling given their newfound capital discipline. But to maintain and expand production in the future, new drilling has to occur.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire