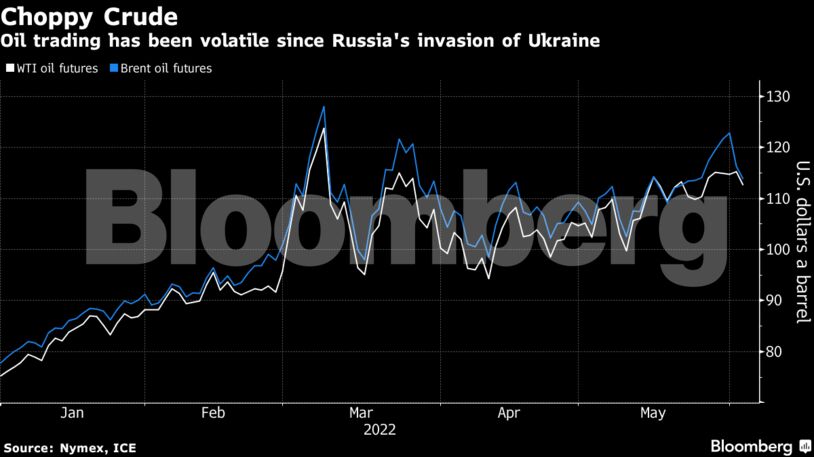

West Texas Intermediate futures fell more than 3% before paring some of those losses, while Brent traded as low as $112.80.

The decrease follows a steep rise in prices last month and comes amid signs that the strained relationship between Saudi Arabia, the world’s biggest oil exporter, and the US is improving.

Biden will almost inevitably meet de facto Saudi ruler Crown Prince Mohammed Bin Salman, who he has so far shunned, if he does travel to the country. That may pave the way for a production boost from the kingdom and help lower US fuel prices, which have soared to record highs, putting pressure on Biden ahead of November’s mid-term elections.

The Financial Times reported Riyadh had indicated to Western allies that it’s prepared to increase oil supply.

The news comes ahead of a monthly OPEC+ meeting on Thursday.

There have been talks about an immediate supply boost from Saudi Arabia and the United Arab Emirates, which could be announced at the OPEC+ gathering, though nothing has been finalized, the FT reported. Output increases scheduled for September might be brought forward to July and August, it said. The Wall Street Journal also reported this week that some OPEC members were discussing exempting Russia from their oil-production agreement.

“The oil market is holding its breath ahead of the OPEC meeting which could prove interesting for once,” said Jens Naervig Pedersen, a senior analyst at Danske Bank A/S in Copenhagen. “The market is likely positioned for some official indication that OPEC will make up for some lost output from Russia following the EU embargo.”

| Prices |

|---|

|

If the Saudis do pump more it would be a turnaround. The kingdom’s foreign minister said last week that there was nothing more it could do to tame oil markets, and even suggested there was no shortfall of crude. OPEC+ was expected to rubber-stamp a production boost of 430,000 barrels a day for next month, although the alliance has struggled to meet its targets in recent months.

It is now possible that the 23-nation group accelerates its monthly increases, according to RBC Capital Markets.

“While we initially thought such a policy shift would likely coincide with a meeting between President Biden and Crown Prince Mohammed bin Salman, we now believe that the expiration of the OPEC+ agreement could potentially come at tomorrow’s ministerial meeting,” RBC strategists including Helima Croft said in a note late on Wednesday. “The remaining barrels could be added back in July and August.”

Oil capped a sixth monthly advance in May, the best winning streak since early 2011, as tightening markets because of the war in Ukraine coincided with a recovery in demand as countries threw off virus restrictions. European Union efforts to approve a partial ban on Russian oil imports hit an obstacle after Hungary raised new or already rejected demands.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS