The U.S. government said Thursday that it would begin buying crude to replenish the nation’s reserve. While the process could begin in the fall, the actual deliveries won’t take place until later in the future.

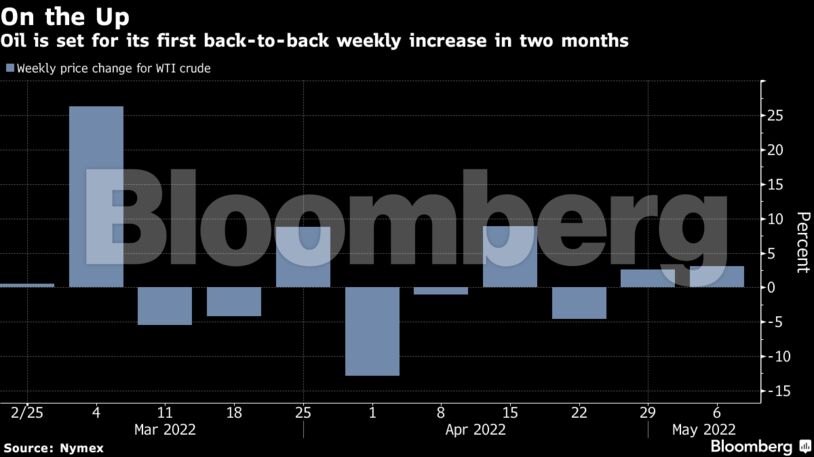

Oil has rallied more than 40% this year as the invasion of Ukraine upended commodity markets. This week’s advance — the third in the past four — has come despite lingering concerns that lockdowns in China to combat Covid-19 outbreaks are hurting consumption.

“Chinese oil demand has been down 1.5 million barrels per day,” due to the lockdowns, according to S&P Global Inc. Vice Chairman Dan Yergin.. But knowing China’s ways, it is expected to stage a strong rebound and that would affect all commodity prices, he added.

This week, the Organization of Petroleum Exporting Countries and its allies did announce another modest increase in supply, there’s doubt the alliance will be able to deliver the full volume.

| Prices: |

|---|

|

Oil-product markets have also shown signs of strength this week, especially in the U.S., where nationwide holdings of gasoline and diesel have dropped. Gasoline futures are trading near a record high after a weekly gain of about 6%.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS