Crude’s outlook has also been clouded as China struggles to contain a wave of Covid-19 infections. While the financial center of Shanghai has begun to emerge from a punishing lockdown, there have been fresh outbreaks in other cities and disruption in Beijing. The country is the world’s largest oil importer.

In the wake of Russia’s invasion of Ukraine, the US and UK moved to ban Russian crude imports to punish and isolate Moscow. The European Union is seeking to adopt a similar embargo for the bloc but has run into opposition from Hungary.

“We don’t see a lasting scarcity” for oil as other production including a US shale boom will fill in supply, said Norbert Ruecker, analyst at Julius Baer Group Ltd. in Zurich. “The lost Russian oil will be compensated by other sources.”

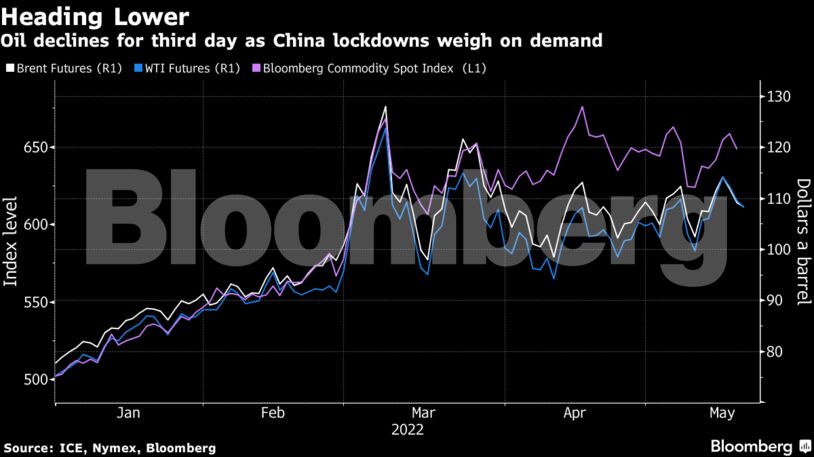

The market has been volatile since late February, when Russia began the war. Despite the recent weakness, prices are up almost 45% higher this year amid strength in product markets, lower inventories, and record gasoline prices. US data this week painted a broadly positive picture for crude ahead of the driving season.

“If you zoom out a bit, oil prices remain rangebound,” said Hans van Cleef, a senior energy economist at ABN Amro Bank NV. “Supply worries regarding exports from Russia — even despite the recent remarks of Russia that output will remain strong — are countered by the lower demand due to lockdowns in China.”

| Prices: |

|---|

|

Oil markets remain in backwardation, a bullish pattern marked by near-term prices trading above longer-dated ones. Brent’s prompt spread — the difference between its two nearest contracts — was $2.14 a barrel in backwardation, compared with $1.46 a week ago.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS