May 10, 2022

(Bloomberg)

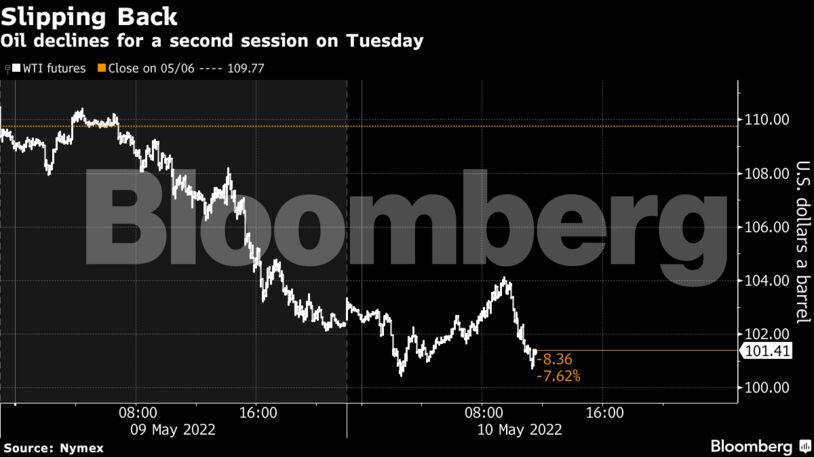

Oil fell for a second day as European Union members continue to discuss Russian oil sanctions, while broader sentiment remained weak over inflation and economic growth concerns.

West Texas Intermediate futures fell near $101 a barrel after sliding 6% on Monday. French President Emmanuel Macron and Hungarian Prime Minister Viktor Orban discussed energy security on Tuesday as the European Union seeks to persuade Budapest to drop its opposition to proposed sanctions on Russian oil imports. The EU also postponed a planned video call with Hungary and its neighbors.

In the U.S., retail gasoline and diesel prices hit fresh records, potentially further fanning inflation in the world’s largest economy. Investors will be keenly watching the April U.S. consumer-price index data later Wednesday as central banks tighten monetary policy to rein in prices that’s been fanned by Russia’s war on Ukraine.

The market has swayed in recent weeks as interest rates rise, and China’s fight against Covid-19 threatens demand. At the same time, Saudi Arabia’s oil minister warned that the entire energy market is running out of capacity, a concern that could potentially drive prices higher. His United Arab Emirates counterpart added that without more global investments, OPEC+ wouldn’t be able to guarantee sufficient oil supplies when demand fully recovers from the pandemic.

The market is being pressured by “the combination of vast interest rate increases, a strong dollar and lockdowns in China,” said Jens Pedersen, senior analyst at Danske Bank A/S.

| Prices |

|---|

|

A broader market selloff on Monday pushed oil down by the most since the end of March. Oil options markets were also caught up in the downturn, with bearish put options fetching a premium to bullish calls for the first time since the outbreak of the war in Ukraine in late February.

China’s Covid-19 resurgence has further added to volatility. Virus lockdowns have strained the economy, while Chinese Premier Li Keqiang warned of a “complicated and grave” employment situation as Beijing and Shanghai tightened curbs in a bid to contain outbreaks.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS