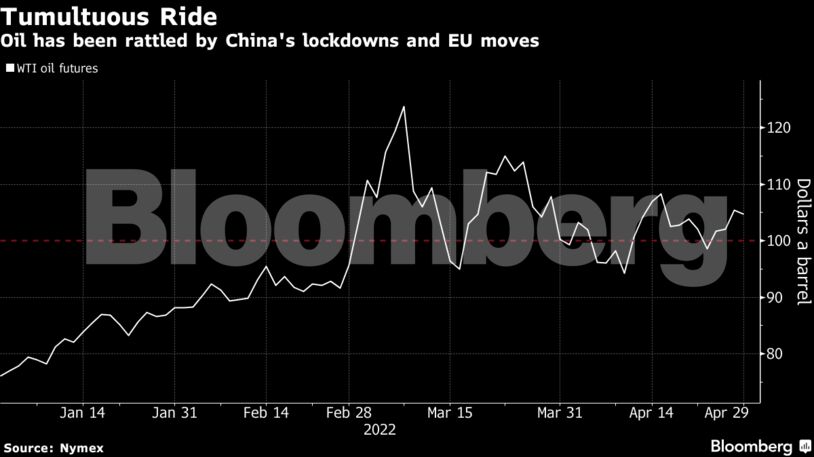

West Texas Intermediate futures slid 3% as data showing a sharp economic contraction in the world’s top oil importer outweighed growing expectations that Europe may agree to curb crude purchases from Russia. Beijing is set to close gyms and cinemas over the Labor holiday that lasts through Wednesday, and Shanghai will keep virus measures in place.

| Prices |

|---|

|

“China growth concerns are a key driver, coming on top of general risk-averse sentiment and signs that high fuel prices are already causing demand destruction,” said Ole Sloth Hansen, head of commodities research at Saxo Bank A/S.

Meanwhile, the European Union is set to propose a ban on Russian imports by the end of the year, with restrictions on shipments introduced gradually until then. While Germany said it could end its dependence on Russia by summer, Hungary signaled it would veto any sanctions on Russian energy.

Oil climbed for a fifth month in April, marking the longest monthly winning streak since January 2018. Russia’s invasion of Ukraine has spurred inflation, and led the U.S. and its allies last month to agree on a coordinated release of strategic crude reserves to ease surging energy prices. The war has also sparked a rally in diesel prices in the U.S.

Crude remains in a bullish backwardated pattern with near-term prices above longer-dated ones, though differentials have narrowed since early March. Brent’s prompt spread — the gap between its two nearest contracts — was $1.60 a barrel, down from $3.88 on March 8.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS