“The United States has become the marginal supplier of an export barrel,” said Tom Nimbley, Chief Executive Officer of refiner PBF Energy, in an earnings call this week.

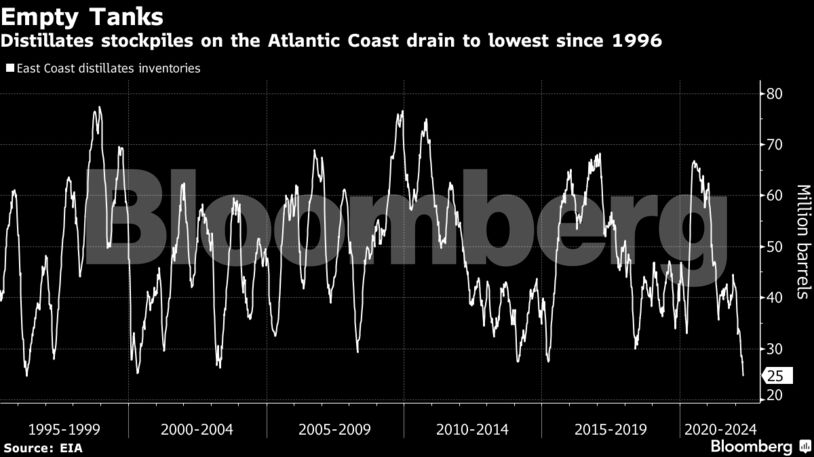

That’s why the Colonial pipeline has been underutilized even as fuelmakers on the Gulf Coast are cranking out as much diesel as they can. With exports rising, diesel tanks on the East Coast are the emptiest they have been in 26 years. The pipeline has not been full since late last year, according to the last update from the company.

It’s especially unusual for the pipeline to have available space given that wholesale diesel in New York was fetching $1.23 a gallon more than on the Gulf Coast on Friday, more than ten times what it was two weeks ago. That premium is typically enough to draw shipments to New York. The arbitrage for shipping fuel on Colonial is considered open when the price difference between the two regions exceeds the pipeline tariff at around 6 cents a gallon. It is now more than 20 times that.

However, the surge in prompt prices makes this a losing proposition for sellers who can also tap lucrative markets abroad. It currently takes more than 19 days to deliver fuel from Houston to Linden, New Jersey. The depreciation during the lengthy transit time means few traders are shipping on the line, leaving East Coast storage tanks precariously low.

U.S. Fuel Traders Ditch Storage as Holding Product Poses Risk

Around 2 million barrels a day of diesel and gasoline has left the U.S Gulf Coast this month, on track to bring April to the highest exporting month since oil analytics firm began tracking this data

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS