West Texas Intermediate futures slid below $96 a barrel. Virus cases continue to rise in Shanghai and there is no clarity on when restrictions will be lifted. The flare-up has led to disruptions at ports and prompted some refiners to trim operating rates.

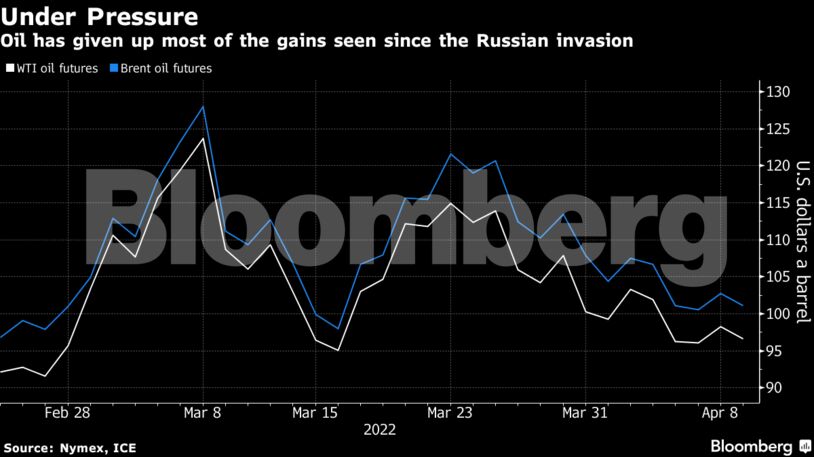

Oil has now given up most of the gains seen since Russia’s invasion of Ukraine in late February following a tumultuous period of trading. A weakening structure in the futures curve in recent days has pointed to diminishing concerns about undersupply. The war has fanned inflation and prompted the U.S. and its allies to release strategic reserves to cool prices.

Shanghai reported a record of more than 26,000 new cases on Sunday and the southern metropolis of Guangzhou is implementing a series of restrictions, with China struggling to halt the spread of the highly infectious omicron variant as it pursues its Covid Zero strategy. Oil analysts are continuing to cut their demand forecasts as the outbreak curbs travel.

“It is above all the bad news from China that is weighing on prices, as the number of Covid cases continues to surge,” said Barbara Lambrecht, an analyst at Commerzbank AG. “The lockdowns that are slowing oil demand in the world’s second-largest consumer country threaten to persist for even longer.”

| Prices |

|---|

|

Factory gate prices in China rose more than expected last month as oil climbed, putting pressure on manufacturers that are already struggling to operate amid repeated virus outbreaks.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS