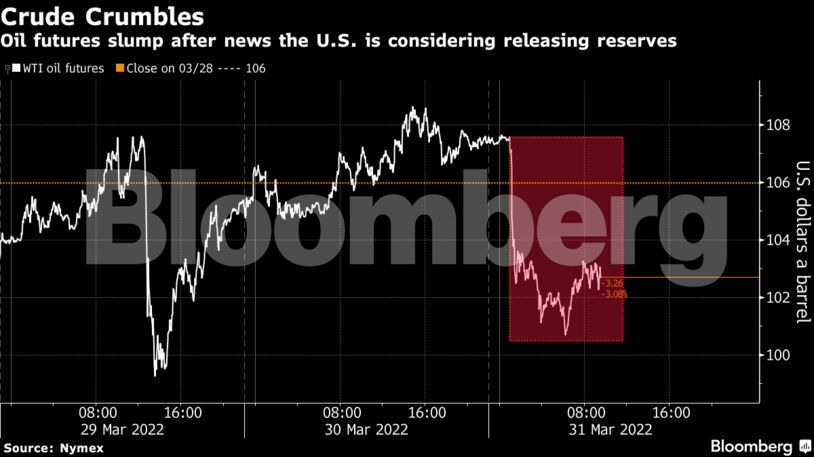

West Texas Intermediate futures fell as much as 6.8%, before paring some of those losses to trade near $102. The U.S. is weighing a release of roughly 1 million barrels of oil a day for several months, said people familiar with the matter. The news comes ahead of an OPEC+ meeting Thursday and follows calls by key members for the U.S. to trust its strategy of managing the market.

The total reserve release could be as much as 180 million barrels, the people said, providing relief to a market that’s tightened significantly due to the war in Ukraine. The invasion has fanned inflation and led to wild volatility across commodity markets, with global benchmark Brent crude set for the widest trading range on record this month.

The U.S. plans are accompanied by a diplomatic push for the International Energy Agency to coordinate a global release. A final decision hasn’t been reached on that yet, but the White House may make an announcement on the U.S. release as soon as Thursday, one of the people said.

A large SPR release “would reduce the amount of necessary price-induced demand destruction, the sole oil rebalancing mechanism currently available in a world devoid of inventory buffers and supply elasticity,” Goldman Sachs analysts including Damien Courvalin wrote in a note to clients. “This would remain, however, a release of oil inventories, not a persistent source of supply for coming years.”

Biden has already ordered two releases of oil from U.S. reserves in the past six months but it’s done little to tame rampant prices. Saudi Arabia and the United Arab Emirates said this week that the U.S. must trust its supply strategy after the cartel faced calls to pump more.

| Prices |

|---|

|

OPEC+ is expected to ratify a modest output increase of 432,000 barrels a day for May when it meets later Thursday, according to a Bloomberg survey. The alliance wrapped up its previous meeting on supply in a record 13 minutes, which was held just days after Russia invaded its neighbor.

Russia is offering India steep discounts on the direct sale of oil as mounting international pressure lowers the appetite for its barrels elsewhere, according to people with knowledge of the matter. That comes as India faces criticism from the U.S. and Australia for considering a Russian proposal which would undermine sanctions imposed by America and its allies.

The market is also facing the prospect of a hit to demand as China tackles a virus resurgence. The nation has initiated a series of lockdowns to curb its spread, including in Shanghai, which is starting to impact the economy — China’s manufacturing activity contracted this month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS