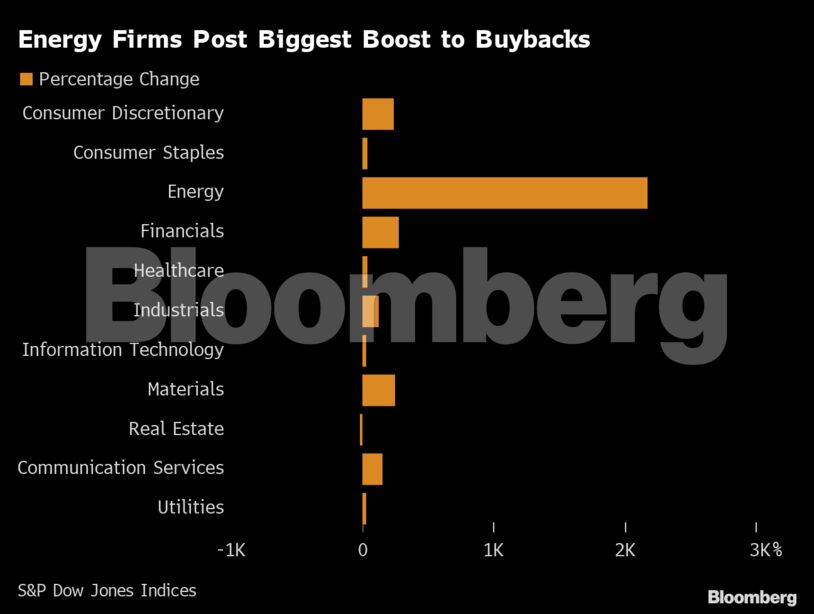

The rapid increase in energy buybacks came before this year’s 28% increase in West Texas Intermediate crude oil prices, though energy costs had started to increase in May of 2020. The jump in prices and buybacks represents a bonanza for shareholders, though not necessarily for the long-term industry prospects.

“Buybacks artificially inflate earnings per share and return-on-asset and capital metrics, but the underlying health of an E&P’s operations doesn’t improve,” Bloomberg Intelligence analyst Vincent Piazza wrote in a note.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS