At least two major Gulf Coast refiners are seeking to diversify their purchases of fuel oil that can be used as a feedstock to produce gasoline and diesel, according to people familiar with the matter, who asked not to be named because they weren’t authorized to speak. One trader is looking for naphtha, a component of oil that’s used in gasoline blending, from sources other than Russia, another person said.

The moves underscore the extent of concerns in the energy industry over the situation in Ukraine, after the Biden administration said Russia could invade. The Kremlin has repeatedly and firmly denied that it plans to attack. While the U.S. is the world’s largest oil producer and one of the biggest exporters, it’s still dependent on imports of crude products, and Russia is a top supplier. Biden has said the U.S. is ready to respond to a Russian attack with crippling economic sanctions.

“Any restrictions on Russian flows would cause pain exclusively on the side of the buyer because the Russians can easily place their fuel oil in China or India,” said David Wech, chief economist at oil-data provider Vortexa Ltd. “That would put the U.S. in a difficult position because of the impact on gasoline prices,” he said.

The questions over Russian oil supplies come as regular gasoline prices in the U.S. are the highest in almost eight years, putting further pressure on President Joe Biden to alleviate pain at the pump for consumers.

Two refiners in Texas are reaching out to suppliers in Mexico and Brazil asking about long-term availability and prices, the people said. Brazil, which typically supplies fuel oil to Singapore and Europe, sold one cargo to the U.S. Gulf Coast in February and has another ship arriving by next month, according to tracking data compiled by Bloomberg.

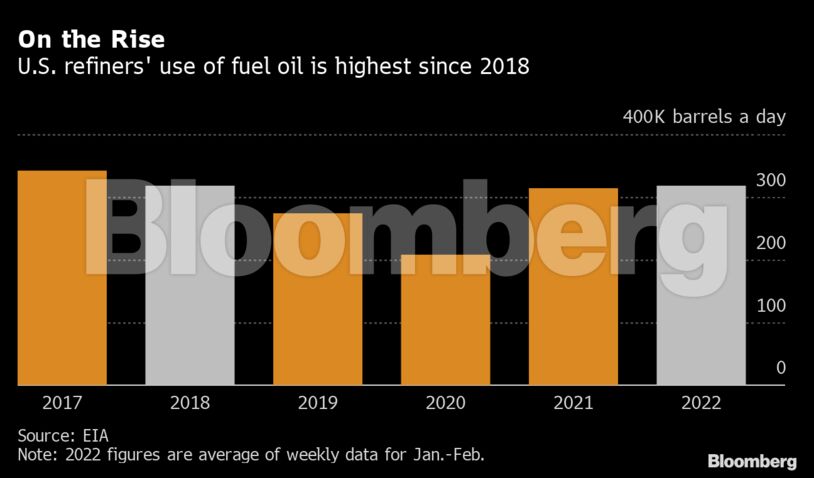

Russian straight-run fuel oil, known as Mazut 100, became a staple for refiners as it’s cheaper than crude oil, which is trading near the highest levels since 2014. The M100 can be used as either a crude substitute in the distillation tower, to top up crude oil from the Permian Basin, or as a feedstock to refinery units called cokers, to make gasoline.

The versatility of Russian fuel oil makes it more desirable than the product supplied by Mexico, for example. Mexican fuel oil can only run in cokers, not in distillation units, due to its volatility. Valero Energy Corp, Exxon Mobil Corp. and Chevron Corp. are among the largest buyers of Russian fuel oil.

In New York Harbor, America’s largest gasoline market, fuelmakers have begun scouting for options to naphtha they typically import from north Russia ahead of the summer driving season, according to other people familiar with the situation. The U.S. typically imports two or three cargoes of Russian light naphtha for gasoline blending and is looking for alternative supplies from Europe and Latin America.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS