U.S. shale could “surprise the market on the upside” on production growth this year, said Artem Abramov, an analyst at Rystad Energy.

Publicly traded independents such as Pioneer Natural Resources Co., EOG Resources Inc. and Diamondback Energy Inc. are well aware of the risks of growing too fast and have so far indicated supply increases of no more than 5% this year. Investors will be watching their forecasts closely over the next few weeks as they report earnings and reveal more details about their 2022 plans.

But the U.S. majors don’t think their Permian expansion plans buck the production discipline trend that’s become a mantra among energy investors. That’s because much of their growth in the U.S. will be offset by naturally declining fields elsewhere in their global portfolios. Independent operators, by contrast, don’t have such offsets, meaning their growing supply flows directly into the market.

Earlier: U.S. Shale Takes On a Taboo Topic and Considers Raising Output

Exxon’s 25% production increase will be “high-value growth” and comes on top of the 460,000 barrels of oil equivalent produced from the Permian Basin last year, CEO Darren Woods said on a call with analysts on Tuesday. Chevron, which produced an average of 608,000 barrels a day from the basin in 2021, also indicated that its Permian barrels are some of the most profitable anywhere in its global portfolio.

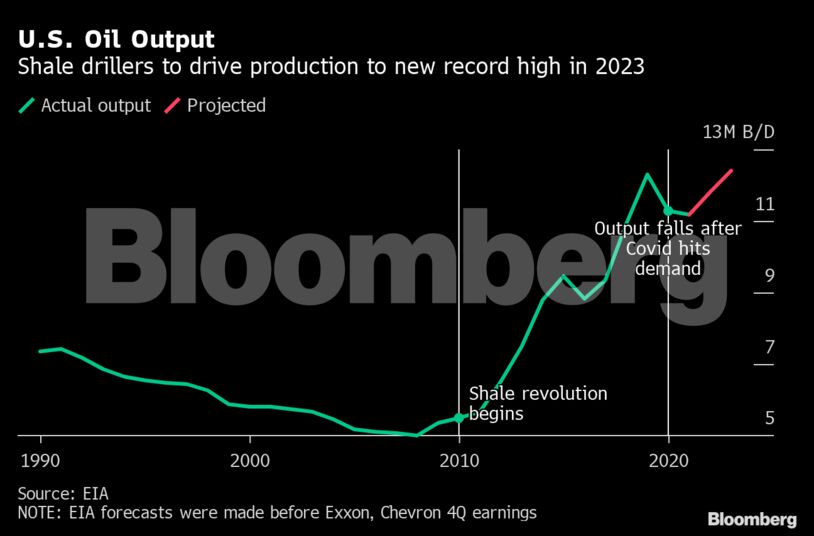

Exxon and Chevron “are resuming the ambitious growth plans of three to four years ago that were delayed by the pandemic,” Rystad’s Abramov said. And with more shale production now concentrated into fewer hands after a series of mergers over the past two years, “Exxon and Chevron will account for more of the forward growth profile than they did historically,” said Stephen Richardson at Evercore.

Still, while the extra barrels may help to balance out some of the surging oil consumption as economies bounce back from Covid-19, they may not be enough to bring about a substantial reduction in prices.

“U.S. production may surprise to the upside this year, but not by so much that it will significantly bring down oil prices,” said Elisabeth Murphy at ESAI Energy LLC. “On top of that, OPEC+ is having trouble lifting output to add the additional barrels.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein