Net income adjusted for one-time items was $2.05 a share, 12 cents above the average of analyst estimates compiled by Bloomberg. Exxon paid down $9 billion in debt during the fourth quarter, reducing outstanding obligations to pre-pandemic levels. The shares rose 6.4% to $80.83 at the close in New York, the highest since April 2019.

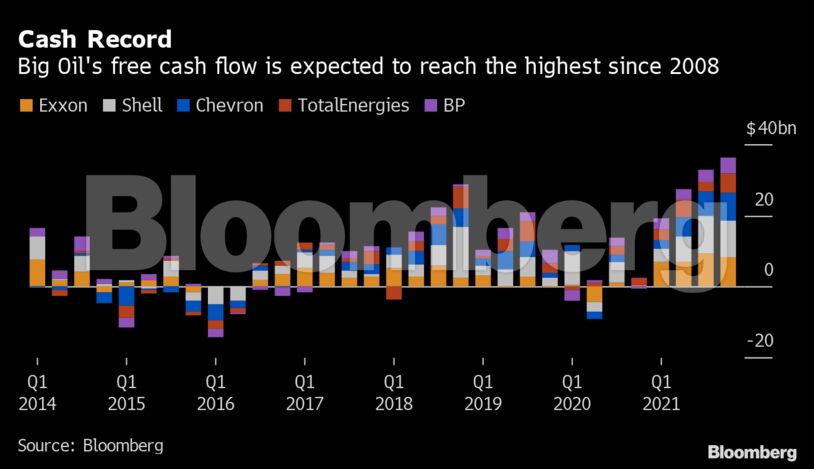

One measure of cash flow more than tripled to almost $18 billion during the final three months of 2021 compared with a year earlier as oil and gas prices soared. Exxon and its four supermajor peers probably raked in record free cash flow during 2021, according to analyst forecasts, and with energy prices still rising this year may be even more bountiful.

Chevron Corp. reported record free cash flow late last week. Shell Plc, BP Plc and TotalEnergies SE are scheduled to post fourth-quarter earnings during the next two weeks.

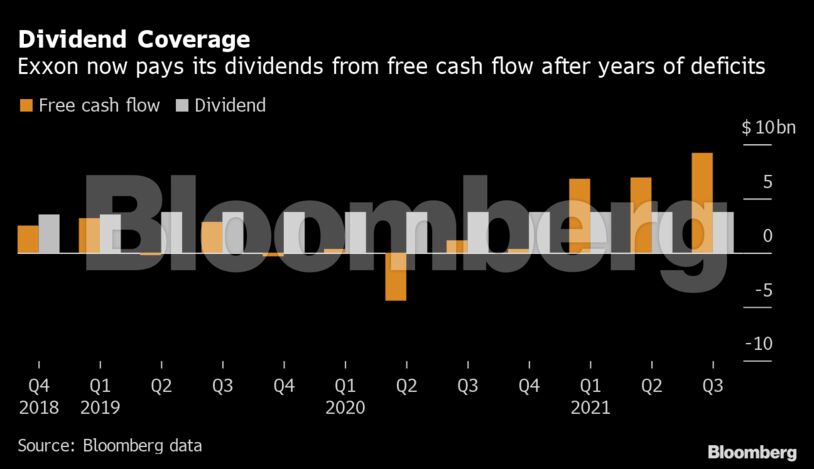

The boost in cash flow will allow Exxon to increase the pace of a $10 billion share buyback previously announced as taking place over two years. Now, the company expects the buybacks to be “faster than that 12-24 month pace,” Chief Financial Officer Kathy Mikells said during a conference call.

Exxon also expects to grow oil production in the Permian basin of West Texas by 25% in 2022 after increasing by the same amount from 2020 to 2021. That dwarfs the 10% increase that rival Chevron announced last week, albeit from a smaller base, and is the latest sign that U.S. shale is ramping up again after two years of restraint.

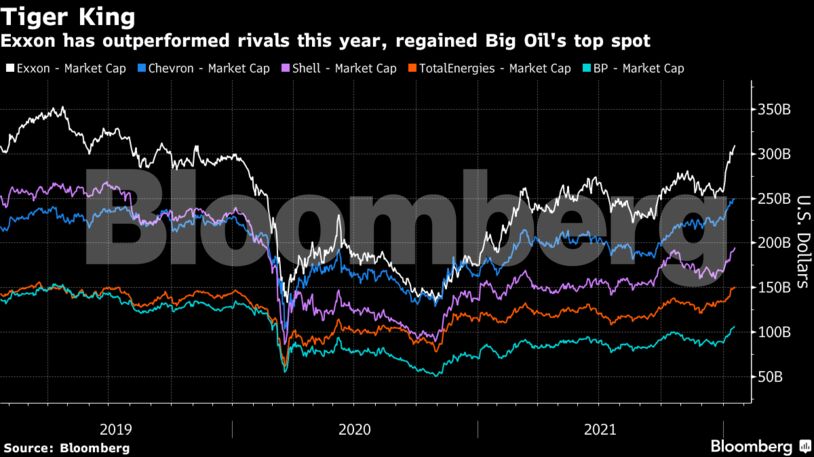

Exxon’s results come a day after the driller disclosed a major restructuring, involving moving its corporate headquarters in suburban Dallas to an existing campus near Houston. Exxon shares have risen 32% this year, on top of an almost 50% advance in 2021, the best annual performance in at least four decades.

Read more: Exxon to Move HQ to Houston, Merge Refining and Chemicals

Natural gas sales provided the primary uplift in fourth-quarter results as Exxon and other suppliers reaped hefty returns amid fuel shortages across Europe and parts of Asia. Escalating oil prices also proved a boon to the Western world’s largest crude explorer.

Chief Executive Officer Darren Woods’ decision to reverse course on a pre-pandemic growth plan and hold capital spending at historically low levels means high commodity prices are translating directly into massive cash flow.

Follow our live coverage of Exxon Mobil earnings at {TLIV <GO>}

While some observers have raised concerns about Exxon’s long-term commitment to fossil fuels, in the near term the company is profitably harvesting older reserves and replacing them with high-margin barrels from new discoveries in places such as Guyana.

In 2021, Exxon garnered ample cash to repair its balance sheet, pay the S&P 500 Index’s third-largest dividend and pledge to restart share buybacks. It’s a remarkable financial turnaround for the oil giant a year after it incurred its first annual loss in at least 40 years during the darkest days of the pandemic.

Exxon is under pressure to do more on climate change, especially after activist investor Engine No. 1’s success last year. Its recently announced ambition to eliminate emissions from its operations by 2050 is one step in that direction but the company will also have to allocate more cash to its low-carbon business over time, especially in areas like carbon capture and biofuels.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire