LAUNCESTON, Australia, Feb 3 (Reuters) – The latest meeting of the OPEC+ group of oil exporters apparently took just 16 minutes to decide to stay on their current course. Perhaps they should have spent more time working out how they will actually meet their production targets.

The Organization of the Petroleum Exporting Countries and allies led by Russia, a group known as OPEC+, met on Wednesday and quickly agreed to stick to their plan of boosting crude output by 400,000 barrels per day (bpd) per month.

In an ideal world this level of supply increase would probably be enough to balance the market and lead to a price closer to around $75 a barrel, rather than the $89.47 close of global benchmark Brent futures on Wednesday.

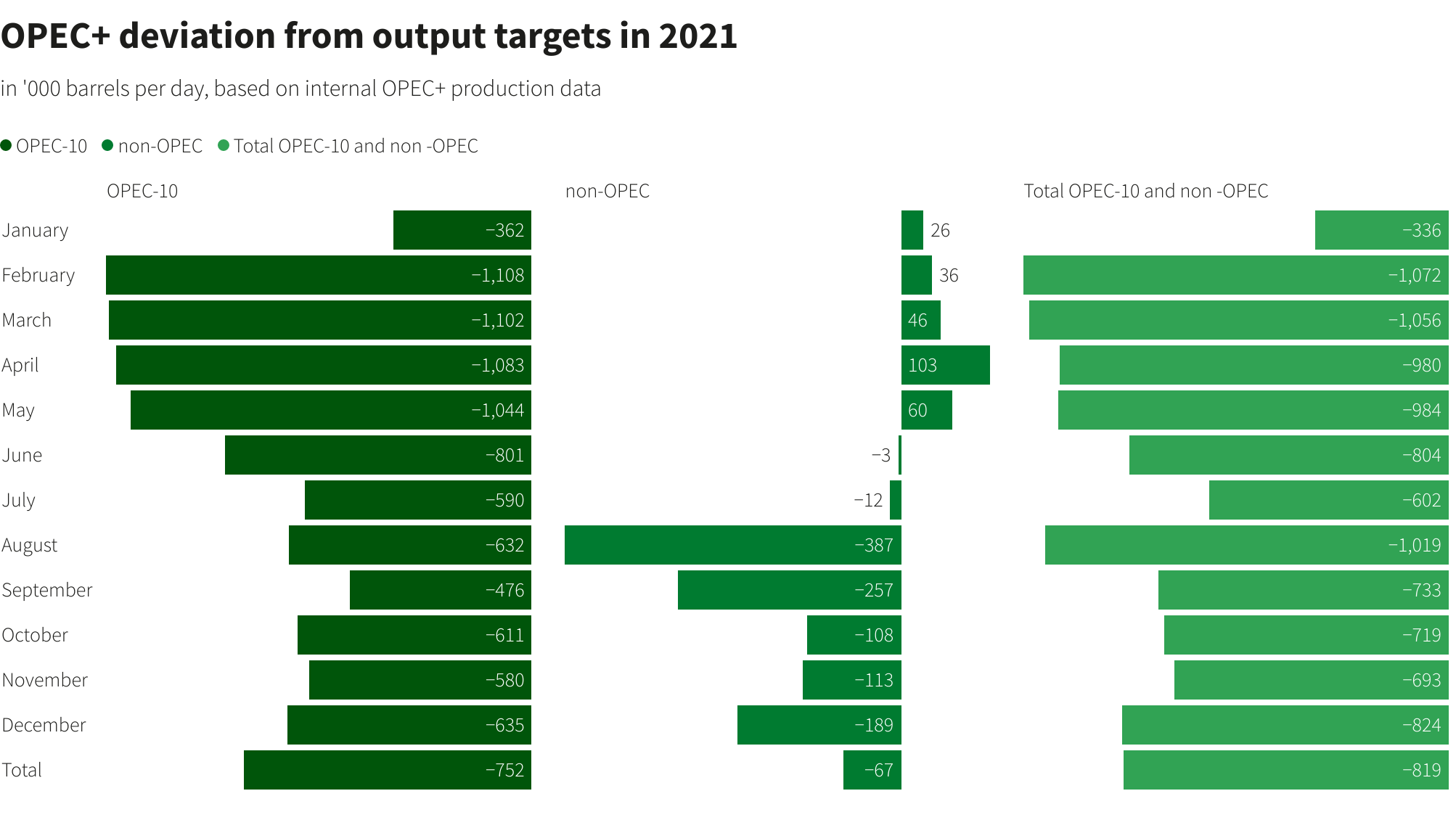

The problem is OPEC+ is falling woefully short of meeting its target to boost output by 400,000 bpd a month, and has done so since it started this plan in August last year.

While estimates vary, the group was about 800,000 bpd behind target at the end of last year, a figure that has likely now grown to something closer to 1 million bpd.

The 10 members of OPEC with quotas in the OPEC+ group increased production by about 210,000 bpd in January, while Russia’s output rose by about 100,000 bpd, according to data published by Reuters.

Even allowing for some small increases in other non-OPEC members of the OPEC+ group, it would still seem that the group was once again well short of boosting production by its stated aim.

The question for the market is whether it believes OPEC+ can eventually get back to meeting its output targets, thereby supplying at least 1 million bpd more crude in present day terms, while still ramping up production by 400,000 bpd a month in the coming months.

Given the group’s track record, the market is probably correct to be sceptical, at least for the first half of 2022.

It seems that it is way easier to shutter some oil production than to bring it back online.

SUPPLY STRUGGLES

Saudi Arabia and fellow Gulf heavyweights Kuwait and the United Arab Emirates may be able to boost output relatively quickly, but the OPEC+ agreement doesn’t allow them to eat into the quotas of other producers who may be failing to lift production.

Throw in a series of geopolitical issues, such as the current tensions between Russia and the Ukraine, as well as ongoing difficulties in resolving Iran’s disputes with Western powers over its nuclear programme, and there is still a wall of worry for the oil market.

There are also signs of demand recovery, with inventories in OECD countries dropping to seven-year lows in November and on track to fall more in December, according to the International Energy Agency (IEA).

The current high price of oil will be deterring importers from replenishing stocks, meaning the issue of low inventory levels is likely to persist.

In some ways the crude oil market is in need of a circuit-breaker.

Either supply does actually start to rise meaningfully, through a combination of OPEC+ and other producers lifting output, or demand growth is hit by rising prices stoking inflation and leading to growth-choking interest rate hikes across the globe.

However, these dynamics won’t play out quickly, with either possibility likely to take several months to become apparent, meaning that oil prices are likely to retain a bid tone.

GRAPHIC-OPEC+ deviation from output targets in 2021: https://tmsnrt.rs/3Gdb9Wd

The opinions expressed here are those of the author, a columnist for Reuters.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS