The positive fourth-quarter earnings cap a tumultuous year in which Shell was targeted by activist investor Dan Loeb, relocated its headquarters to London and dropped “Royal Dutch” from its name. Yet the company has also been buoyed by surging oil and gas prices, causing the biggest annual share-price gain in five years.

“We delivered very strong financial performance in 2021, and our financial strength and discipline underpin the transformation of our company,” Chief Executive Officer Ben van Beurden said in a statement on Thursday. “Today we are stepping up our distributions with the announcement of an $8.5 billion share buyback program.”

Ever since Shell slashed its dividend in 2020 during the initial stages of the Covid-19 pandemic, van Beurden has been seeking to lure back investors by improving returns. The company had already pledged to give back to investors $5.5 billion of the cash proceeds from the sale of its Permian-basin oil assets. It has also promised to raise its dividend by 4% each year.

Shares of the company rose 1.7% to 1,964.2 pence at 8 a.m. in London.

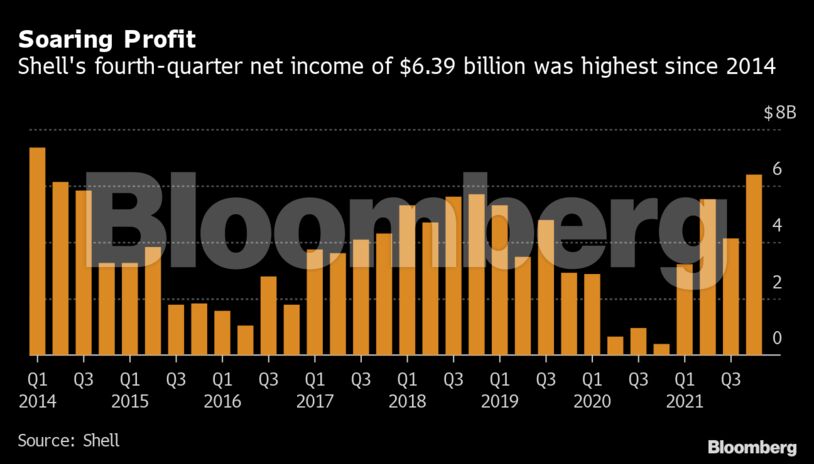

The company’s adjusted net income was $6.39 billion for the period, up from $393 million a year earlier and beating even the highest analyst estimate. Cash flow from operations was $8.2 billion, a reduction of almost 50% from the third quarter due to the movement of working capital and margin-call payments.

“The numbers look extremely solid” with “monster integrated gas earnings,” RBC Capital Markets analyst Biraj Borkhataria said in a note. Shell could end up surpassing the bank’s estimate for total buybacks of $11.5 billion this year, he said.

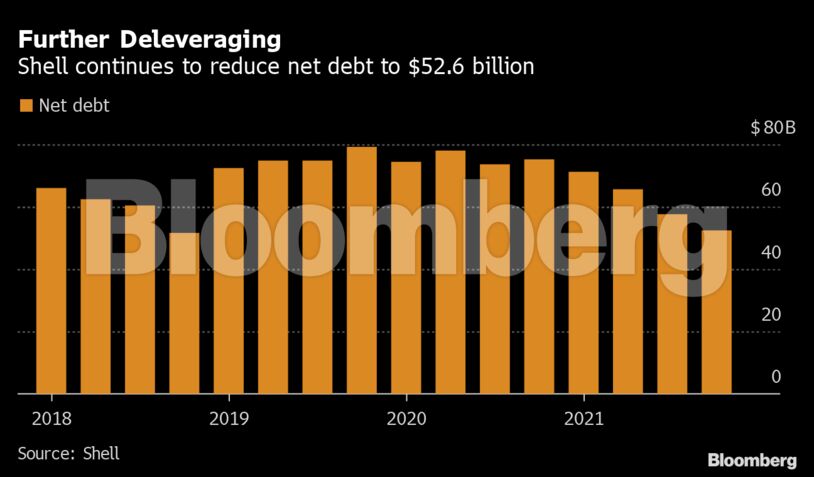

Falling Debt

Shell is signaling that it’ll stay conservative on capital spending, which will be at the lower end of the range of $23 billion to $27 billion forecast for this year. That’s an increase from $20 billion in 2021 but little changed from what the company was planning several months ago, despite soaring profits and the cost inflation coursing through the industry.

Instead of investing to grow oil and gas output, which fell 6.8% from a year earlier to 3.14 million barrels a day, the extra cash from high energy prices is being used to boost shareholder returns and pay down net debt, which fell by $4.9 billion to $52.6 billion over the fourth quarter.

One key measure of Shell’s ability to make money on its vast array of assets, return on capital employed, rose to 8.8% in the fourth quarter from 2.9% a year earlier. For much of the past decade the company has struggled to boost this figure — one of the factors cited by activist investor Loeb last year when he called for Shell to be split into two.

Shell is the first European oil major to report earnings, following a mixed bag of results from its U.S. peers. Last week, Chevron Corp. disappointed investors after its overseas upstream business and domestic refining network fell short of expectations. Exxon Mobil Corp. however tripled its cash flow and said it would accelerate buybacks, elevating its shares to the highest since April 2019.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS