The market’s structure is trading at its strongest level in years, indicating scarce supply. Diesel — the fuel that helps power the global economy — is also surging as a cold snap hits the U.S and demand soars. Inventories at key storage hubs are waning, and vital price gauges indicate an expectation the tightness will persist.

Traders increasingly suspect demand is being underestimated as economies emerge from Covid-19. Saudi Arabia’s state oil company said late last month that consumption will soon return to pre-pandemic levels, although International Energy Agency data show it at about 1 million barrels a day lower in the first quarter than during the same period in 2019.

Meanwhile, supply outages from Libya to Ecuador to Nigeria have limited production of the light-sweet oil that underpins global crude benchmarks. There’s also a growing geopolitical political risk premium as Russia amasses troops near Ukraine, though President Vladimir Putin has said his country has no plans to invade.

“This market is extraordinarily tight,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “We have low inventories, tight balances, great margins, geopolitical risk. This is a very bullish market.”

All of that is coming as OPEC+ struggles to lift output by the 400,000 barrels a day it has pledged each month. In January, OPEC’s 13 members added just 50,000 barrels a day, fanning trader concerns that the market’s spare capacity buffer is dwindling.

The rally means a return of $100 oil is growing increasingly likely by the day. For months, options markets have been abuzz with trading of contracts above that level. There are the equivalent of almost 112 million barrels of $100 calls for the global Brent benchmark over the next 12 months. Call options sold by banks in the $90s are also likely contributing to oil’s move higher.

On Friday, headline prices rose again, adding 1.5% to $92.43 in London. West Texas Intermediate was up 1.6% to $91.75. The latter is up about 6% this week.

Diesel Soaring

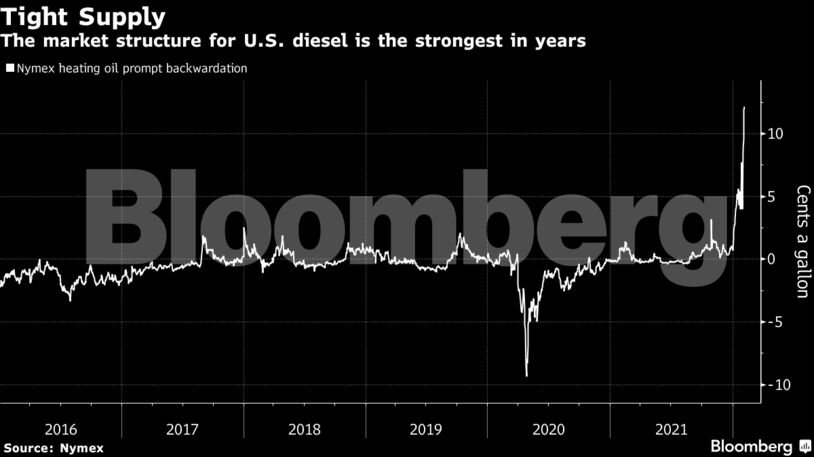

One of the clearest sings of strength in refined fuels is diesel. Demand in the U.S. in recent weeks has been at, or close to, the highest level for the time of year in at least three decades. Stockpiles on the nation’s East Coast, the delivery point for the Nymex heating oil futures contract, are the lowest since April 2020. In Europe they’re the lowest at a key storage hub seasonally since 2008, according to data from Insights Global.

“Refinery runs haven’t kept pace with the recovery in demand so stocks have been drawn down and are tight,” said Jonathan Leitch, an oil market analyst at Turner, Mason & Co.

It’s not just diesel stockpiles that are falling. At the key U.S. storage hub of Cushing, Oklahoma, there is once again talk of inventories hitting tank bottoms — their operational minimum levels — this month. Energy Information Administration data put inventories there at close to 30 million barrels last week, and they’re expected to decline further.

While there are some red flags, traders have shrugged them off for now. The value of more sulfurous, or sour, barrels has fallen this week, with supplies growing as the U.S. releases oil from its strategic reserves. They are also less attractive to refiners as high gas prices mean they are more costly to process.

In contrast, less sulfurous, or sweet, crude keeps rallying. Key price metrics that indicate the value of oil in the North Sea on a weekly basis are at their strongest level since 2011, according to brokerage PVM Oil Associates. It’s a sign that the oil market is struggling to produce the barrels it needs right now.

Still that could change as the year evolves. WTI for 2023 is now trading above $75 a barrel, and ConocoPhillips said this week that a surge in U.S. shale production should be something for oil markets to worry about.

“With more Covid related restrictions likely being lifted over the coming weeks and months we should expect a strong summer for oil demand,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “Spare capacity will fall to low levels this summer, and prices need to provide a signal to support stronger U.S. supply growth and limit demand growth.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire