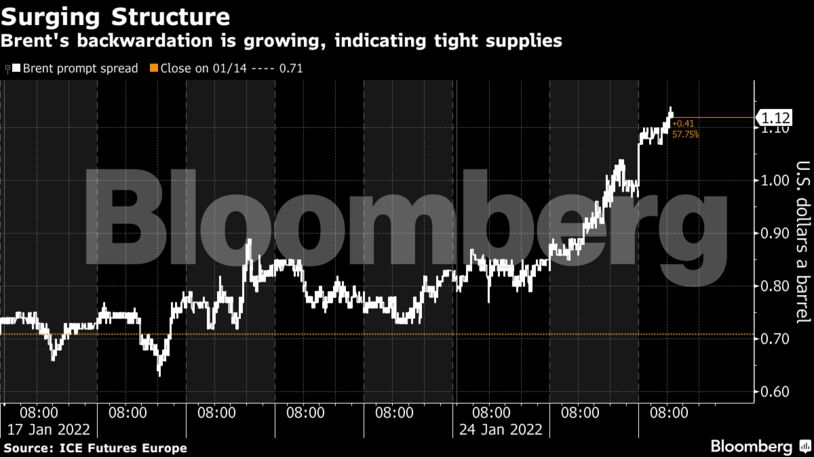

The global crude benchmark rose 0.9% in London. The American Petroleum Institute reported a 875,000-barrel weekly drop in U.S. crude stockpiles, according to people familiar with the data. If confirmed by government figures later Wednesday, it would be the eighth decline in nine weeks. The oil market’s structure has also surged in recent days, signaling tight supply.

Wider markets also rallied on Wednesday, as this week’s selloff started to ease.

Crude is having a volatile week, retreating Monday then rebounding Tuesday. Prices remain close to a seven-year high with demand continuing to recover from the pandemic as mobility picks up. A string of Wall Street banks including Goldman Sachs Group Inc. have forecast oil will hit $100 a barrel this year as the global market tightens.

“The market has basically been in persistent undersupply since mid-2020, thanks to OPEC+ cuts and a continued oil demand recovery,” said Helge Andre Martinsen, a senior oil analyst at DNB ASA. “We fully acknowledge that the world is not running out of oil resources, but we might enter an oil-market squeeze triggered by too little investment and oil demand rebounding quickly.”

Prices have also reacted to mounting concern over a possible Russian incursion into Ukraine, with U.S. President Joe Biden saying he’d consider sanctioning Vladimir Putin if the Russian leader orders an invasion. However, while a potential conflict carries large risks for financial markets — especially energy commodities such as gas and oil — Goldman Sachs’s base case is for no disruption to supplies.

| Prices |

|---|

|

Also in focus Wednesday is the Federal Reserve’s first policy-setting meeting of the year. Officials are expected to reaffirm their commitment to containing roaring inflation by ending stimulus and raising interest rates over 2022.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS