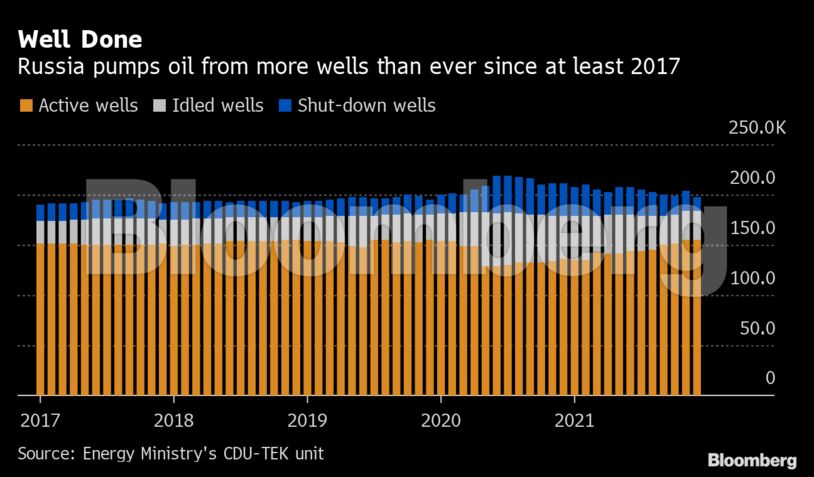

Last month, Russia pumped oil from more than 155,600 wells, according to Bloomberg calculations based on data from the Energy Ministry’s CDU-TEK unit. That’s the country’s highest number of active ones on a monthly basis since at least 2017, when Moscow partnered with the Organization of Petroleum Exporting Countries in coordinating output curbs to rebalance the market.

Yet despite this surge in December, Russia’s crude output that month dropped below its monthly OPEC+ quota for the first time since the alliance enforced record coordinated cuts.

The figures show the challenge Russia faces in reviving oil output after the deepest-ever curbs and reduced upstream investment. Over the next six months, Moscow may only be able to deliver about half of its scheduled increases in crude production, according to analysts.

Russia is among OPEC+ nations that have struggled to bring back oil production curtailed at the start of the pandemic. Members of the alliance have faced a growing lack of spare capacity, a factor that could push oil prices higher through the rest of this year as global demand recovers.

Surging Prices

Brent crude prices surged to a seven-year high last week after the International Energy Agency said that markets look tighter than previously thought. Analysts are increasingly forecasting that the international oil benchmark will price into the $90s, and potentially above $100 a barrel in the second half of 2022 as supply tightens.

Russia expects to bring its oil production back to pre-pandemic levels by April or May, provided that its OPEC+ quota allows it to add 100,000 barrels a day every month, according to Deputy Prime Minister Alexander Novak. However, a lack of growth in Russia’s production in December and the absence of factors to boost output in the short-term signals the target may take longer to achieve.

“Russian crude production is likely to be unable to keep up with these full quota increases, falling below the country’s OPEC+ quotas as summer approaches,” analysts at BCS Global Markets said. By July, the nation’s output may lag the quota by about 240,000 barrels a day, the analysts said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran