(Bloomberg) Saudi Arabia’s larger-than-expected rise in oil prices is a signal it will continue resisting U.S. pressure to pump faster, according to Vitol Group.

Saudi Aramco hiked December prices for customers in Asia, the U.S. and Europe on Friday, a day after OPEC+ stuck to its plan to boost output only at a gradual pace. The state producer’s month-on-month increase in the official selling price, or OSP, for its main Asian grade was the third-largest this century, according to data compiled by Bloomberg.

“They are unlikely to change stance,” Mike Muller, the head of Asia for Vitol, the world’s biggest independent oil trader, told Bloomberg on Sunday.

U.S. President Joe Biden called on OPEC+, a 23-nation alliance led by Saudi Arabia and Russia, to speed up the easing of supply curbs it began in early 2020 with the onset of the coronavirus pandemic.

Oil has climbed around 60% this year to more than $80 a barrel because of the global economic recovery and OPEC+’s cuts. That’s hit American drivers by pushing gasoline up to a seven-year high of $3.70 a gallon.

Saudi Arabia “went further with the OSPs than anyone expected,” Muller said earlier on a webinar hosted by Dubai-based consultancy Gulf Intelligence. “That was a signal to those that were critiquing OPEC+ for not putting enough oil on the market. The Saudis felt they can indeed make higher prices stick.”

On Thursday, the Organization of Petroleum Exporting Countries and partners decided to keep raising daily crude output by 400,000 barrels a month. Biden’s energy secretary, Jennifer Granholm, said the U.S. is considering releasing crude from its strategic petroleum reserves as a response. The White House may seek to co-ordinate any sell down with other major importers such as Japan and China.

“The market does seem to have an expectation that there’ll be some form of SPR release,” Muller said. Still, “the market is in a position where inventories are low and supplies are tight. The Saudis are pricing their oil accordingly.”

OPEC+ has argued its stance is justified because resurgent coronavirus outbreaks could hit consumption. China is still “grappling” with cases, “and ‘grappling’ in China always means oil-demand reduction,” Muller said.

Don’t Blame Oil

Even if OPEC+ did want to raise production faster, it would be hindered by the lack of spare capacity among most members, Muller said. Some, including Angola and Nigeria, are already struggling to meet the group’s current targets.

“The peak of their production would seem to be in the past,” Muller said of the two countries.

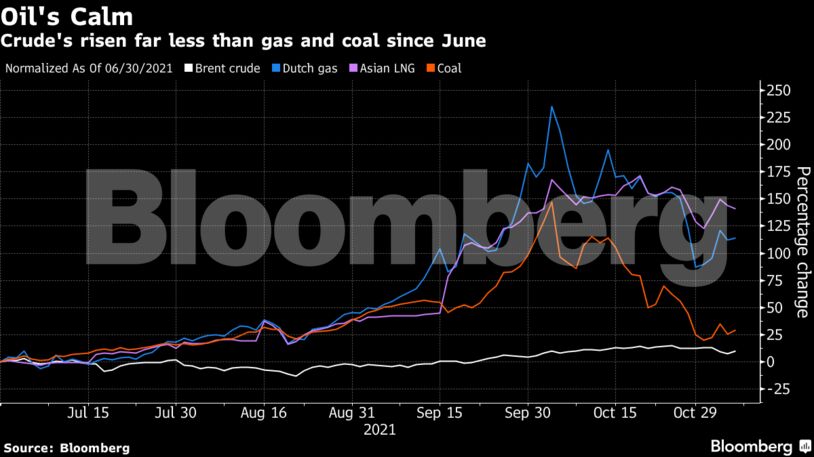

After the OPEC+ meeting, Saudi Energy Minister Prince Abdulaziz bin Salman said the group had kept oil markets much more balanced than those for natural gas and coal. Prices for both fuels surged to record levels in parts of Asia and Europe in recent months amid a supply squeeze.

Gas futures in Asia and Europe have more than doubled since the end of June, while coal’s up 25%. Brent crude, by contrast, has climbed 10%.

“Oil is not the problem,” the minister said. “The problem is the energy complex is going through havoc and hell.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS