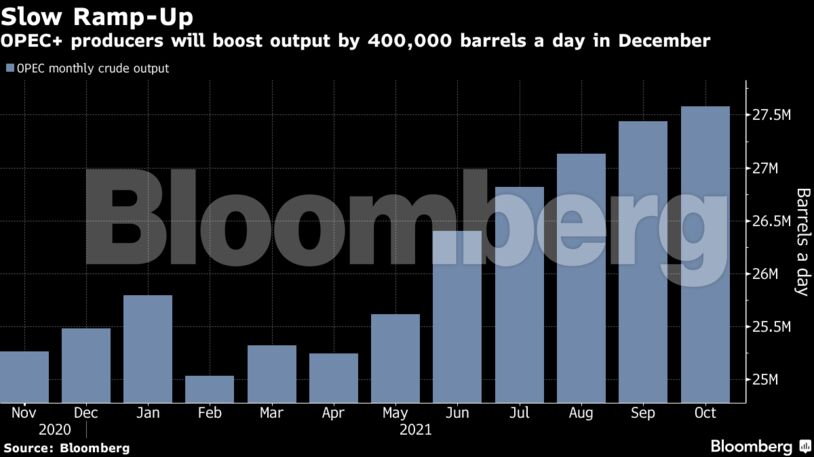

Futures in New York traded above $79 a barrel, though prices have shed about 5% this week. After a brief meeting, OPEC and its allies agreed to boost output by 400,000 barrels a day in December, maintaining its modest pace of monthly increases. The White House is considering a range of tools to deal with prices, the National Security Council said after the OPEC+ decision.

Price volatility is likely to rise in the coming weeks after the alliance shunned a U.S. request for more crude, according to Goldman Sachs Group Inc., adding that the market remains under-supplied. UBS Group AG, meanwhile, underlined its forecast for global benchmark Brent oil to reach $90 a barrel over the coming months.

President Joe Biden has led calls for OPEC+ to add more barrels to tame high oil prices, which he blames for inflationary pressures. The U.S. was seeking an increase of as much as double the amount that was agreed and has been among key consumers that previously raised the prospect of tapping their own strategic reserves if the alliance didn’t cooperate.

“The ball is back in Biden’s court; is he going to do the SPR release?” Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. said in a Bloomberg TV interview. “It’s going to be a short-term measure, it will not solve the problem” of low stocks, she added.

Oil has rallied to multiyear highs as major economies including the U.S. and China recovered from the pandemic, with BP Plc estimating global demand has rebounded above the pre-virus level of 100 million barrels a day. OPEC+ has cited risks from ongoing outbreaks for its cautious approach.

| Prices: |

|---|

|

A global energy crunch due to coal and natural gas shortages has exacerbated the tightness in the oil market, while some OPEC members’ failure to reach their output targets has put additional pressure on crude supply.

“Oil is not the problem,” Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said after the OPEC+ meeting on Thursday, citing natural gas shortages. “The problem is the energy complex is going through havoc and hell.”

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS