As the U.S. mulls a crude-supply release, Saudi Arabia and the United Arab Emirates signaled that OPEC+ will continue to be cautious in its plans to raise output. The group has been adding 400,000 barrels a day of production each month on paper, but so far its members have failed to pump that much.

The Organization of Petroleum Exporting Countries and its allies are particularly wary about the stability of demand in the coming months. Already in Europe, a handful of smaller consuming nations have reimposed restrictions as a result of Covid-19 cases. President Biden will also meet virtually with China’s President Xi, the world’s largest oil importer, on Monday.

“Possible U.S. SPR crude releases are blamed for the weakness,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “But rising Covid-19 infections, as well as China weakness, is probably the more likely reason.”

| Prices: |

|---|

|

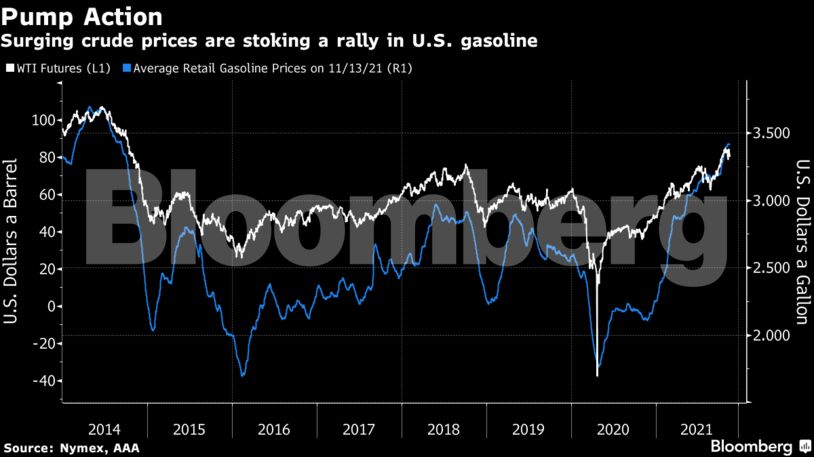

The challenge from inflation, especially gasoline, is a mounting political problem for Biden. The president’s approval rating sank to a new low, according to a Washington Post-ABC News poll. About half of Americans overall, as well as independents, blame him for accelerating inflation, it showed.

All the while, Italy’s Eni SpA said oil may hit $100 a barrel due to a lack of investment from energy companies.

“Maybe it can reach that,” Chief Executive Officer Claudio Descalzi told Bloomberg Television. “But not for a long time.”

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS