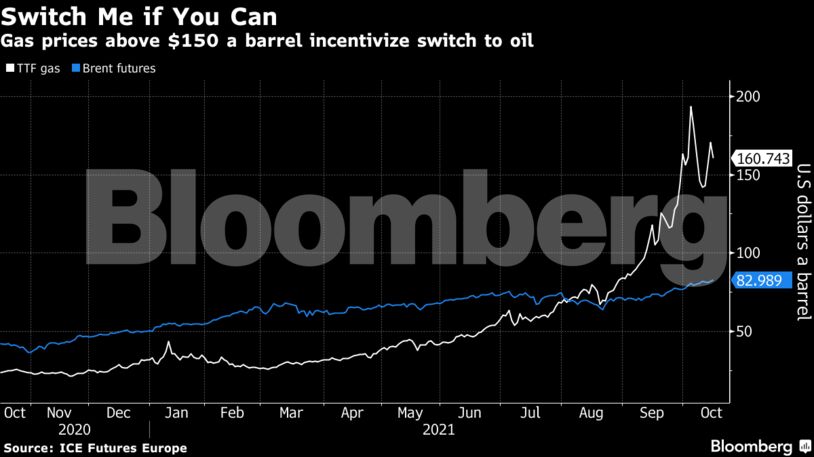

An underlying recovery in consumption — driven by road-fuel, freight activity, and latterly air travel — is now being fired by the energy crisis. With natural gas trading at close to $200 in per-barrel terms in Europe, the consensus among analysts is that oil demand globally will be boosted by a further half a percentage point as companies rush to secure any fuel that can be used as a substitute, from diesel to fuel oil to crude.

To outsiders, such a shift might seem tiny. In practice it’s transformative, exceeding a month’s output increases that the Organization of Petroleum Exporting Countries and its allies are aiming to bring to a market that was already churning through its stockpiles.

“The situation is tight and OPEC is overtightening,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “The broader energy problem is making things worse because you’re getting substitution on top of seasonal demand increases. This is quite an explosive situation.”

Read: Gas-to-Oil Switching: A Trend to Shape Winter Crude Prices

Oil refiners are making as much money as at any time since the pandemic began. Gasoline margins in the U.S. are rallying at a time of year when they’d normally fall. In Europe, profits from making diesel are the highest since March 2020, while propane and low sulfur fuel oil prices have been rocketing to their highest since 2014.

Nowhere is the strength in oil clearer than in the futures curve, used by traders to wager on the health of the market. Nearby prices are trading at their biggest premiums to those further out in years, with the closely watched Dec.-Red-Dec. spreads on Brent crude and European diesel both at their strongest since 2013. Such a pattern, known in industry jargon as backwardation, indicates relative scarcity of supply.

Those signs of strength in the futures market reflect what most analysts see on paper — supply exceeding demand by about a million barrels a day in the fourth quarter.

Power Problems

To be sure, the energy crunch isn’t necessarily a one-way bullish force for oil demand.

A deepening crisis in China and other nations with large heavy industry sectors is raising the specter of lower industrial output, weaker economic growth, and with it curtailed fuel usage.

China has already said it will allow power prices to rise, removing price caps for energy-intensive firms. A raft of Wall Street banks have already cut their 2021 economic growth forecasts for the world’s biggest oil importer.

In Europe too, everything from zinc smelters to carbon dioxide plants have been forced to cut back output at times to some degree, potentially dimming the impact of gas-to-oil switching.

“A lot of energy intensive industry have been forced to stop or reduce their activities due to the high energy cost,” Toril Bosoni, head of the oil markets division at the International Energy Agency said in a Bloomberg Television interview, flagging the risk to oil demand.

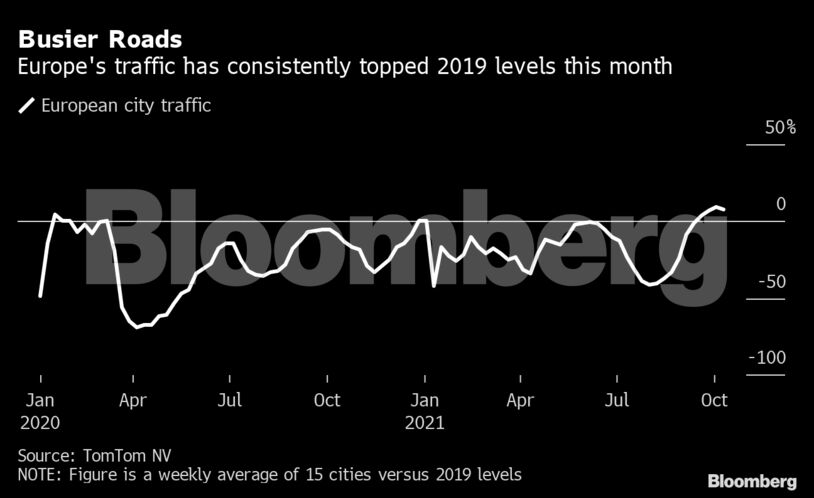

For now, though, oil consumption is growing. In Europe, strong mobility data are being replicated in demand figures. Oil products deliveries in Spain last month show gasoline demand 5% higher than 2019, while diesel demand was only 0.5% lower, according to pipeline operator Exolum. The IEA said this week that gasoline demand is now down just 2% on pre-pandemic levels worldwide.

Even aviation is showing signs of life. Air traffic in Europe has recovered to three-quarters of normal levels, up from about half in June. Companies from United Airlines Holdings Inc. to EasyJet Plc have been boosting capacity after the U.S. relaxed travel rules and Europe’s vaccination program has kept cases low.

The uplift to demand from gas-to-oil switching is also showing up in the physical market, where barrels of actual oil are bought and sold.

Sokol oil, a diesel-rich grade from Russia’s east, is trading at the strongest in 21 months. In North Sea market that helps set the world’s benchmark crude price, differentials have been strengthening over the past week with traders citing rising demand from European refiners and declines in November cargo loadings.

With the recovery now becoming broad-based, refiners Repsol SA, OMV AG and Royal Dutch Shell Plc all posted stronger margins in the third quarter, boosting their incentive to churn through more crude.

Sliding Stockpiles

That in turn is helping drive crude stockpiles lower. Satellite tracker Kayrros says global crude inventories, including onshore, oil in transit and floating storage are below pre-pandemic levels. While nationwide U.S. crude stocks rose last week, those at the key storage hub at Cushing Oklahoma fell by the most since June, sparking a volatile week of derivatives trading.

Even with prices nearing $85, speculators remain relatively disinterested in oil, transfixed instead by gas markets, consultant Energy Aspects Ltd. said this week. Speculative length is about $35 billion lower than it was last time Brent got to this level in 2018, it said, meaning that unlike then, a sharp price pullback doesn’t look to be on the cards any time soon.

“Amid low inventories globally, stronger refining margins and gradually eroding spare capacity, only a demand pullback can hold crude prices back over winter,” the consultant’s analysts Amrita Sen and Kit Haines wrote in a note to clients.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS