Demand was about 100 million barrels per day (bpd) in 2019 and has yet to recover to that level because of the pandemic.

The rise of electric vehicles and a shift to renewable energy has also led to revisions in forecasts.

There is no consensus on when oil demand could peak, but the predictions could affect oil exploration and development plans.

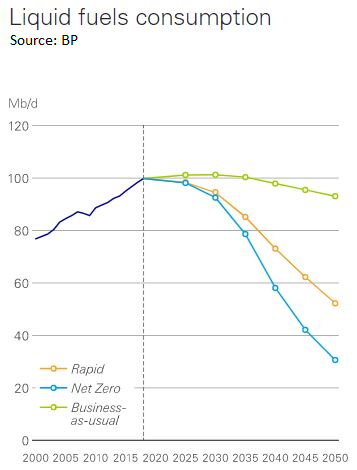

BP – 2019 may have been the peak

BP provides three scenarios, all showing the pandemic reduced demand growth. In one scenario, the British energy producer says demand may have peaked in 2019, while another of its scenarios sees a peak in 2035.

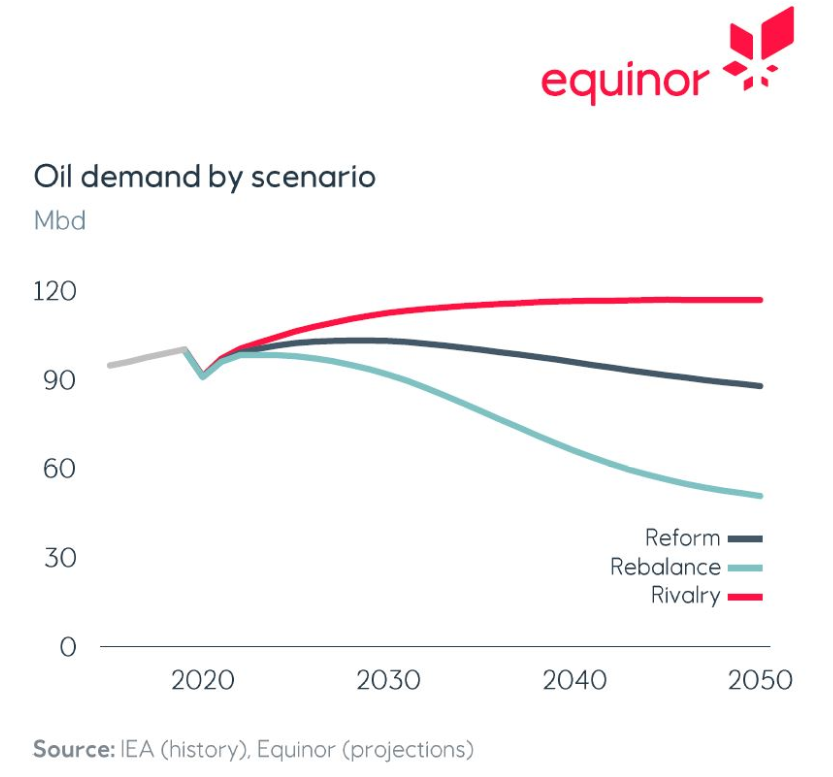

EQUINOR – From 2027 to 2028

The Norwegian oil and gas producer expects oil demand to peak from 2027 to 2028, two to three years sooner than it previously forecast. In its main scenario, Equinor sees oil demand at 99.5 million bpd in 2030 and 84 million bpd in 2050.

BERNSTEIN ENERGY – Between 2025 and 2030

Consultancy Bernstein Energy expects demand to return to 2019 levels by 2023 and reaching a peak between 2025 and 2030.

“Oil demand has not peaked, but it is likely not that far off either,” the company’s analysts wrote.

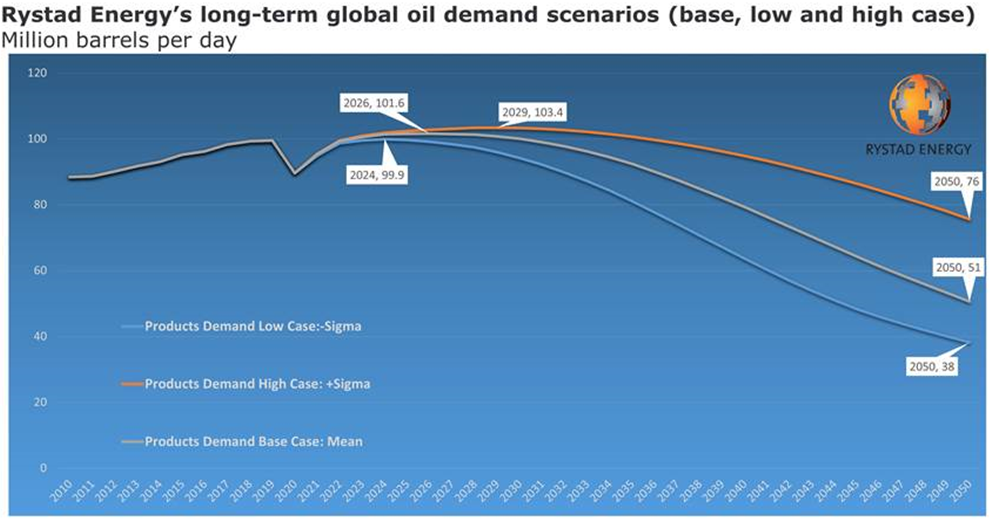

RYSTAD ENERGY – 2026

Consultancy Rystad Energy sees demand peaking at 101.6 million bpd in 2026, revised down from its November forecast for a peak in 2028 of 102.2 million bpd.

“The adoption of electrification in transport and other oil-dependent sectors is accelerating and is set to chip away at oil sooner and faster than in our previous forecast,” Rystad wrote.

TOTALENERGIES – Before 2030

The French oil major, which previously forecast a peak around 2030, now says demand is expected to peak before 2030 and would drop to 40 million to 64 million bpd by 2050.

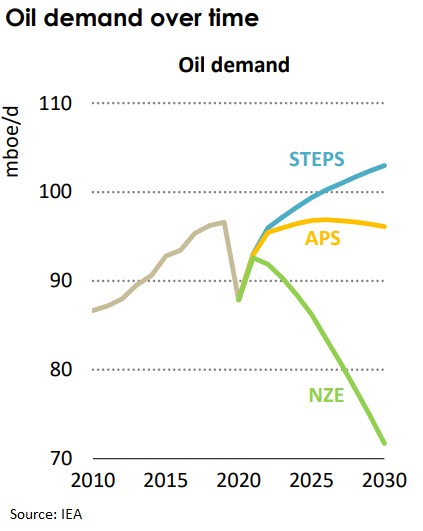

IEA – Within 10 years or by mid 2030s

The Paris-based International Energy Agency foresees a peak to oil demand in all its various future demand scenarios. read more

It puts the date sometime in the mid‐2030s in its most conservative Stated Policies Scenario forecast with a very gradual decline but in its Net Zero by 2050 case sees demand plateauing within a decade and dropping further by nearly three-quarters by 2050.

GOLDMAN SACHS – After 2030

The rise in electric cars, renewable energy and plastics recycling will sap oil demand but growth in developing countries will push a peak in demand beyond 2030, Goldman Sachs said.

“We do not expect global oil demand to peak before 2030 in our base case driven by solid fundamental economic growth, emerging market demographics and relatively low oil prices,” the bank said.

VITOL – 2030s

Demand will continue to grow to 110 million bpd by the early to mid 2030s, the commodities trading house said.

“The consensus amongst all commentators out there, and my company here included, is that the peak for oil demand is still ahead of us,” Vitol Asia Chief Executive Officer Mike Mueller said.

OPEC – Around 2040

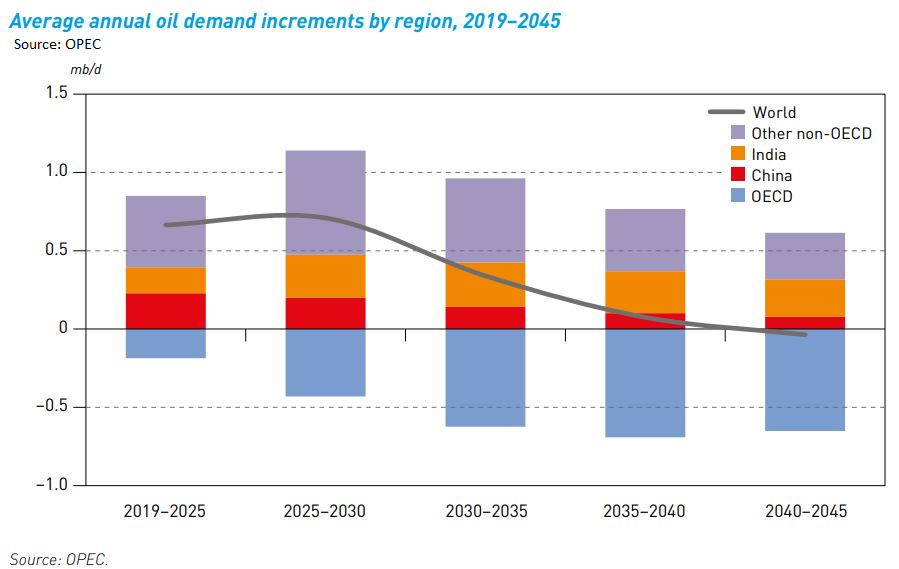

In its first prediction for peak demand, the Organization of the Petroleum Exporting Countries said demand would recover in the next two years and plateau by 2040.

“At the global level, oil demand is expected to increase by almost 10 million bpd over the long term, rising from 99.7 million bpd in 2019 to 109.3 million bpd in 2040 and to 109.1 million bpd in 2045,” it said in its World Oil Outlook.

SHELL – No specific date but peak may have been reached

Royal Dutch Shell has not forecast a date for peak demand but Chief Executive Ben van Beurden suggested this year the pandemic might have already brought a peak, saying: “Demand will take a long time to recover if it recovers at all.”

“Energy demand, and certainty mobility demand, will be lower even when this crisis is more or less behind us. Will it mean that it will never recover? It is probably too early to say, but it will have a permanent knock for years,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS