Summary

LONDON, Sept 28 (Reuters) – Oil demand will grow sharply in the next few years as economies recover from the pandemic, OPEC forecast on Tuesday, adding that the world needs to keep investing in production to avert a crunch despite an energy transition.

The view from the Organization of the Petroleum Exporting Countries contrasts with that of the International Energy Agency, which in a May report said investors should not fund new oil projects if the world wants to reach net zero emissions.

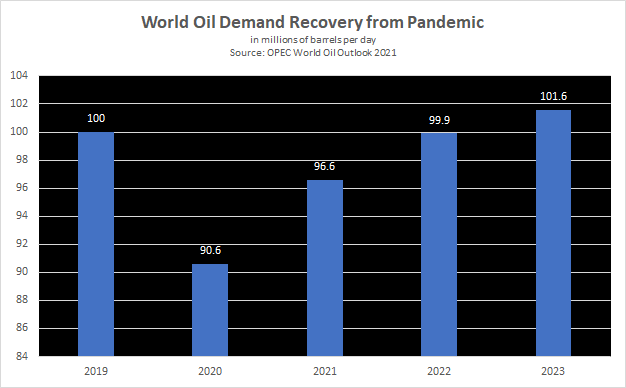

Oil use will rise by 1.7 million barrels per day in 2023 to 101.6 million bpd, OPEC said its 2021 World Oil Outlook, adding to robust growth already predicted for 2021 and 2022 , and pushing demand back above the pre-pandemic 2019 rate.

“Energy and oil demand have picked up significantly in 2021 after the massive drop in 2020,” OPEC Secretary General Mohammad Barkindo wrote in the foreword to the report. “Continued expansion is forecast for the longer term.”

OPEC World Oil Outlook 2021

With oil demand recovering, OPEC and its allies such as Russia – a grouping known as OPEC+ – are unwinding record supply cuts made last year. But there are signs some OPEC+ producers are unable to pump more due in part to a lack of investment, and that has boosted prices.

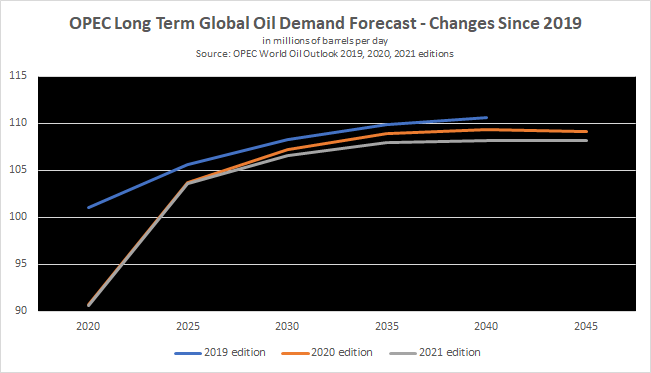

OPEC also lowered its estimates for longer-term oil demand, citing changes to consumer behaviour brought about by the pandemic and competition from electric cars. Global demand is expected to plateau after 2035, the report said.

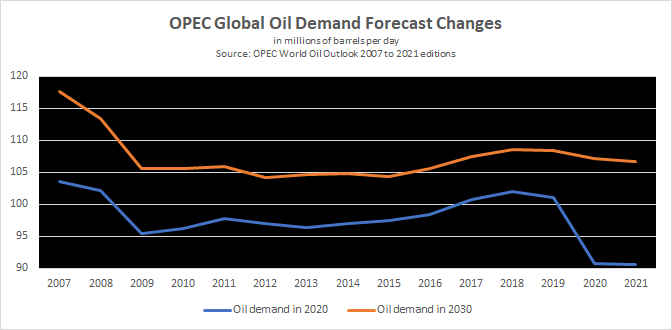

Last year’s report said world oil demand would exceed 2019’s rate in 2022, not 2023. Now demand is expected to reach 106.6 million bpd in 2030, down 600,000 bpd from last year’s figure and 11 million bpd lower than OPEC’s view in 2007 of what 2030 demand would be.

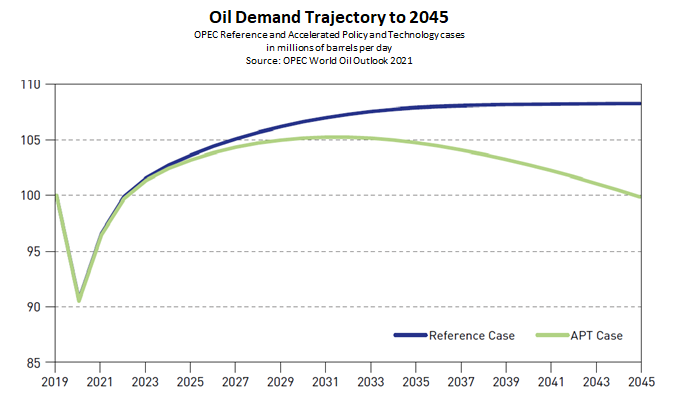

Assuming a faster take-up of existing technology, the Accelerated Policy and Technology Scenario, demand could be falling by the 2030s, according to an OPEC chart showing a more pronounced demand drop-off than a similar chart last year.

“Tele/homeworking is becoming a norm for many companies as a result of the pandemic,” OPEC said.

“Long-term oil demand growth will be limited by growing penetration of electric vehicles.”

UNDERINVESTMENT

Last year OPEC+ agreed record output cuts of 9.7 million bpd, the equivalent of 10% of global supply.

With demand recovering, those barrels are being returned to the market but OPEC said it was essential to step up investment in supplies to avert a future crunch.

Last year upstream oil capital spending dropped by nearly 30% to about $240 billion due to the pandemic.

“It is clear that underinvestment remains one of the great challenges for the oil industry,” Barkindo wrote. “Without the necessary investments, there is the potential for further volatility and a future energy shortfall.”

OPEC sees the demand for its oil rising in the next few years, but rising supply from the United States and other outside producers means OPEC output in 2026 will likely be 34.1 million bpd, below 2019’s level, it said.

The group shifted last year to acknowledging demand would peak one day, after predicting growth for years. This year’s 2045 demand forecast was trimmed to 108.2 million bpd, down 900,000 bpd from last year.

Still, OPEC is upbeat about its future prospects, seeing its market share rising in later decades as competition from non-OPEC producers will wane. OPEC expects U.S. tight oil output, another term for shale, to peak around 2030.

“Oil is still expected to retain its number one position in the energy mix,” Barkindo wrote.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS