By Geoffrey Cann

If you’re submitting a funding request to a competitive call for investment proposals, here’s some tips to help you make the killer pitch.

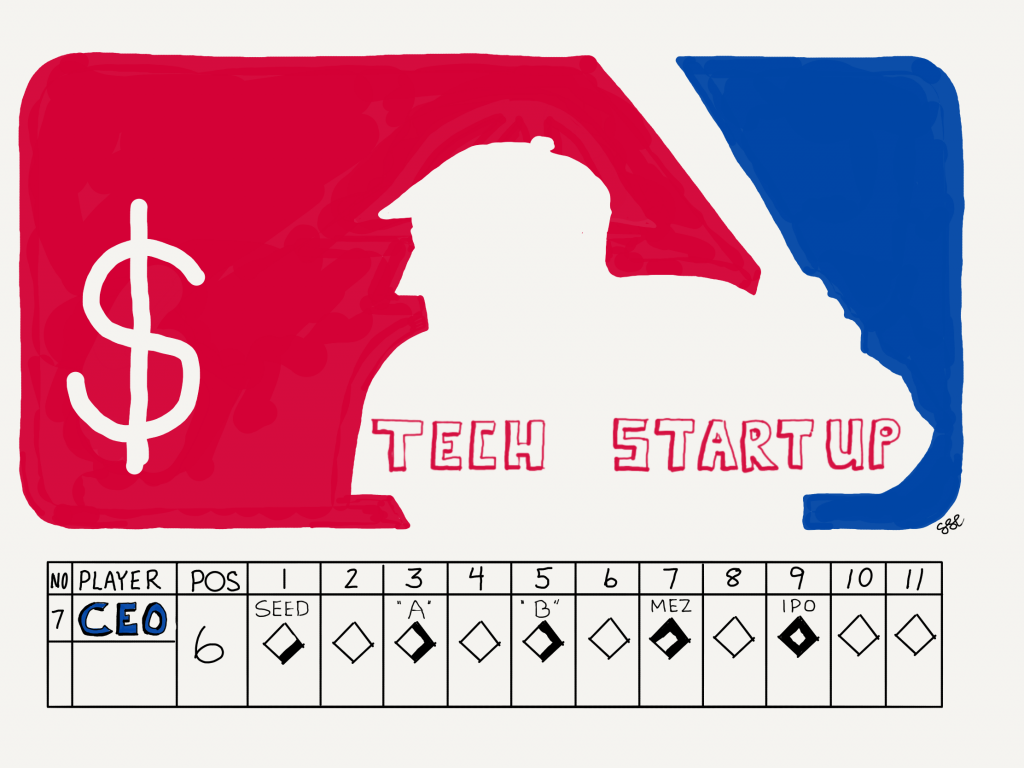

A Pitch Off

One of the really great side benefits of my self-defined role as head cheerleader for digital innovation in oil and gas is the constant exposure to novelty and new ideas. I am regularly invited by conferences to review paper abstracts and posters. Tech entrepreneurs send me their business plans for my reaction. I get to serve on judging panels for various competitions involving new business ideas.

Put another way, I am (sometimes) paid to indulge my adult attention deficit disorder and check out the latest and greatest.

One time I was invited by a new venture incubator, asking me to serve as a reviewer of the submissions they expected to receive for their call for proposals. The proposals were focused on an area where I have some level of expertise, and so I anticipated that I could carry out quick and meaningful reviews. The opportunity to have a peek into the submissions process, get some exposure to some ventures with which I was otherwise unfamiliar, and the chance to meet the other reviewers was pretty appealing.

Have you noticed that increasingly there are large pots of money and funding becoming available for investable ideas? It stands to reason that the investors value help in discerning the rubbish ideas from the gold.

There is a downside to my affliction. As flattering it is to be invited, these reviewer roles are typically pro bono, and I must be cautious about volunteering too much of my time—the mortgage has to be paid after all. But in the end, I accepted the commission.

It turned out I was right—the process was very sophisticated, the submissions were fascinating, and the other reviewers constituted a stellar group of professionals.

With the benefit of hindsight, it was easy to see what the better submissions did to boost their chances of succeeding in a pitch off and equally, what those of lesser quality consistently did (or failed to do) to lower their chances.

It’s in all our interests that new business ventures succeed—our society is in a collective ditch caused by that malignant little bastard COVID, and we need the jobs and the economic benefits from new business. If you’re pitching to a venture fund, an incubator, or any other type of forum where you are up against a yardstick of some kind, you might want to reflect on this article.

The Reviewers

In this case, the industry pitch off was organized by an agency not associated with the industry (a common thing so as to avoid any bias that might creep into the competition) and as a result they sought out experienced reviewers.

The reviewing panel consisted of a dozen industry specialists who had, individually, considerable depth in the nuances of the industrial landscape, the competitive positioning of a wide range of digital innovations, general entrepreneurship, the commercial practices that differentiate, and the patterns of innovation adoption in the industry. We each received up to eight individual submissions to review, and we declared any conflicts of interest publicly so that we were reviewing the proposals with integrity.

The role of the reviewer was to score the individual proposals against a kind of maturity framework, on a scale of one to ten (with ten being a perfect score) and not against each other. This was sensible because the proposals aimed at solving quite different problems and were not directly comparable, and there were dozens of submissions. This also meant that every proposal was competing precisely with itself for funding, and not against the other submissions.

Initially, the reviewers scored the submissions independently before participating in a consensus call to compare notes, and flag those submissions worthy of deeper consideration. One unique addition to the consensus call was the presence of a fairness advisor, whose role was to flag if the process introduced any unintended biases or prejudices.

The submissions all completed the same template submission form, and were afforded the opportunity to record a video of what they intended to use the funding for.

The Lessons

The submissions were mostly consistent in format (the form saw to that) but varied considerably in length and content. It was abundantly clear which companies had prior experience presenting their pitch to private equity and venture capital players.

- Their submissions were concise and without the usual puffery and self adulation.

- Their documents included references to independent research backing up their assertions.

- Their pitches were more visual, incorporating graphs and charts.

- They devoted a lot of time on how the funding would be used.

- They identified their collaborators, key partners and critical suppliers.

On the other hand, reviewers are quick to detect when a submission is ill considered. They are experts in their fields, after all. They are reviewers because they have personal knowledge or special insight into the companies in question because of their work in the area. They know a great deal about the industry and topic areas. They have often started their own companies or have been CEOs of start ups. There was very little in the submissions that could pass by unchallenged or unquestioned.

For example, all the proposals that I reviewed included vague directional statements of intent to incorporate artificial intelligence or machine learning or advanced analytics in their solutions so as to generate “actionable insights”, whatever that meant. Few bothered to explain with any clarity what insights they were after and how those insights would somehow yield a benefit to the customer.

Many of the proposals were blind to their own competition, which was a big red flag. With their extensive backgrounds, the reviewers were frequently able to name the competition, including actual product names, current customers and even investors. If you’re declaring your innovation to be completely unique, differentiated and disruptive, you better be right.

Most proposals, even the good ones, were wildly optimistic when it came to risk management, either flagging relatively few risks, or arguing that the risks were of low probability and low impact. This was simply not plausible to a sophisticated review panel with 200+ years of experience. Research shows that only 3% of startups succeed, so there must be risks.

Many submissions made heaps of declarative statements and provided no back up or evidence to support their positions. Statements like “we have done a lot of demos” was really weak compared to one that says “we have completed demos with Companies A, B and C”.

A few submissions lacked even basic commercial sensibility. In one instance, the proponent intended the funding to shore up an internal process with an innovation, but made no attempt to reveal how the innovation would commercially appeal to the broader market.

Another weakness from the submissions was the assertion that the innovator could do it all, do it alone and without any ecosystem support. This also beggared belief. It was simply not plausible that start up ventures could handle cloud complexities, full cyber risk mitigation, and multiple parallel customer deployments with a team of just three.

The submission process required supporting certification from third parties who were also willing to invest in the venture with cash, services and deployments. This served as a kind of market validation of the idea. The way the letters were worded sometimes left considerable doubt about the strength of the commitment to the venture. There’s a big difference between ‘funding is committed’ to ‘funding is contingent on board approval’. The reviewers were much more impressed with those ventures that had already lined up the money.

Finally, while not a strict criteria, word counts were specified on the submission forms for the responses to specific questions. That way the submissions would not become bloated and unwieldy. Unfortunately, word count limits were more ignored than respected. Lengthy unfocused responses tended to irritate the reviewers and while we tried not to let that get in the way, the proponents’ inability to adhere to even this simple ask was revealing.

How To Write a Compelling Pitch

These investment forums appear regularly enough, and with them, the opportunities to pitch for funding. Here’s what stood out as the best practices for writing a compelling pitch that could win over a jaded panel of reviewers.

PROVIDE THE EVIDENCE.

Apply the lens of a fact checker to your story, and test out if any of your assertions really need evidence. Quote reliable third party studies, public data, and consulting reports. If someone else is saying it, chances are better that it’s true.

NAME NAMES.

If you’ve done demos with specific companies, and they didn’t ask you to sign an NDA, then name them. If you have a hot prospects list, name the companies. If you’re doing pilots or proof of concepts, name the sites. If you can secure a recommendation from a credible customer, include it.

BE HONEST ABOUT RISK.

Build a comprehensive risk assessment with real risks, even the ones that you think are pretty obscure. Don’t be afraid to flag them as red—it actually makes your venture more believable.

GET CREATIVE.

If charts and pictures tell your story more effectively than words, include them, as the application platform that is housing your submission probably accepts embedded pictures, charts and graphs. If the option to include a video is offered, take it.

KNOW YOUR COMPETITION.

If you declare your offer as unique, make absolutely certain that you truly have no competition in your space because it’s a sure bet that the reviewers have superior market visibility.

READ THE RULES CAREFULLY.

The competition rules are there to assure a level field, but also to make the process efficient. If the numbers are supposed to add up, make sure they do. Rounding errors raise suspicions. Curiously precise numbers where there can be no precision are also flagged. Playing loose with the word count can backfire.

RELY ON THE NUMBERS.

Bang on the numbers since you can’t bang on the desk. Show how the numbers compellingly work out for the customer and the investor. The customer is buying their specific benefits, but the investor is after the industry.

Conclusions

Pitches are a fact of life for new ventures. You might as well become good at them because your venture’s funding future depends on how good you are at telling the story.

Check out my book, ‘Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas’, coming soon in Russian, and available on Amazon and other on-line bookshops.

Take Digital Oil and Gas, the one-day on-line digital oil and gas awareness course.

Mobile: +1(587)830-6900

email: [email protected]

website: geoffreycann.com

LinkedIn: www.linkedin.com/in/training-digital-oil-gas

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran