The Organization of Petroleum Exporting Countries and its allies will meet on Wednesday to assess the global market and prospects for demand as the pandemic grinds on. The alliance forecasts a supply deficit this year, even as it continues to add production, though a surplus is expected to return in 2022.

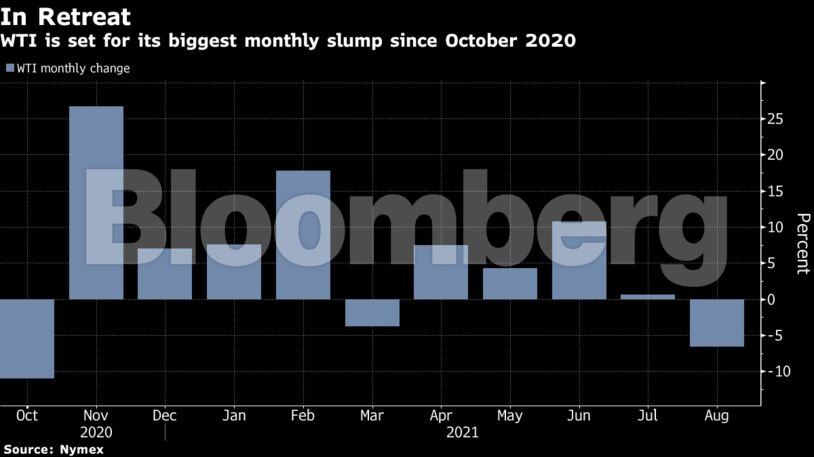

Oil has endured a turbulent August, rising and falling on alternate weeks, as investors reacted to the latest twists in the global health crisis and swings in the U.S. currency. The U.S. benchmark crude has slumped this month, even though there has been a steady draw in stockpiles, and some nations including key importer China have managed to control their delta-variant outbreaks.

There are “some pre-OPEC+ jitters and the realization that Hurricane Ida has a short term negative impact on demand, while supply should not be impacted,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S.

| Prices: |

|---|

|

Energy companies affected by Ida moved to restore operations. Colonial Pipeline Co. said it would restart gasoline Line 1 and diesel and jet fuel Line 2 from Texas to North Carolina on Monday evening.

Data on Tuesday showed that Beijing’s curbs on mobility to check the spread of the delta variant seemed to affect the pace of growth. The official manufacturing purchasing managers’ index fell to 50.1 from 50.4 in July, slightly lower than the median estimate in a Bloomberg survey of economists.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS