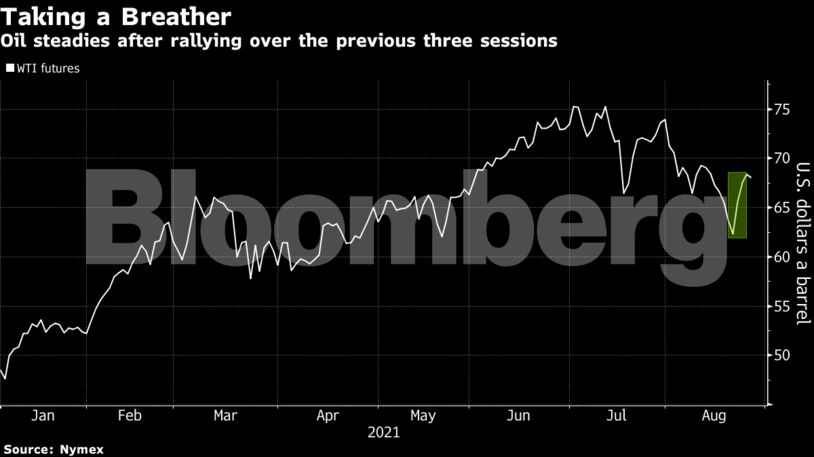

Futures in London fell below $72 a barrel after adding more than 10% over the past three sessions. Shrinking U.S. stockpiles, a rebound in Indian demand and China’s containment of its latest outbreak are providing some positive signs for the market, but restrictions on mobility still remain in place in many regions due to the fast-spreading delta variant of the coronavirus.

Investors will also be keenly watching the Jackson Hole meeting from Thursday for insights on how the Federal Reserve will ease stimulus. The dollar edged higher, making raw materials such as oil that are priced in the U.S. currency more expensive for investors.

Oil has been volatile this month, clawing back some losses this week after the worst streak of declines since October 2019. A large supply outage in Mexico added some bullish impetus earlier this week, though that probably will be short-lived. The European Union will discuss on Thursday whether to reimpose curbs on U.S. visitors as cases spike, while the market will be looking for any changes to production policy from the OPEC+ alliance when the group gathers on Sept. 1.

“The market appears to have run out of steam with lingering Covid-19 concerns, along with the fact that it appears as though Mexican oil production will make a quick recovery,” said Warren Patterson, head of commodities strategy at ING. “A stronger dollar is also not helping.”

| Prices |

|---|

|

| Key market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann